Africa-Press – Kenya. Be cautious about investing in Money Market Funds (MMFs), Treasury Cabinet Secretary John Mbadi has now warned.

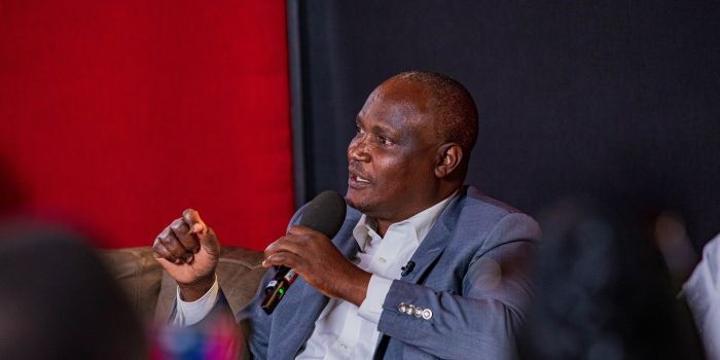

While speaking during the Youth Parliament Session on the Budget and 2025 Finance Bill, Mbadi disclosed that the current low interest on Treasury Bills that make up a large portion of MMF funds, resulted in low yields for individuals who have invested in MMFs.

T-Bills are short-term government securities issued by the Central Bank of Kenya (CBK) to raise funds for the government. They come in tenors of 91, 182, and 364 days. They are considered low-risk investments because they are backed by the government.

MMFs are unit trust funds that pool money from many investors to invest in short-term, low-risk instruments such as Treasury Bills.

Mbadi noted that the current interest rate on T-Bills stands below nine per cent, down from a whopping 15 per cent in August 2024. This, in the long term, according to the CS, would bring down the yield of the MMFs.

“Interest rates have been going down, especially the rate at which the government borrows (T-Bills). When I came into office, the rate was 15 per cent. Right now, it is going below nine per cent, going to eight for 91-day T-Bills,” he stated.

“So money market (funds) is not as lucrative as it used to be. I know some of you who have been into MMFs are wondering what the government is going to do. It is better for the economy as a whole but it may not be good for an individual investor,” Mbadi expressed.

When the interest rates on T-Bills decline, the returns from MMFs also decrease. This is because MMFs in Kenya typically invest a large portion (sometimes over 50 per cent) of their assets in T-Bills, and their performance is closely tied to the yields offered by these government securities.

If the Central Bank of Kenya (CBK) lowers interest rates, or market demand for T-Bills rises (driving yields down), MMFs can only buy new T-Bills at lower returns. These lower-yield T-Bills drag down the overall fund yield.

Even so, MMF returns don’t drop overnight—they decline gradually as the fund’s existing higher-yield investments mature and are replaced by new lower-yield T-Bills. This leads to a slow but steady drop in the daily yield and the effective annual yield (EAY) published by MMFs.

As such, investors in MMFs will earn less interest over time, especially if T-Bill yields stay low for an extended period.

This makes MMFs less attractive compared to other asset classes if inflation is rising or if alternative fixed-income instruments offer better returns.

For More News And Analysis About Kenya Follow Africa-Press