Africa-Press – Malawi. Malawi’s debt to rebased gross domestic product (GDP) ratio increased to 56.8 percent as at the end of 2021, a situation feared to pile extra pressure on fiscal space and the economy.

A recent financial statement from the Ministry of Finance and Economic Affairs shows that public debt rose to K5.8 trillion in December 2021 from K5.5 trillion in June. Experts say the country is at a high risk of debt distress and that the central government should work decisively in reversing the situation.

According to the statement from the Treasury, total external debt, however, went down from $3.59 billion in June 2021 to $3.44 billion in December 2021 on account of a reduction in commercial debt, largely held by the Reserve Bank of Malawi, from $823.16 million to $661.85 million.

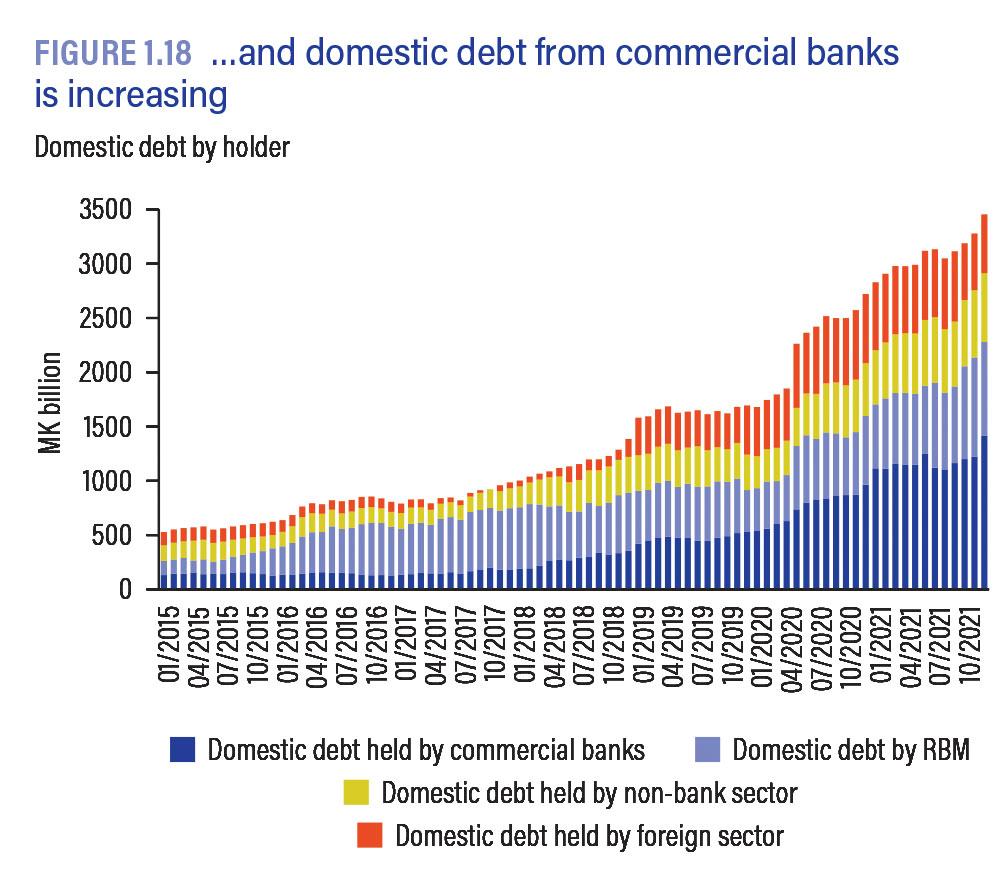

But both bilateral debt and multilateral debt have marginally increased due to project/programme disbursements according to the report. On the domestic front, the report indicates that in December 2021, total domestic debt amounted to K3 trillion, representing an increase of 18.37 percent as compared to June 2021.

“As at December 2021, Malawi’s debt was assessed to be unsustainable over the medium term with the county’s risk of debt distress rating moving from moderate to high. The change in the rating is due to the worsening of debt burden indicators,” reads the statement.

The United Nations Economic Commission for Africa (Uneca)—a UN agency mandated to support countries in the sub-region achieve inclusive industrialisation for the reduction of poverty and inequality—recently ranked Malawi among regional countries facing a threat of continued rising debt to (GDP) ratio due to escalating global economic woes coupled with structural domestic challenges.

Economist from the Malawi University of Business and Applied Sciences Betchani Tchereni said the country continues facing a debt distress. He said the country’s tax base remains limited while public expenditure continues rising on recurrent and not development budgets, and this has been piling pressure on the fiscal space.

“We need a different approach to things by approaching sectors that can bring high returns with aggressiveness. We need to quickly revamp the mining sector and work on mega farms with speed and industrialise this country otherwise we will continue borrowing,” he said.

When presenting the 2022-23 National Budget, Minister of Finance Sosten Gwengwe said public debt management will be at the centre of the national financial plan’s implementation.

Gwengwe said public debt will be managed by maintaining a policy of concessional borrowing; preferring grants and only under very exceptional circumstances contract non-concessional loans for high value investments and the government will engage its external creditors to restructure some of the loans.

In a recent interview, Gwengwe the budget was on course but a few re-alignments, especially on government expenditure to continue reducing the deficit, will be done during the mid-year review.

“The budget is not yet off balance. Second half needs alignment but for now all is going on as planned,” Gwengwe said. In the 2022-23 budget, overall fiscal balance was estimated at a deficit of K884.0 billion, which is 7.7 percent of GDP.

The deficit is expected to be financed through foreign borrowing amounting to K230.07 billion and domestic borrowing amounting to K653.98 billion. The Malawi economy has been sailing through turbulent waters, with a squeezed fiscal space leading to rising public debt levels.

Justin Mkweu is a fast growing reporter who currently works with Times Group on the business desk. He is however flexible as he also writes about current affairs and national issues.

For More News And Analysis About Malawi Follow Africa-Press