Africa-Press – Botswana. The International Monetary Fund (IMF) has said that monetary authorities across Africa find themselves facing an increasingly delicate trade-off: raising rates to keep inflation in check will risk choking off credit for investment, depressing economic activity, and reducing incomes. Meanwhile, fiscal consolidation and the global slowdown weigh on domestic economic activity.

Available figures shows that African countries’ central banks have over the past year been forced to front-load interest rates in an attempt to curb rising inflation and protect weakening exchange rates, while having to deal with deteriorating economic growth prospects.

These issues have placed the mandate of African states’ central banks under a microscope, with most governments questioning the inflation-targeting mandate of their monetary policies — decisions that led to excessive borrowing costs, while inflation continues to remain above the upper band of the inflation bracket.

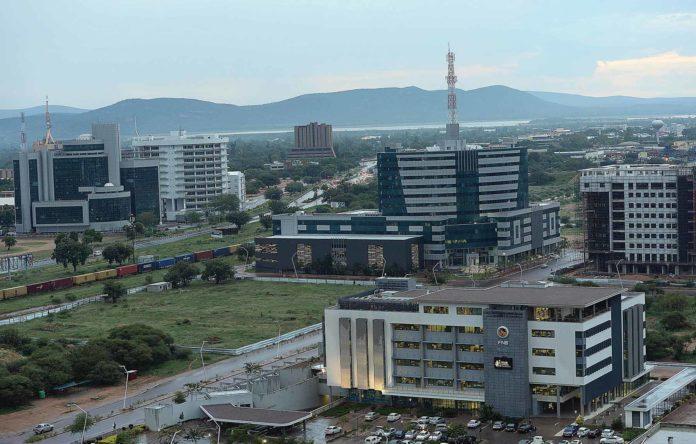

In Botswana , in the past ten months of the year, inflation has averaged 12.1 percent, almost twice the annual inflation rate in 2021 which averaged 6.7 percent. The increase in the two years has been steep compared to the annual inflation rate of 1.9 percent in 2020.

The core inflation, which excludes regulated prices, as well as food and energy prices, was eight percent in October, maintaining the same rate since August. Core inflation rate averaged 4.68 percent from 2011 until 2022, and reached the all-time high in August, a sign that the increase in prices is widespread and rapidly rising even after excluding prices of volatility goods and services.

The increase in consumer prices has been pushed by the rise in transport, food and housing prices, which have a large weighting in the CPI. These major groups account for 67.8 percent of the overall CPI Basket. Overall inflation in 2021 was largely driven by Transport (12.3 percent); alcoholic beverages and tobacco (8.9 percent); housing, water, electricity, gas and other fuels (7.7 percent); and food, (6.0 percent).

It has been the same case this year, with the usual suspects leading the surge in prices. The transport group, with the largest share of the CPI at 23.43 percent weight, rose the most: growing by 15.6 percent in the past six months and by 32.3 percent in the last 12 months.

The housing, water, electricity, gas and other fuels group, which constitutes 17.45 percent of the CPI, has registered price increases of 0.6 percent from April and 5.4 percent in the past 12 months. The third largest component of the CPI, food and non-alcoholic beverages, has seen prices rise by 15.8 percent in the past 12 months, and 11.3 percent in the last six months.

To tame the spiraling inflation and bring it down to Bank of Botswana’s tolerable range of 3-6 percent, the central bank has effected sharp interest rate increases, rising the monetary policy rate three times this year, from 1.14 percent rate to 2.65 percent.

The challenge…

Central banks across the continent hiked interest rates in response to rising inflation, capital outflows and currency depreciation resulting from monetary policy tightening in advanced economies. Examples include Botswana, Ghana, Malawi, Mozambique, Nigeria, Uganda and the economic and monetary unions for both Central and West Africa. In South Africa, the central bank says it will continue use interest rates to curb inflation. The bank governor, Lesetja Kganyago recently responded to calls for South African Reserve Bank’s mandate to explicitly include promoting economic growth and creating jobs by saying monetary policy already targets those indicators. Kganyago, who has been in his role for eight years, is a staunch proponent of inflation targeting.

The IMF says central banks should proceed with caution and raise interest rates gradually so as not to jeopardize the recovery. The IMF also advises that policymakers must also not be complacent: countries where domestic demand pressures are acute, or inflation is very high may need to tighten faster or more decisively.

For More News And Analysis About Botswana Follow Africa-Press