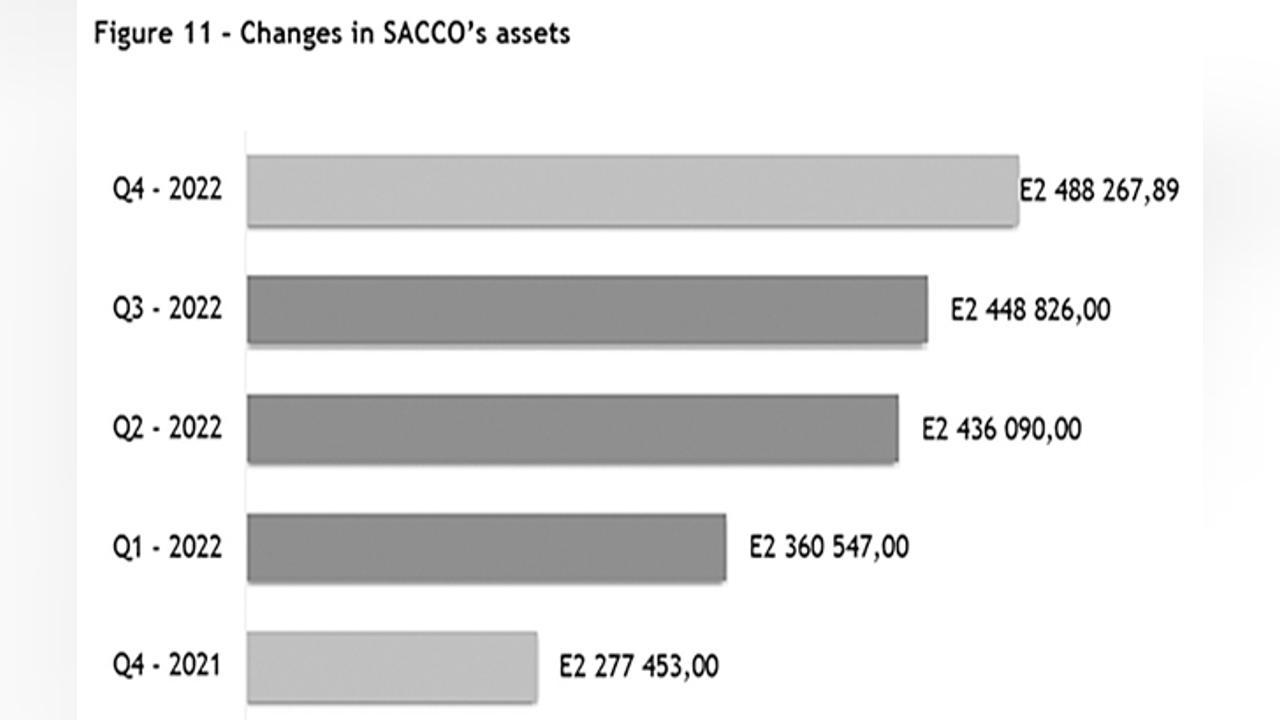

Africa-Press – Eswatini. The total assets for the Saving and Credit Cooperative Society (SACCOs) were valued at E2.5 billion, indicating a 1.6 per cent increase when compared to the previous quarter as of December 2022.

This is according to the fourth quarter of the Financial Services Regulatory Authority (FSRA) quarterly statistical bulletin.

The bulletin reported that this could be linked to the continuous increase in the country’s interest rates, which meant that investments now yield more returns than before.

“There was also an increase in savings as investors saw an opportunity in keeping their funds within SACCOs rather than withdrawing and or an increase in new membership and savings. Loans and advances were valued at E1.8 billion with the portfolio at risk at 15.0 per cent,” read a part of the report.

It was also reported that the year-on-year comparison showed a 6.09 per cent increase while on a quarter-on-quarter basis, a 7.3 per cent increase was observed.

“Total cash and bank balances stood at E235 million indicating a 0.83 per cent decline compared to the previous quarter. Total investments stood at E340 million. Property and equipment stood at E99 million showing an increase of 3.1 per cent when compared to the previous quarter,” read the report.

The report further added that as of December 2022, total loans and advances amounted to E1.8 billion and non- performing loans stood at E1.4 million with portfolio at risk increasing to 15.0 per cent from 7.7 per cent in the previous quarter.

“Performing loans accounted for 91.8 per cent of the total loans, which meant that a majority of the members are paying back their loans and pose no risk, 2.6 per cent are however on the watch list but pose no real risk, 3.1 per cent are substandard but are on the risk list, 0.7 per cent are doubtful and might not be able to pay back the loans, and a 1.3 per cent loss has been accounted for by the sector, as some members may not be able to repay their loans,” read part of the report.

The bulletin also mentioned that 1.3 per cent of the total loans had to be renegotiated with members, who wanted to pay but could not afford to make repayments under the current stipulated conditions they had.

“Portfolio at risk continued its second cycle of growth, as it can be noted that in the third quarter of 2021, there was an increase of 44.1 percentage points, then the was another jump in quarter three of 2022 of 95 percentage points increase, this shows a pattern of events, especially in the third quarter on a year-on-year,” reads part of the bulletin.

It was further reported that the SACCOs total investments stood at E340 million indicating a 7.1 per cent decline when compared to the previous quarter.

“Most of these sector’s investments were held in money market instruments for liquidity purposes, as it is much easier to withdraw or repurchase funds should a need arise especially for advancing loans to the members,” read the report.

It added that the bulk of the investments were held in the African Alliance money market accounting for 36.4 per cent, followed by Sanlam money market which accounts for 31.2 per cent and Stanlib which accounted for 22.5 per cent.

“Government bonds which range between 3.5,7 and 10 years, together with treasury bills which range from 90,180,270 and 365 days only accounted for 0.3 per cent. Ecsponent accounted for 1.4 per cent of the sector’s investment holdings and has remained constant,” reads the report.

It was further added that the SACCOs total savings were valued at E1.8 billion in the period under review, indicating a slight increase of 2.6 per cent when compared to last quarter.

“A year-on-year comparison indicated a 10.7 per cent increase. Savings are known to decrease toward the end of the year as members prepare for the festive season as seen in the 4th quarter of 2021, but this did not happen in the 4th quarter of 2022 as there was an increase in members’ savings, the continuous increases in interest rates may have influenced them to save more with the expectation of higher future returns,” continued the bulletin.

The bulletin also reported that non-withdrawable savings increased by 2.0 per cent when compared to the previous period and term deposits also increased by 8.5 per cent, bringing the total to E1.8 billion.

For More News And Analysis About Eswatini Follow Africa-Press