Africa-Press – Mauritius. Air Mauritius seems to have seen off the threat of liquidation after an agreement with its creditors to restructure its debt through a massive Rs12 billion government bailout.

Out of this, Rs 9.5 billion is just to pay off the debt the airline had struggled with before heading into voluntary administration in April last year. What went so wrong with Air Mauritius?

AIR Mauritius has headed off a liquidation, coming to a deal to restructure the air- line’s debts after a massive Rs12 billion bailout from the government.

“This is a compromise agreement with the airline’s creditors.

In fact, to make such an agreement, they had to get money from the government, which is not a grant, but a big shareholder’s loan,” explains economist Pierre Dinan to l’express.

The government directly or indirectly controls over 50 percent of the voting rights in Air Mauritius. “What has not been disclosed yet is what are the terms of this loan, or how long the airline has to pay it back,” Dinan points out.

The report from the administrators points out on page 24 that Rs9.5 billion out of this Rs12 billion, “concerns only the amounts due to creditors as at the appointment date (i.

e. April 22, 2020)”. That is to say, at the time the airline entered into voluntary administration, just as Covid-19 was getting into full swing. The report says that the remaining Rs2.5 billion is to keep the airline going.

“The administrators ran the company for over 16 months, so that’s Rs1.7 billion spent; I assume that they are asking for the additional Rs2.5 billion to absorb the costs since airline went into administration,” says Megh Pillay, ex-CEO of Air Mauritius, “that does not leave much in terms of working capital; in 2019 alone, the turnover of the airline was Rs22 billion, so that means the costs were higher than that.

Rs2.5 billion won’t go very far. ” What is missing, Dinan argues, “is anything about the future of the airline, will it be revamped? Is it a company that is solvent or will it make a profit?” Given that the bulk of the bailout is needed to just paper over the airline’s debts even before Covid-19 put it to a near stop, it is important to understand just what went wrong with Air Mauritius.

The roots of the problem date back to the days of Sir Harry Tirvengadum, who ran the airline as a fief insulated from the interference of politicians between 1978 and 1997.

“I joined the airline in 1984, at the time we had just a couple of Boeing 707 planes,” recalls Raj Ramlugun, former manager at Air Mauritius and currently the secretary of the Listed Companies Minority Shareholders’ Association, “in those days Tirvengadum was all-powerful and so long as it turned a profit, no one was too keen to look too closely at what was going on inside.

” As the airline expanded, both in terms of buying planes and adding routes, this started changing.

“That’s when politicians started seeing the airline as a potential cash cow, when it started expanding, buying more planes and hiring more people,” says Ramlugun.

It was only in 2001, that the omerta surrounding Air Mauritius broke with the Caisse noire scandal and allegations that Tirvengadum and others within the company had been using the airline to run a slush fund out of a bank account in Geneva to pay off people within the company, politicians and some in the media.

“That was a wake-up call for us,” recalls Ramlugun. The scandal, while revealing the inner-workings of the airline, also crippled the airline’s ability to resist direct government control.

As the politicians stepped in and started opening up the airline from the self-contained fief it was previously, the airline swiftly became a place to hire political favourites.

The danger of this readily became apparent when the airline lurched into its most long-lasting disaster. Following the 2008 economic crisis, the airline entered into a hedging exercise, to lock-in the price at which it bought its fuel.

While other airlines at the time were looking at short-term hedging arrangements, Air Mauritius entered into a two-year arrangement and hedged its oil purchases at $105 a barrel for between 80 to 90 percent of its fuel until 2010.

The problem was that while Air Mauritius was expecting oil prices to rise further, major oil-producing states were signalling that they expected oil prices to fall, with some coming up with budgets expecting a price fall to as low as $45 a barrel. The result was a financial disaster that wiped off nearly Rs7 billion of Air Mauritius’ books.

“Air Mauritius always had a lot of cash, despite the slush funds and the murky deals; the money was coming in and the airline had built up enough re- serves to keep it going,” says Ramlugun, “but with the hedging saga all of this was wiped out nearly overnight.

” Dinan terms it a “turning point” for the airline, “it just made things worse for Air Mauritius going forward”.

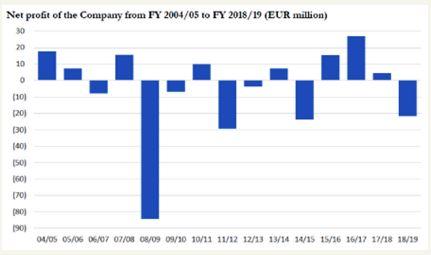

How much worse? “After that, we just saw the airline go through a seesaw performance each year, it would post profits but how real were they? They were just circumstantial, when fuel costs were low,” insists Ramlugun, “rather than the financial strength of the airline itself”.

Prior to the hedging exercise, Air Mauritius had its equity valued at 200million euros and a cash position at 82million euros. Posthedging, its cash position was reduced to 20million euros, and its equity never crossed the 100-million-euro mark.

It is this Air Mauritius that then launched on a buying spree for more planes. Buoyed by low oil prices and a better-looking balance sheet, following an air show at Farnborough in the UK, the airline announced in June 2014 that it was in talks with Airbus to buy six A-350s.

Two were bought through the leasing company AerCap to be delivered in 2017, and the remaining four directly from Airbus, two to come in 2019 and the last two in 2023.

Two of these planes were leased to South African Airways. Air Mauritius signed an MoU with Airbus in July and the order placed in November 2014, barely a month before the general election.

“Air Mauritius just bit off more than it could chew,” argues Pillay, “an airline with a total fleet of 13 planes just cannot go on a shopping spree for six more planes at one go.

The deal was criticised by the MSM then-opposition party, which argued that Air Mauritius had overpaid for the planes and other terms like escalation clauses in the lease agreement that meant that as time went by (and the value of the planes went down), the lease payments would go up.

When it came to power in the 2014 election, the new government announced that on January 12, 2015, it had asked the financial services ministry to investigate the Airbus deal. The idea was that the new aircraft, being more fuel-efficient, would bring down the airline’s costs.

“That is not the only factor to consider,” maintains Pillay, “when oil prices go up, these are passed onto the price of the ticket through a fuel charge, and they are applied quickly, and then when prices go down, they are removed slowly unless consumers protest, or a competitor drives ticket prices down.

Air Mauritius is not like Ryanair, which operates in a low-cost environment with a fleet of 400 planes where a few dollars here or there make a difference.

” But instead of revisiting the deal, Air Mauritius not only continued with it, but decided to buy two more planes, this time A330s. By March 2019, the airline ended up paying 15.9 million euros a year just for the leases on its new planes.

For an airline already swinging between the red and the black with little financial muscle to spare, the new planes piled on the pressure, plunging the airline into a 21.7-million-euro loss.

To make up for it, by 2019, Air Mauritius had sold its stake in Cotton Bay Resort, Rodrigues, for Rs111.3 million and a share swap with Air Mauritius buying a 20 percent stake in Mauritius Duty Free Paradise for Rs405 million.

It has now sold that stake for Rs355 million. 12 percent of what Grant Thornton itself had valued the stake at in 2019. But it is not just the new planes that are the problem. What is also interesting is what it has been done with its older ones.

According to the report submitted to the airline’s creditors, the administrators of Air Mauritius announced that they sold two A319 planes for $3 million each to a leasing company and sold two of its A340s to a plane-scrapping company from which it hopes to get $350,000 over two years for its parts.

“That’s quite far from the book value of these planes,” says Pillay, “in fact, it’s hardly 10 percent of what these planes were valued at in 2019.

” The irony is that the same Grant Thornton – currently running the administration of Air Mauritius and negotiating the deals for selling off these planes – was responsible for valuing them in 2019.

For Pillay, this sale raises a lot of questions: “We all know that the greater part of the global airline fleet is still grounded; this was no time to sell off planes.

” He further points out that Air Mauritius had already managed to get Rs300 million from the government in May 2021 and another overdraft of Rs200 million from a bank, with the government already signalling its intention to bail out the airline.

“Then why the hurry to get rid of these planes.

Since all they got was Rs280 million, why not just ask the government for that amount too?” The administrators’ report argues that by getting rid of the older planes, the airline will save $23 million in maintenance costs.

“The A340s could have been gradually phased out rather than sold like this, they cost barely $350,000 to maintain, but the new A350s each cost four times that with Rs1.2 million in lease payments,” Pillay points out.

It was not just new planes that Air Mauritius had to struggle with, but also ambitious government schemes. In June 2015, the government launched its vision 2030 document proposing to position Mauritius as a hub on an Asia-Africa air corridor.

So, in October 2015, it signed an agreement with Changi airport in Singapore. Singapore would be the hub at the Asian end of the corridor and Mauritius would be the hub at the African end. The idea was the brainchild of then-government advisor Georges Chung Tick Kan.

The problem was that Mauritius just did not fly to many places in Africa and Air Mauritius was just a bit player in the Asian-African route, accounting for just 6 percent of bookings for flights between Asia and Africa, compared to giants like Emirates, which had a share of 22 percent or Ethiopian Airlines that had 16 percent, or Qatar Airways with 11 percent.

Nor was it as revolutionary an idea as it seemed. After all, before 2002, Air Mauritius had treated Singapore as its Asian hub, before dropping it for Kuala Lumpur.

With the corridor, it seemed to be going back to the pre-2002 strategy. “This cost quite a bit; we were flying empty aircraft into Africa, and it cost much more to fly to Singapore as opposed to Kuala Lumpur,” argues Pillay.

All this, it seemed, was being shouldered by the airline itself. “One principle was not observed; if a national company is asked to do something, it can say yes, but ask for subsidies as British Railways did when it was asked to service remote villages by the UK government.

But nothing like that happened in the case of Air Mauritius,” insists Dinan. The folly of this soon became evident. Despite Air Mauritius insisting as late as 2018 that the corridor was a success, by 2019, it had quietly dropped its flights to Maputo and Harare, part of its corridor project.

Even before that, in November 2015, China Southern Airlines pulled out of Mauritius, as did Air Asia, which left in March 2017. By April 2018, Air Mauritius was also cutting flights to Guangzhou, Chengdu and Wuhan.

Asia just wasn’t all that interested in Mauritius, and its much-touted Asian-African Air Corridor simply fizzled out. Now it seems the airline is finally coming to grips with that, recently announcing that they will restart direct flights to Kuala Lumpur.

The costs of these ambitions were, of course, borne by the airline that could not say no to the government THE running thread of the Air Mauritius saga has been the pendulum swing towards the politicians after the Caisse noire affair.

And it seems that few lessons have been learned from the subsequent history of Air Mauritius. Take, for example, the government subsuming Air Mauritius within a larger organization, Airport Holdings Ltd, together with Airports of Mauritius Ltd, Airport Terminal Operations Ltd and Mauritius Duty Free Paradise.

The idea seems to be that, if Air Mauritius is the sick man of the group, then the others would help cross-subsidise the airline. This, of course, replicates what has been done in countries like the UAE and Singapore, where their airlines are part of larger, diversified clusters.

“This won’t make Air Mauritius profitable. You can cross-subsidise, but the airline by itself has to be a profitable business,” argues Dinan.

Simply cherry-picking from abroad will not work here either, as Ramlugun insists, “the leadership culture is just not here, you cannot have one of the largest companies listed on the Stock Exchange come with an elaborate structure to cross-subsidise the airline and all this being run by a novice at the top.

” The reference here, of course, is to Ken Arian, a senior government advisor parachuted into the post.

This, too, is not as much of a departure as it seems: in January 2021, before Covid-19 plunged the airline into voluntary administration, the government attempted to get another government insider, the Mauritius Telecom CEO Sherry Singh, to head a transformation committee to restructure the airline.

All that seems to have changed is that one government insider has replaced another to pilot the airline. “The problem is that Air Mauritius has never been allowed to run as a business,” concludes Dinan. With the government’s plans to keep Air Mauritius under its thumb, that does not seem likely to change anytime soon.

For More News And Analysis About Mauritius Follow Africa-Press