Africa-Press – Malawi. Total principal amount of all loan facilities extended by commercial banks in 2021 including interests increased by 19.5 percent to K871.6 billion, figures from the Reserve Bank of Malawi (RBM) show. This is contained in the RBM’s 2021 Financial Institutions Annual Report issued on Monday..

According to the report, economic concentration of the top three sectors (community, social and personal services; wholesale and retail trade; and agriculture, forestry, fishing and hunting) remained high and increased to 67.5 percent from 55.9 percent in December 2020.

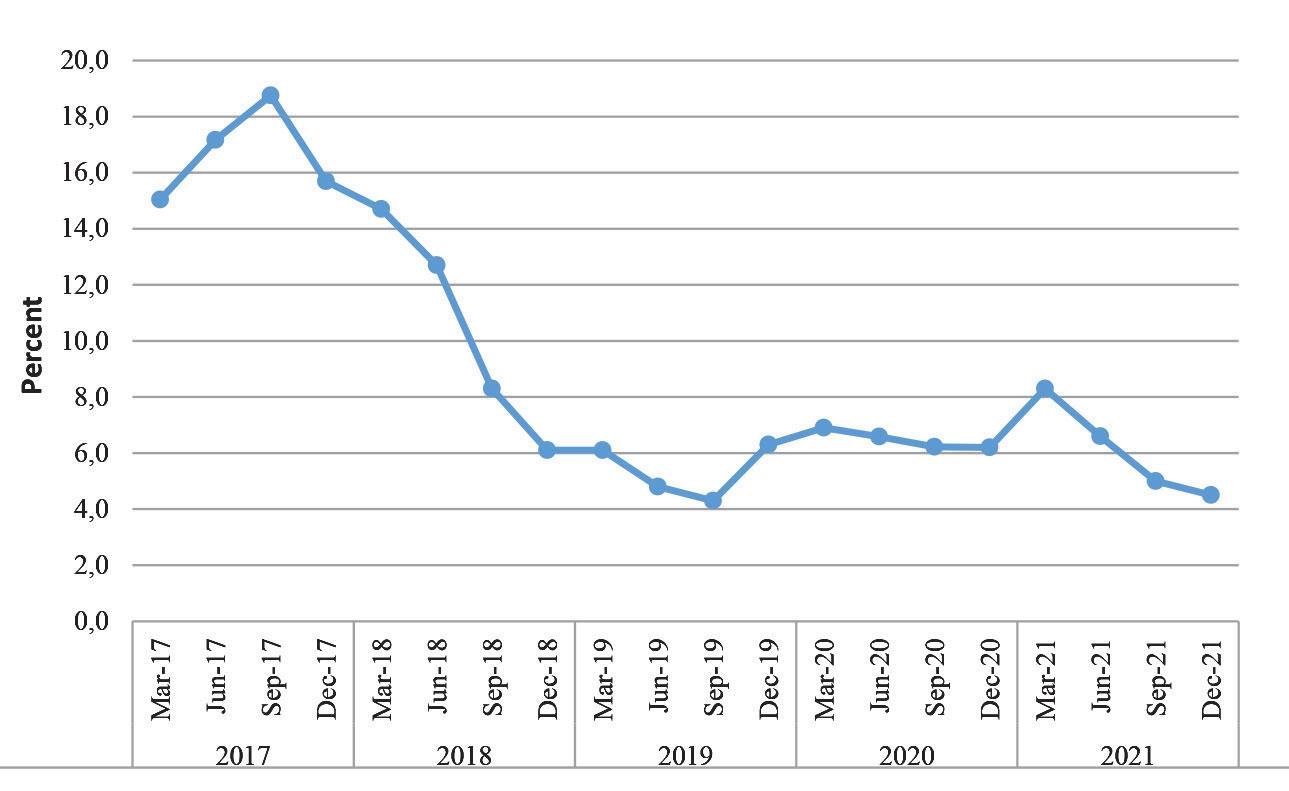

The central bank says this, coupled with a 16 percent drop in Non- Performing Loans, made the banking sector’s assets quality improve as depicted by a decrease in the NPL ratio to 4.5 percent in December 2021 from 6.2 percent in December 2020, against acceptable prudential ceiling of 5.0 percent.

The central bank has attributed the increase in gross loans and the reduction in NPLs to interventions in loan restructuring and moratoriums which were affected in 2020 by the financial sector regulator and continued in 2021.

The report indicates that as at December 2021, a total of 38 facilities amounting to K21.0 billion were still under moratorium, which was a reduction in terms of numbers, from a total of 350 facilities worth K20.4 billion as at December 2020.

Economist from the Malawi University of Business and Applied Sciences Betchani Tchereni said the reduced NPLs and gross loans increase are a good development for the banking sector. He however said this could not signal improved economic activity as most loans were meant for consumption.

“Going forward, the loans might dwindle because if inflation does not go down we expect interest rates to also increase which will make the cost of borrowing high and dwindle loans,” he said.

Malawi has eight commercial banks which are still showing signs of resilience amid the economic volatility. Justin Mkweu is a fast growing reporter who currently works with Times Group on the business desk. He is however flexible as he also writes about current affairs and national issues.

For More News And Analysis About Malawi Follow Africa-Press