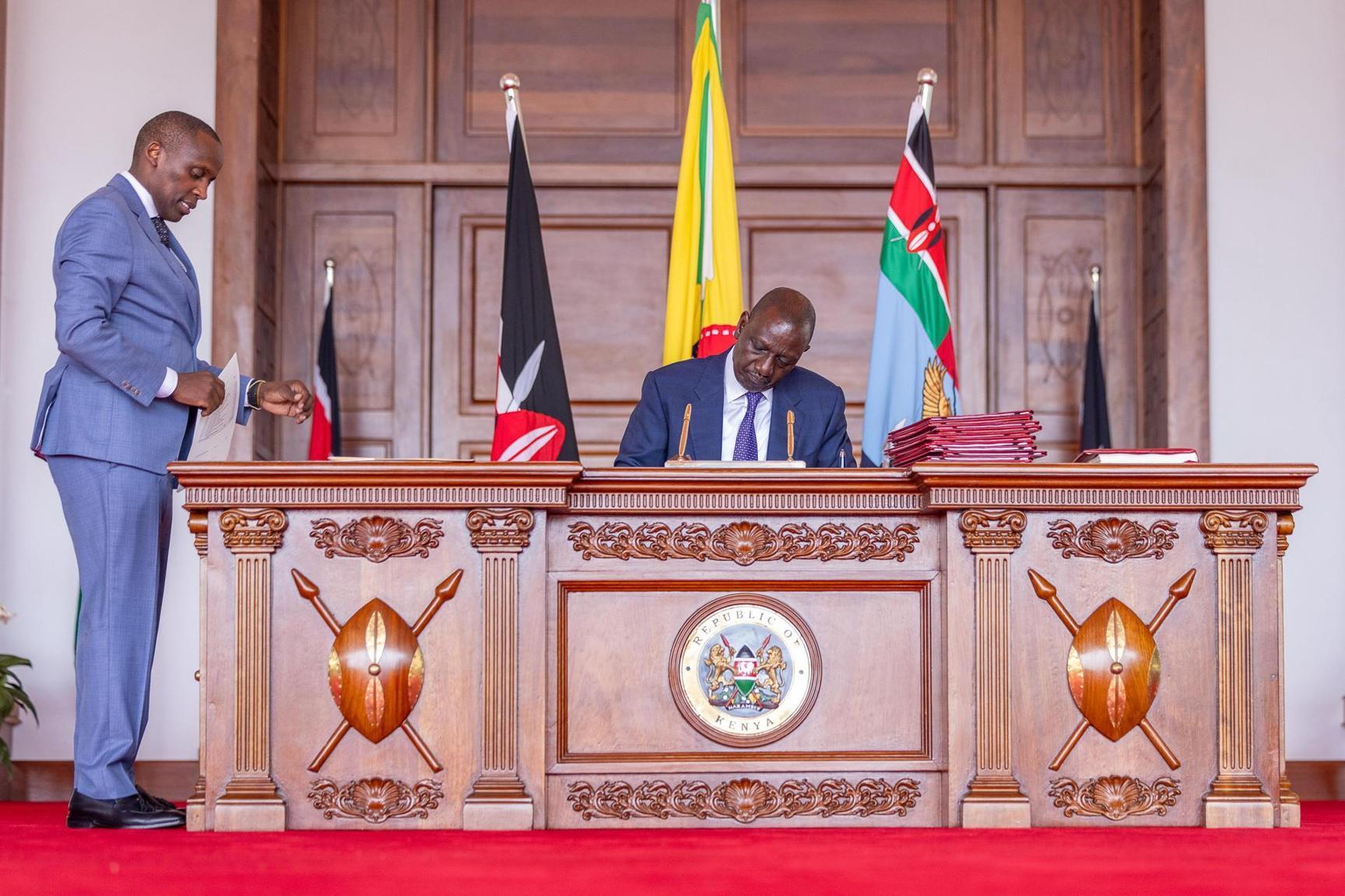

Africa-Press – Kenya. President William Ruto has assented to the Finance Bill 2025, officially making it law. The ceremony took place at State House, Nairobi, where he also assented to the Appropriations Bill and the Supplementary Appropriation Bill.

The Finance Act, 2025, introduces new changes, among them a tax relief for employees requiring employers to automatically apply all tax exemptions and deductions.

The tax-exempt subsistence allowance is also set to rise from Sh2,000 to Sh10,000 daily. To promote digital growth, the Act repeals the Digital Assets Tax and replaces it with a 5% excise duty on transaction fees charged by virtual asset providers.

Capital Gains Tax will be slashed from 15% to 5% for major investments certified by the Nairobi International Financial Centre. Manufacturers and farmers are expected to benefit from tax exemptions on inputs and raw materials, including mosquito repellent, tea, and coffee packaging.

The law also introduces new excise duties on betting, gaming, and digital services, while easing compliance for small-scale distillers. It is expected to reshape Kenya’s fiscal landscape and support innovation-driven economic growth.

The Appropriation Act authorises the release of Sh1.88 trillion from the Consolidated Fund for government spending in the 2025/26 financial year. An additional Sh671.99 billion will be drawn from internally generated revenue by Ministries, Departments, and Agencies as Appropriations in Aid.

It gives the agriculture sector a major boost with Sh47.6 billion, which will be allocated to programs like fertiliser subsidies, coffee reforms, and value chain development. Sh18 billion will go to agro-industrial and textile park development.

To promote health, the new law allocates Sh133.4 billion to Universal Health Coverage, including Sh17.3 billion to fight HIV, malaria, and TB. Education gets Sh658.4 billion, covering teacher recruitment, free basic education, and scholarships under the new university funding model.

Infrastructure will be funded through Sh217.3 billion for roads and bridges, and Sh62.8 billion for energy projects, including rural electrification and clean energy. Also enacted was the Supplementary Appropriation Bill.

For More News And Analysis About Kenya Follow Africa-Press