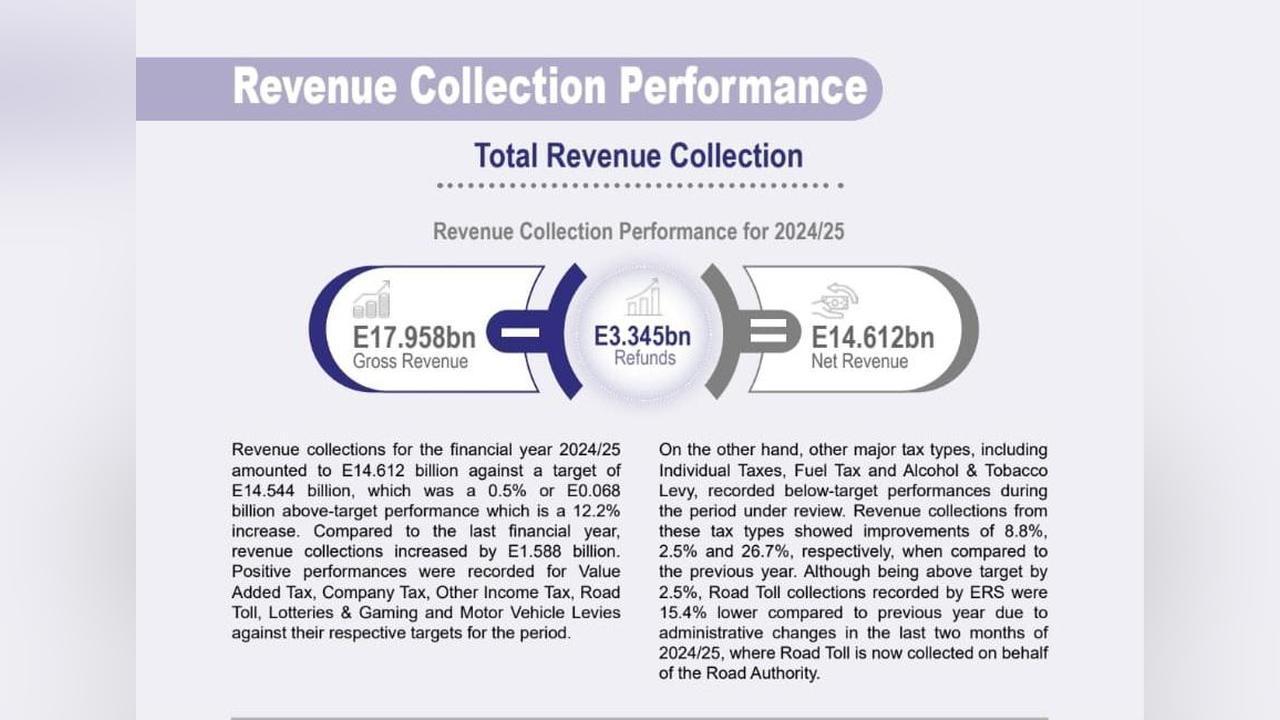

Africa-Press – Eswatini. The Eswatini Revenue Service said it successfully processed E3.3 billion in tax refunds in the 2024/25 financial year, reflecting a 41.8% year-on-year increase that supported business liquidity and strengthened confidence in the tax system.

Nearly 99% of the refunds were VAT-related, providing critical cash flow support to VAT-registered businesses and exporters.

The improved refund performance coincided with a rise in voluntary compliance to 70.5%, highlighting the link between fairness and compliance.

Commissioner General Brightwell Nkambule said education played a central role.

“Through campaigns such as Bafundzise, we worked to promote voluntary compliance,” he said.

Taxpayer registrations also grew, with company registrations rising by 8.4% and individual taxpayers by 5.7%.

Board Chairperson David Dlamini said recognising compliant taxpayers is essential.

“Their commitment makes our work easier and contributes directly to the fiscus,” he said.

Together, improved refunds, compliance, and engagement signal a maturing and trust-based tax environment.