Africa-Press – Malawi. The Malawi Stock Exchange (MSE) recorded active trading last week, with FDH Bank plc becoming the most valued counter with a market capitalisation of K4.7 trillion, up from K4.03 trillion a week before.

The bank’s market value more than doubled from K1.9 trillion in February, a feat FDH Bank Financial Holdings Limited Head of Marketing and Communication Levie Nkunika attributed to the bank’s strategic focus.

Last week, the bank announced to have secured a 98.9 percent stake in Ecobank Mozambique SA (EMZ) through a definitive agreement with Ecobank Transnational Incorporated.

Standard Bank is the second most valued listed firm, at K4.3 trillion.

Total market capitalisation for the week stood at approximately K18.3 trillion, reflecting a broadly steady market sentiment that has persisted since the onset of the year.

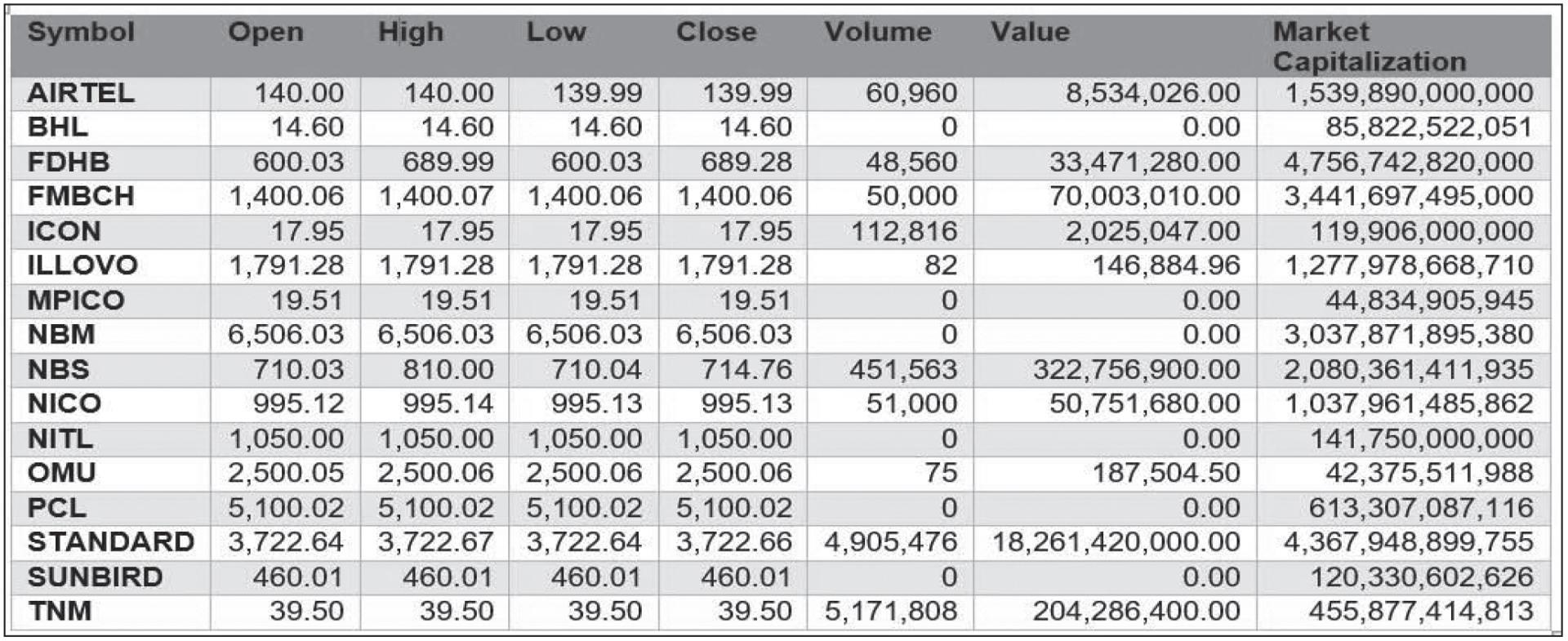

In the week under review, Airtel Malawi plc and Standard Bank Malawi plc drove market turnover, according to the MSE Weekly Summary.

Airtel Malawi plc posted the highest value of shares traded at K597.7 million from 4.28 million shares, closing at K139.99 per share, while Standard Bank plc followed closely, generating K19.01 billion from 5.1 million shares traded, closing at K3,722.66 per share.

FDH Bank plc traded 319,244 shares worth K195.5 million to close at K689.28, and NBS Bank plc, which saw 624,380 shares worth K444.17 million change hands, ended the week at K714.76.

FMB Capital Holdings plc was stable, with 310,944 shares traded at a closing price of K1,400.06, translating to K435.3 million in turnover.

National Bank of Malawi plc traded 19,828 shares worth K129 million, closing at K6,506.03.

Illovo Sugar Malawi plc closed unchanged at K1,791.28 per share after trading 15,554 shares worth K27.86 million while Press Corporation plc also remained flat at K5,100.02 per share with 3,213 shares traded at K16.38 million in value.

Equity market analyst Kondwani Makwakwa said the market was recording growing demand from investors who were scrambling for a few counters on the market.

“To keep the momentum, more companies need to list, especially in key sectors such as agriculture and energy. This would give investors more choice, improve liquidity and make the market a better reflection of real business performance,” he said.

For More News And Analysis About Malawi Follow Africa-Press