Africa-Press – Malawi. Pensioners had the year to remember in 2024 as their investments grew by almost 300 percent, generating K981 billion, figures in the Reserve Bank of Malawi (RBM) Financial Stability Report shown.

This, coupled with K260.3 billion contributions in the six months to December, helped the industry’s assets to swell to K3.5 trillion from K2.8 trillion.

“This was mainly driven by 115.4 percent growth in pension contributions to K260.3 billion.

In addition, the sector registered a total investment income of K981.1 billion, representing a 298.9 percent increase from the K246 billion registered in June 2024,” reads the report.

The sector’s investments are observed to be concentrated in listed equity and government securities, posing a concentration risk, the central bank noted.

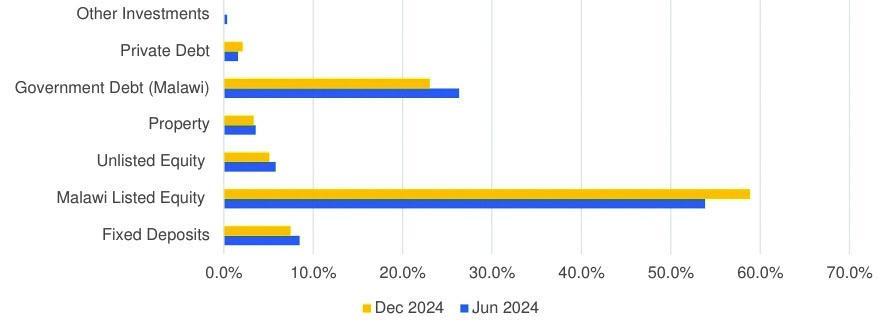

“The proportion of listed equity as a percentage of total investments increased to 58.9 percent from 53.8 percent in June 2024, whilst the share of government securities to total investments marginally decreased to 23.1 percent from 26.3 percent in June 2024,” reads the report.

The report further states that the absolute value of listed equities stood at K2 trillion, while government securities amounted to K800 billion.

Economist Lesley Mkandawire said the industry is capitalising on the revenue challenges the government is facing, thereby making short-term investments in treasury bills which are turning out to be highly profitable and risk free.

Mafuta Mwale“We need [more] pension resources to be invested in infrastructure; real estate is one area that should be considered,” he said

In a recent interview, RBM Governor McDonald Mafuta Mwale said the country needs to utilise pension savings to transform the economy.

He said the central bank will work with the industry to diversify investments to the real sector.

Mafuta Mwale said modalities are being put in place to allow offshore investments by the industry to maximise investment opportunities.

He admitted that the current inflation trend poses risks of value erosion of the pension savings hence the need for pension companies to be more innovative on investments to ensure high returns that beat inflation.

For More News And Analysis About Malawi Follow Africa-Press