Africa-Press – Angola. The Public Offering for Sale (IPO) processes of shares held by the State shareholder in BAI (1%) and 24% of Caixa Geral Angola (BCGA) banks, influenced the increase in account openings by individuals and individuals at the Central de Valores Mobiliários de Angola (CEVAMA).

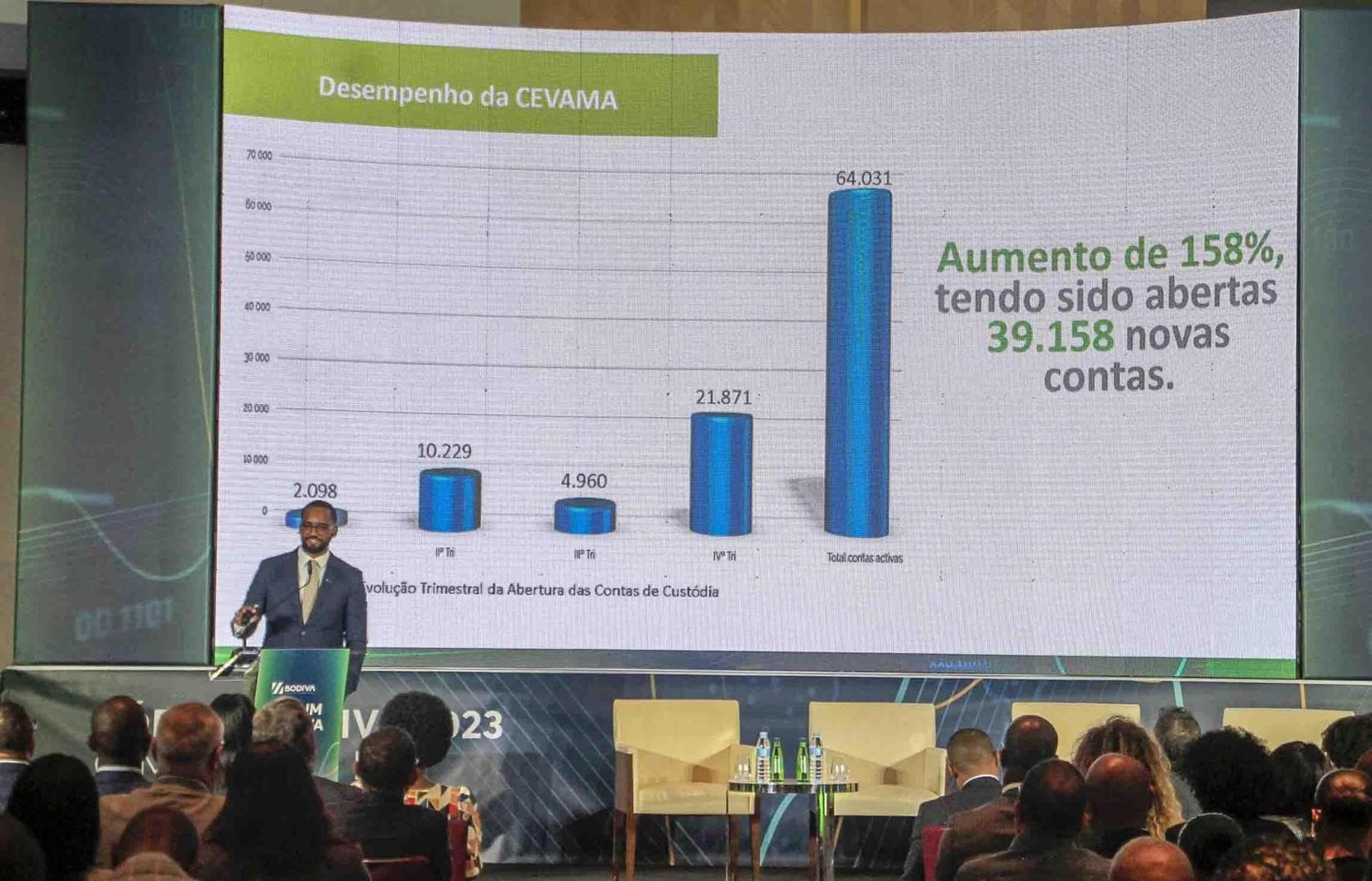

In 2022, 39,158 individual registration accounts were opened, with a growth of 158% compared to the same period of the previous year, highlighting the highest registration in the fourth quarter.

According to Bodiva’s annual report for 2022, the high number of account openings was verified in the months of May and November, justified by the IPO processes of the shares held by the State in the BAI and BCGA banks, followed by the sale in the Bodiva markets of BAI’s own actions.

Overall, in terms of the performance of custody markets, CEVAMA accounts for individuals and individuals account for 85.33%, followed by the financial and insurance sector with just 8.03%.

Wholesale and retail trade comes next with a 2.33% share, while the extractive industry is present with 0.47%.

Overall, according to Bodiva’s annual report, so far, CEVAMA has a total of 64,031 active accounts, after having started, in 2017, the process of opening individual customer accounts.

The accounts are related to the members’ own portfolio, regularization and individual registration of various types of investors.

In 2022, the average number of accounts opened per quarter stood at 9,779 accounts, which reveals a percentage increase equal to the growth recorded, according to the presented report.

In terms of distribution of individual registration accounts, three members account for 91.66% of the total.

These are BAI banks (61.88%), BFA (25.70%) and BMA (4.07%).

Advantages of CEVAMA

The opening of individual customer accounts, i.e. investors, holders of real estate securities, at the Central offers several advantages, such as asset segregation between the financial intermediary and its client, which can provide greater transparency to the transactions carried out in favor of the account .

The process also makes it possible to safeguard the integrity of investors’ securities and ensure greater speed in the treatment of interest and dividends.

For the account opening process, everything starts with sending a contract with the minimum clauses to the investor through their financial intermediary (liquidating member) registered at Bodiva.

Upon receipt and signing of the contract, it is sent to the settlement member (ML) who attests to its compliance and proceeds to open the individualized account at CEVAMA.

After opening, transfer of securities held in custody in the regularization account to that of the investor.

For More News And Analysis About Angola Follow Africa-Press