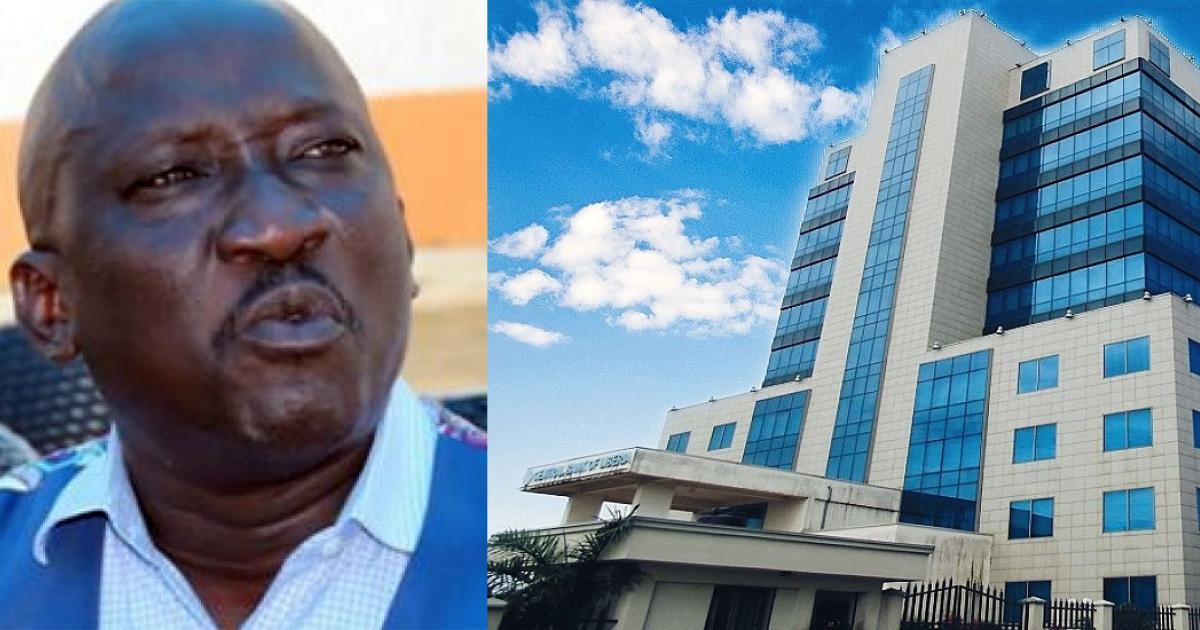

Africa-Press – Liberia. The Debt Court for Montserrado County has ordered the Central Bank of Liberia (CBL) to testify in a case involving businessman, George Kailondo, and Guaranty Trust Bank, in which the latter is accused of conniving with ACE Global to dupe the bank of petroleum products worth US$3.3 million.

ACE Global is a firm responsible for the storage of petroleum products for private entities stationed on the premises of the National Port Authority (NPA). The suit alleges that Kailondo has intentionally refused to pay his debt which is a little over US$1 million.

The Debt Court has, however, compelled the Central Bank of Liberia (CBL), which is alleged to have played a part in the deal, to testify whether it authorized the attachment of Cllr George Kailondo’s properties to a US$1,231,521.01 lawsuit filed against Kailondo.

The attachment was attached to a bond proffered on behalf of the Guaranty Trust Bank (GT-Bank) co-respondent, that is seeking the lawsuit was filed by Palm Insurance Corporation.

To ensure the enforcement of its orders contained in a writ “subpoena ad testificandum”, the court summoned the bank to appear and give oral testimony. According to the court, failure to appear would cause the bank to be held in contempt.

The bank, now named as a co-respondent, is expected to appear on Wednesday, May 31.

However, a team of lawyers representing Kailondo’s properties and himself has strongly resisted the attachment of the bond to his properties, which they are seeking to set aside. Kailondo’s lawyers are Sesay, Johnson, and Associates Law Chambers, the Wright and Associates Law Firm, and the Kailondo and Associates Law Firm.

In opposition to Kailondo’s contention, the GT-Bank lawyer, Jonathan T. Massaquoi, said the CBL, or regulatory authority, has authorized Palm Insurance Corporation to execute a surety bond in the country.

“Palm Insurance Corporation is authorized to proffer bonds within the Republic of Liberia, as evidenced by the surety’s article of incorporation, business registration, updated tax clearance, and CBL’s license, together with the said certification of Palm Insurance Corporation assets, as required by law,” Massaquoi claimed. “Kailondo’s contention is false and misleading.”

Kailondo’s had further argued that CBL knew that Palm Insurance Corporation lacked standing to issue attachment bonds, other monetary intermediation, and non-life, “because they are allowed to issue only life insurance and not non-life insurance. The evidence is provided by the business registration certificate attached to the bond issue by the CBL.”

Kailondo also accused Judge James Jones of approving the bond immediately after it was filed and subsequently placing Kailondo’s properties under its custody, pending the outcome of the suit.

“The document purporting to be a bond with the Palm Insurance Corporation of Liberia as surety was filed on behalf of the Palm Insurance in the action before this Honorable Court and inadvertently approved by your honor on May 16, 2023, in the amount of US$1,231,521.01,” Kailondo’s contention to the bond alleges. “The purported bond is insufficient, inadequate, and invalid in that while it is alleged in the bond that the amount of US$1,231,521.01 has been set aside as surety.”

But Cllr. Massaquoi argued that initially the court had approved the attachment bond, indicating that Palm Insurance Corporation has sufficient assets to cover the value of the bond, as evidenced by the CBL certification of Palm Insurance Corporation’s assets.

“Having met the mandatory requirement to proffer bond in Liberia, the surety’s attachment is more than adequate to ensure that Kailondo properties will be indemnified as and when the court renders a final judgment consistent with the CBL certification of Palm Insurance Corporation assets,” argued Massaquoi. “Palm Insurance Corporation is duly recognized and legally qualified as a surety to post such an attachment bond to carry out the business of a general insurance company in Liberia.”

These are the claims and counterclaims the CBL is expected to address when it appears on Wednesday.

The case grew when the GT-Bank accused Kailondo of conniving with ACE Global, the storage company at the Free Port of Monrovia, to dupe the bank of US$791,458.21, in the sale of petroleum products that were under the custody of the GT-Bank, and the insurance company posted the US$1,231,521.01 on Kailondo’s properties.

According to the suit, Kailondo entered into a collateral management agreement with the bank on September 29, 2017, for a letter of credit to facilitate the shipping of his petroleum products to Sweden and also entered into an agreement with ACE Global to monitor the petroleum movement from storage to the market.

The suit claimed that ACE without the bank’s knowledge conspired with Kailondo and secretly took away the petroleum products subject to the agreement without any payment.

“When the bank discovered ACE Global and Kailondo’s dubious acts, Kailondo offered to make the full payment of US$791,458.21,” the suit claimed. “Defendant Kailondo’s offer was accepted in the utmost good faith to pay the full amount of ACE Global’s financial obligation, that is, terms of payment were drawn out in the Novation Agreement payable in twenty-four (24) consecutive monthly installments of the amount of US$32,977.45 commencing from November 30, 2017, to October 30, 2019.”

For More News And Analysis About Liberia Follow Africa-Press