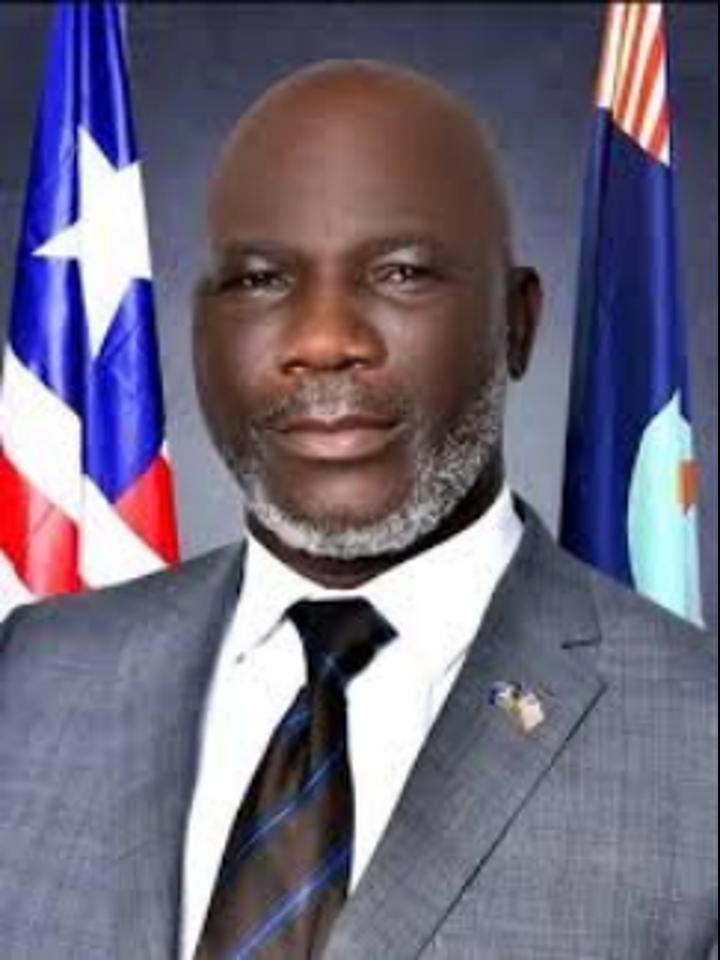

Africa-Press – Liberia. President Joseph Nyuma Boakai Sr. has submitted an Act that introduces a new chapter for the establishment of a legal framework for tax incentive and expenditure Management.

The Bill, “An Act to Amend Part I, Chapter 1 of the Liberia Revenue Code by Introducing a New Sub-Chapter D to Establish a Legal Framework for Tax Incentive and Expenditure Management,” was read during the House’s fifth day sitting of the 3rd quarter of the 55th Legislature.

In his communication to the House, President Boakai said the bill aims to respond to long-standing deficiencies in the classification, approval, administration, monitoring, and review of tax expenditures — including deductions, exemptions, and other preferential treatments granted to businesses and organizations.

The Liberian leader stated that the absence of a unified legal and institutional framework has weakened Liberia’s ability to evaluate the cost and impact of tax incentives, undermining fiscal discipline and equity in public resource management.

“As a consequence of the foregoing, both domestic and international stakeholders have consistently called for reforms that promote transparency, equity, and fiscal discipline. This bill seeks to address those concerns by consolidating the legal and institutional mechanisms governing tax expenditures,” writes the Liberian leader.

The bill also seeks to consolidate all existing and future tax incentives under a single, comprehensive framework.

President Boakai believes that such instrument will govern incentives granted through domestic laws, ratified agreements, international conventions, or treaties, ensuring that every form of tax relief is subject to standardized oversight and reporting requirements.

Most importantly, the proposed law aims to domesticate a regional directive adopted by the ECOWAS Council of Ministers during its Ninetieth Ordinary Session, a decision that calls for the harmonization of the methodology for evaluating tax expenditures across West Africa.

According to the President, aligning Liberia’s tax framework with ECOWAS standards will not only enhance regional coherence but also strengthen accountability in fiscal policy implementation, a key commitment under his administration’s ARREST Agenda for governance reform.

Following the reading of the President’s communication in plenary, a motion was proffered and voted upon that forwarded the bill to the Committees on Ways, Means, Finance and Development Planning and Judiciary for scrutiny and recommendation.

The committees will then scrutinize the instrument and report back to plenary within two weeks’ time.

For More News And Analysis About Liberia Follow Africa-Press