Africa-Press – Angola. The resident representative of the International Monetary Fund (IMF) considered, on Tuesday, in Luanda, that the reduction in Angola’s sovereign debt differential, in the order of 650 basis points, since 2022, constitutes a plausible indicator that public debt continues sustainable, despite the risk of over-indebtedness.

Victor Lledo made these statements at the presentation of the “Regional Economic Perspectives for Sub-Saharan Africa” (a biannual IMF report), under the theme “A Timid and Expensive Recovery”, in the document’s reference to the evolution of the economy of the continental sub-region.

The most significant risks, according to the IMF representative, are associated with the exchange rate, given the high percentage of debt in foreign currency and the drop in tax revenues, given the volatility of the price of oil, at a time when the State is making an important effort to reduce the cost of debt, in order to extend terms, and curb debt exposure in foreign currency.

At regional level, he stressed, almost a third of countries record decreasing inflation rates, but moderately exceeding the target, which may justify the lack of receptivity of monetary policy to maintain confidence in achieving price stability.

In this situation, warned Victor Lledo, “policy makers must be firm and tighten monetary policy until inflation adopts a clearly downward trajectory” and inflation projections return to the range defined by the Central Bank.

He said that the monetary and budgetary policy implemented so far allows us to assess that Angola “is aligned with the process of receptivity and combating inflation”, but recommends better communication in relation to data on debt.

On the other hand, he continued, “Angola, like most Sub-Saharan African countries, continues to face exchange rate pressures, when, for example, between January and March 2024, the Nigerian Naira depreciated by around 35 percent in relation to to the dollar, while the Kwanza, between May and June of last year, devalued 40 percent”.

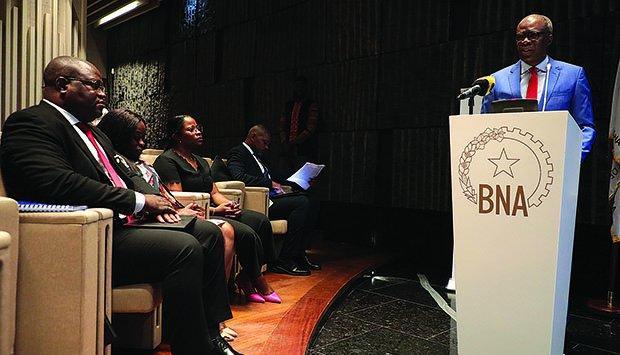

The governor of the National Bank of Angola (BNA), Manuel Tiago Dias, defended, when presenting the report, the adoption of measures to control and stabilize prices in the economies of the Southern African region.

Manuel Tiago Dias stated that around a third of the countries in the region have recorded double-digit inflation rates, and it is “remarkable to mention the situation in Angola, which has recorded high inflation rates since the second half of 2023”.

For More News And Analysis About Angola Follow Africa-Press