Sana Khan

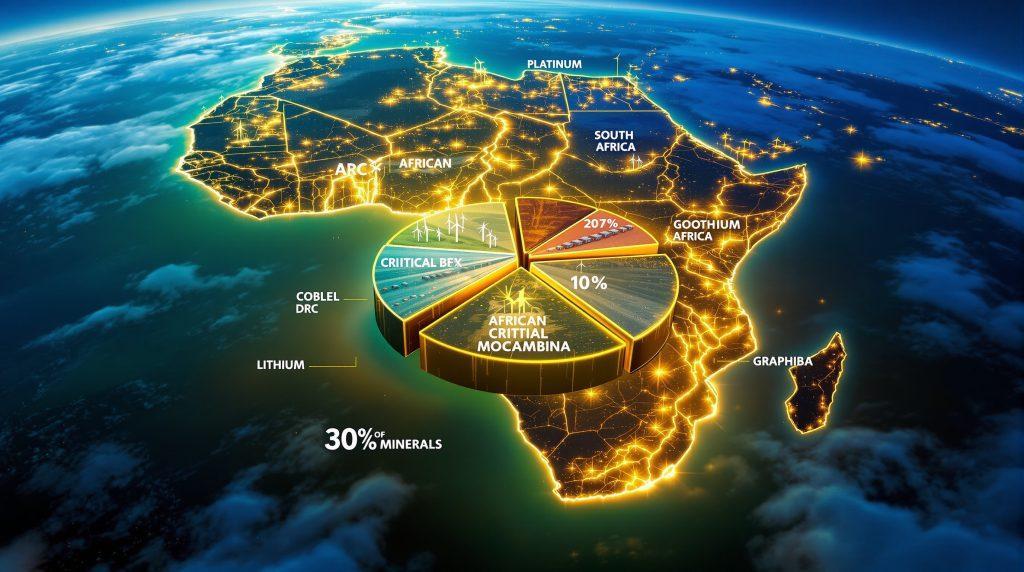

Africa-Press – Eritrea. As the global race for critical minerals intensifies, African countries are positioning themselves to move beyond exporting raw materials and instead build domestic industries around refining and manufacturing. With around 30% of the world’s mineral reserves including lithium, cobalt, and nickel the continent stands at a pivotal moment to shape its economic future amid the global green energy transition.

Experts like Hany Besada of the London School of Economics call it “an unprecedented opportunity” for Africa to secure a stronger position in global value chains. However, realising that potential requires overcoming long-standing challenges from power shortages and weak infrastructure to skills gaps and trade barriers.

At the heart of this effort are countries like Zimbabwe, which is pushing investors to process lithium domestically, and the Democratic Republic of Congo, home to most of the world’s cobalt but plagued by child labour and conflict.

Why It Matters

The global shift toward clean energy and digital industries has sent demand for critical minerals soaring. The International Energy Agency predicts demand for lithium will increase fivefold by 2040, while nickel and graphite demand will at least double.

For Africa, this could mean billions in new revenue and millions of jobs, but only if nations can add value locally rather than exporting raw ore. “Africa wants to be a meaningful participant and beneficiary of the green economy,” said Ibrahima Aidara of the Natural Resource Governance Institute.

At the upcoming COP30 climate summit in Brazil, African leaders are expected to push for fairer global partnerships to ensure that the mineral boom translates into sustainable growth, social equity, and green development not another cycle of exploitation.

Governments across Africa are drafting policies to boost domestic proessing a strategy known as beneficiation. Zimbabwe’s government, for example, has attracted Chinese investment, including Zhejiang Huayou Cobalt’s $400 million lithium plant, slated to start production in 2026.

Regional efforts such as the African Continental Free Trade Area (AfCFTA) aim to remove internal barriers to trade, helping countries collaborate on infrastructure and industrial development. Projects like the Lobito Corridor railway, linking Zambia’s copper belt to Angola’s Atlantic coast, signal Africa’s ambition to become more than a supplier of raw materials.

However, experts warn that resource nationalism, seen in countries like Guinea, could backfire if not balanced with smart, evidence-based policy. “This problem is bigger than individual countries,” Aidara said. “We need national strategies that link mining to industrialisation and long-term growth.”

Civil society and younger Africans are also pushing for transparency and fair distribution of resource wealth. Gen Z protests in Kenya, Nigeria, and Madagascar have highlighted public anger over corruption and inequality, pressuring governments to ensure that mining profits reach ordinary citizens.

What’s Next

At COP30, African leaders will advocate for global rules that ensure the energy transition benefits local communities, not just foreign investors. Over 100 civil society groups, including Amnesty International, have urged governments to integrate human rights and environmental safeguards into the green minerals agenda.

The stakes are high: without decisive reforms and regional cooperation, Africa risks remaining a raw material supplier while others profit from its mineral wealth. But with the right investments in energy, skills, and governance, the continent could become a key driver of the global green economy turning the “resource curse” into a resource revolution.

moderndiplomacy

For More News And Analysis About Eritrea Follow Africa-Press