Africa-Press – Kenya. Despite President William Ruto’s relentless pursuit of investors through more than 40 foreign trips, World Bank data shows Kenya’s foreign direct investment inflows plunged to their lowest level in over two decades in 2023 — down to $202.85 million, or 0.2 per cent of GDP, from a peak of $717 million in 2020.

According to the data published on Saturday, Kenya’s net foreign direct investment inflows have dropped to Ksh29.32 billion as of 2023. This is a drop from Ksh32.39 billion in 2022.

However, the net drop follows a very sharp decline in 2021 that saw the investments from foreigners fall from Ksh49.63 billion and Ksh50.09 billion in 2020 to just about Ksh32 billion. This is largely informed by the post-pandemic economy, which marked a year since President Ruto took power.

Foreign Direct Investment (FDI) occurs when a foreign investor takes control of or gains significant influence in a business abroad. It includes equity capital, reinvested earnings, and other related investments. FDI is key to cross-border economic ties and global growth.

The data, which is sourced from the International Monetary Fund, Balance of Payments database and supplemented by data from the United Nations Conference on Trade and Development and official national sources, shows the country’s foreign direct investment in terms of net inflows slightly dropped from 2023 to stand at Ksh94.23 billion from Ksh102.40 billion in 2022.

In terms of net outflows, the data shows that this too dropped to Ksh64.75 billion from Ksh70.01 billion in 2022. The outflows as a percentage of GDP – the figure remained relatively level at 0.5 per cent.

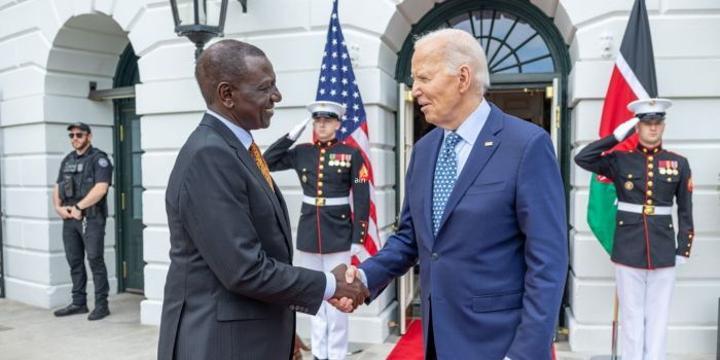

The data paints a picture of slowed investor investments in the country, despite revitalised efforts to bring in more investors. Although the data does not cover 2024, a year that saw the country nearly burn after protests emerged and also marked Ruto’s state visit to the United States, which saw the signing of crucial investment deals.

Ruto’s administration has rolled out legal and regulatory reforms, including liberalising the foreign exchange regime, removing limits on foreign ownership in the ICT sector, and aligning tax policies with global standards.

To make Kenya more attractive to investors, the government also scrapped VAT on exported services and removed taxes on stock-based compensation for startup employees. Special Economic Zones have also been established in key areas like Mombasa, Thika, Eldoret and Busia, offering tax incentives and infrastructure to lure both local and international investors.

Kenya has spent billions to sponsor President Ruto’s over 70 foreign trips since taking power in September 2022, in a bid to increase both investments into the country and create export markets for Kenya’s goods and services.

Between September 13, 2022, and December 31, 2023, Ruto made a total of 44 international trips. This includes 9 trips in 2022 and 35 trips in 2023, all of which fall under the reporting period for the World Bank’s analysis.

While a return on investment is not often immediate, Kenyans will be expecting the USD 1 billion data centre investment with Microsoft and UAE-based G42 and the new green energy partnerships with just the heavy lobbying.

FDI is crucial for the Kenya Kwanza government, which is struggling to raise revenues without increasing the already heavy-handed taxation on Kenyans.

For More News And Analysis About Kenya Follow Africa-Press