Africa-Press – Mauritius. The Mauritius Revenue Authority (MRA) has reaffirmed its efficiency and effectiveness as a world-class revenue-raising system by exceeding the benchmark of 21.6% growth in revenue collections, amounting to Rs 137 billion for the Financial Year (FY) 2022-2023.

The largest contributors to MRA Revenue Collections were found to be the trade sector (36.3%), followed by the manufacturing sector (11.5%), the global business sector (10.3%), and the hotel sector, which altogether covered 64% of all receipts.

The financial sector inclusive of banks, insurance, other financial and insurance activities, and global business activities accounted for 19% of total revenue while the hotel sector’s share increased to 5.8% in 2022-2023 as compared to 4% in the previous year.

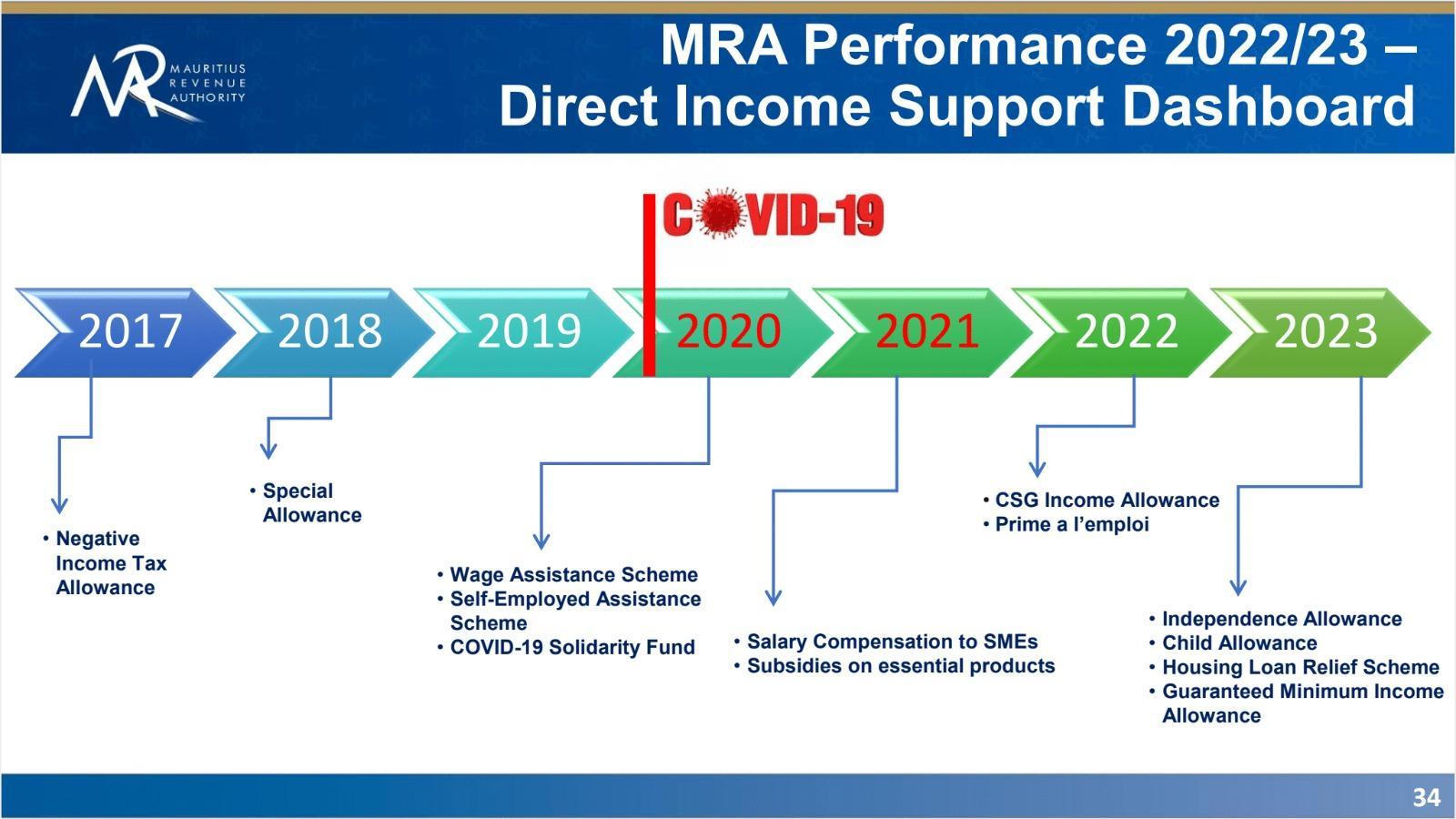

Direct Income Support Schemes Over the recent years, the Revenue Authority has undergone an outstanding transformation, expanding its mandate beyond tax collection to include providing financial assistance through Direct Income Support Schemes.

Following the announcements made in the budget speeches 2022-2023 and 2023-2024, MRA has successfully implemented several new financial assistance schemes, namely the: Contribution Sociale Généralisée (CSG) Income Allowance; Independence Allowance; CSG Child Allowance; Housing Loan Relief Scheme and; the Guaranteed Minimum Income Allowance.

The CSG Income Allowance is an allowance of Rs 2,000 and Rs 1,000 payable to eligible employees and self-employed individuals whose total emoluments do not exceed Rs 25,000 and whose total emoluments are above Rs 25,000 but not exceeding Rs 50,000 respectively.

The CSG Child Allowance is an allowance of Rs 2,000 for the months of July 2023 to June 2024, designed for parents with children aged up to three years while the Independence Allowance, a one-off allowance of Rs 20,000, is directed to eligible children who have attained or will attain the age of 18 years during the period of 01 January 2023 to 30 June 2024.

In a bid to provide relief to households affected by rising interest rates, the Housing Loan Relief Scheme, a monthly allowance of Rs 1,000 will be paid for the months of July 2023 to June 2024 to an individual who has contracted a secured housing loan not exceeding five million rupees.

In the same vein, the Guaranteed Minimum Income Allowance was announced in the Budget 2023-2024 and is payable to individuals in full-time employment to increase the guaranteed minimum income to Rs 15 000 as of July 2023.

Through these financial assistances, the MRA has effectively demonstrated its proactivity, adaptability, responsiveness, and dedication to supporting the citizens of the Republic of Mauritius in challenging times. MRA Customs: Trade Facilitation and Border Protection

In line with MRA’s strategic objectives, the Customs collects revenue for the government, ensures national security, protects the society, and prevents illicit financial flows while facilitating the legitimate movement of people and goods across the border.

For the FY 2022-2023, the MRA Customs again geared all its efforts towards managing the Customs functions effectively through the implementation of Trade Facilitation and Border Protection Projects.

As such, the number of Consignments scanned reached 1,256,083, while the number of Customs Declarations processed for Imports amounted to 238,022, and that of Exports amounted to 74,534.

Interception of smuggled and contraband goods resulted in the seizure of 200,205,000 Synthetic Cannabinoids; 108,276,900 Heroin; 49,016,550 Cocaine; 23,771,950 Hashish; 8,341,431 Cannabis; 2,044,000 Ecstasy; 19,100 Cannabis Seeds and 7,500 Psychotropic Substances, amounting to a total of 391,682,431 narcotic seizures.

Furthermore, through the Post-Control Audit, revenue collected amounted to Rs 22.4 million while revenue collected through the Post-Clearance Review of Declarations reached Rs 39.3 million.

In a bid to enhance boarding, searching, and tactical operations to combat contraband, future projects contemplated for the MRA Customs involve: the Setting up of a Visit, Board, Search, and Seizure Simulator (VBS3) facility; a Container Control Programme (CCP) to identify trans-national crimes and inspect such high-risk shipments in the port with minimum disruption to legitimate trade; Firearms and Defensive Weapon for the safety and security of Customs Officers and; the provision of five additional scanners at the Sir Seewoosagur Ramgoolam International Airport at the Arrival Hall (landside) for the scanning of hand-carried luggage.

For additional information, kindly see the links below to videos containing detailed information about MRA’s revenue collections and financial assistance schemes.

For More News And Analysis About Mauritius Follow Africa-Press