Africa-Press – Mauritius. The first Corporate Governance (CG) Scorecard Assessment Report 2021, was presented, yesterday at the FSC House in Ebène, in the presence of the Minister of Financial Services and Good Governance, Mr Mahen Kumar Seeruttun; the Chair of the National Committee on Corporate Governance, Ms Aruna Radhakeesoon; Assurance Partner, PriceWaterhouseCoopers (PWC), Mr Julien Tyack, and other eminent personalities.

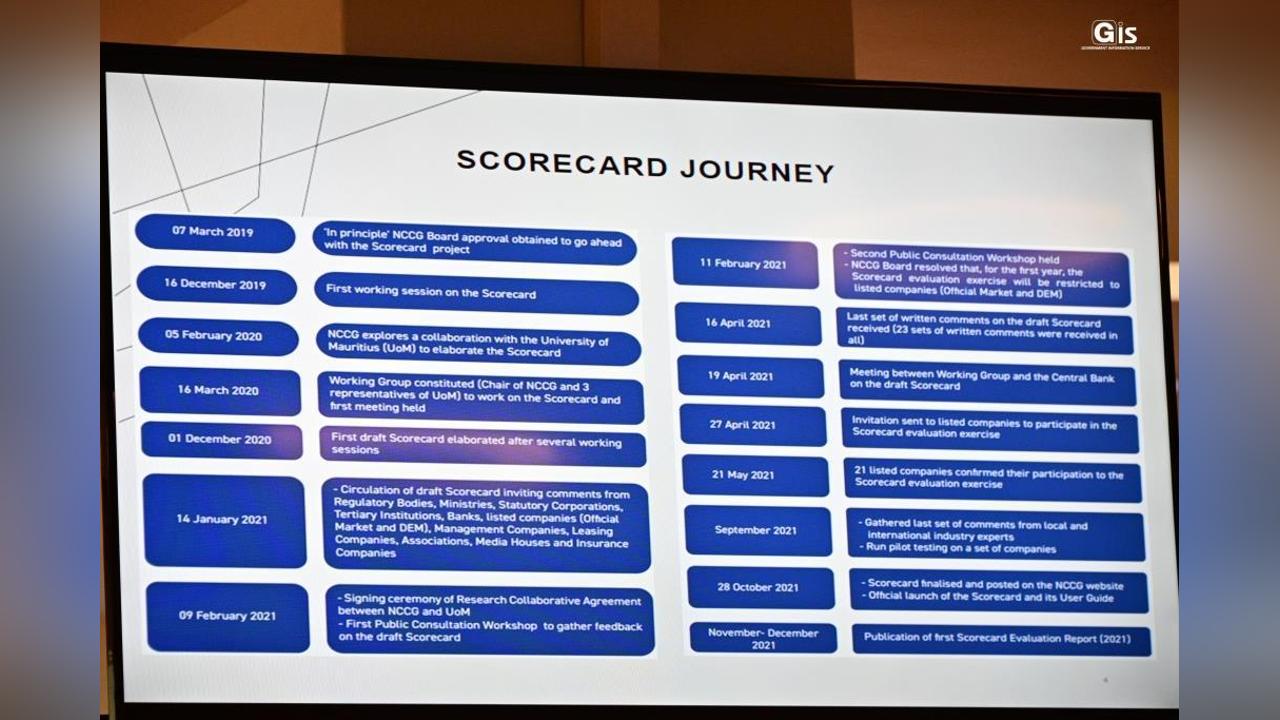

The CG Scorecard for Mauritius was successfully launched in October 2021. The objective of the CG Scorecard was to achieve concrete progress in CG practices in Mauritius by way of meaningful comparative data year in year out.

The Report showcases, for the first time in Mauritius and for the year 2021, the governance practices where listed companies excel and where they must focus their energy to raise their standards. It will put Mauritius amongst the few countries in the world to measure progress in corporate governance practices in a quantitative manner.

The Scorecard is a tool to measure in quantifiable terms the extent of compliance of CG practices with the indicators set out in the Scorecard by analysing the public disclosures and explanations given by organisations in their annual report and on their website.

The Scorecard is divided into three key parts – Board Effectiveness, Audit Oversight and Effectiveness, and Relations with Stakeholders/Shareholders, Sustainability and Inclusiveness and consists of 66 Key Performance Indicators.

In his keynote address, Minister Seeruttun commended the National Committee on Corporate Governance (NCCG) for achieving another milestone after successfully introducing the Corporate Governance Scorecard for Mauritius in October 2021.

He said that good governance is key to sustainability of organisations and helps to improve the quality of life for citizens. Governance is much more than just the structure, processes, and rules of decision-making and controls.

Good governance is a culture and a climate of consistency, responsibility, accountability, fairness, transparency, and effectiveness that is deployed throughout the organisation, he added.

He recalled that the financial crisis has shown that strong and well-regulated institutions build resilient and sustainable markets by instilling investor confidence and protection.

Good governance through Government’s political commitment in strengthening its regulatory institutions and working closely with private sector and all of its stakeholders to successfully address the strategic deficiencies identified by FATF was instrumental in steering Mauritius off FATF’s grey list and the EU’s black list, he underlined.

He emphasised that Mauritius still requires commitment from both public and private sector to sustain a stronger and more effective AML/CFT framework to further strengthen the reputation of the country as a credible and robust international financial centre.

Speaking about the CG Scorecard for Mauritius 2021, Minister Seeruttun highlighted that it provides a structured and comprehensive framework for organisations to identify the range of items requiring disclosure, as well as the breadth and depth of that disclosure to effectively communicate good corporate governance practices.

According to him, the yearly assessment corporate governance exercise and the dissemination of the assessment report will put Mauritius amongst the few countries in the world to measure objectively progress in corporate governance practices in a quantitative manner.

He expressed hope that the Corporate Governance Scorecard and its 66 indicators will give rise to a new type of corporate citizenship consciousness. He therefore urged organisations to use the Scorecard together with its user Guide to self-assess the level and quality of their corporate governance practices and disclosures in their annual reports and on their websites.

For her part, Ms Aruna Radhakeesoon observed that the Scorecard Assessment Report 2021 marks an important milestone in the corporate governance journey of Mauritius.

She said that very few countries in the world measure progress in corporate governance practices in a structured, objective and quantifiable manner adding that Mauritius is now amongst them.

This will certainly make our International Financial Centre more attractive to foreign investment, she added. She announced that the NCCG will shortly be kicking off the 2nd Scorecard Assessment Exercise and that all Public Interest Entities will be invited to participate in the exercise.

Key findings of the CG Scorecard Assessment Report 2021 Twenty-one companies listed on the Stock Market of Mauritius volunteered to participate in the first Scorecard Evaluation Exercise.

PWC was appointed to carry out the scoring exercise. This first Scorecard exercise shows a mixed picture, with a significant difference between the strongest and weakest performing companies.

The scores achieved across the 21 companies range from 24 to 81% with an average score of 54%. While nine entities have scored over 60%, eight have not achieved more than 50%.

The strongest element is Board Effectiveness. The average score achieved across the companies is 61%. Companies score relatively well for disclosure of the composition, strength and experience of their Board of Directors and Sub-Committees.

The average score for Audit Oversight and Effectiveness is only 51%. Many companies are providing minimal disclosures on their Risk Management, Internal and External Audit.

The average score for Relationships with Shareholders, Stakeholders, Sustainability and Inclusiveness is only 49%. Only 60% of companies in Mauritius state that they fully comply with the 2016 Code of Corporate Governance.

The most common type of non-compliance is in respect to Board Composition. These include lack of independent directors, executive directors, an independent chair or a female director.

The second most common non-compliance is in respect of disclosure of the remuneration of individual directors. Some companies are still reluctant to disclose the remuneration of Executive Directors stating commercial sensitivity as the main reason.

For More News And Analysis About Mauritius Follow Africa-Press