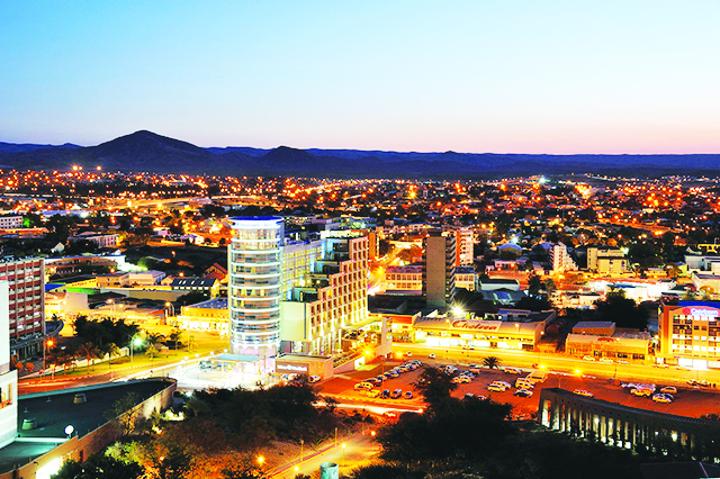

Africa-Press – Namibia. THE Windhoek municipality has completed the valuation process of immovable property to determine the values of new properties and upgrades made to rateable properties constructed between 2016 and 2020.

The general property valuation conducted in 2015 shows there were about 57 000 rateable properties in Windhoek at the time. However, a municipal report dated 2018/19 shows there were only 54 990 rateable properties in the city by 2019, excluding sectional titles.

The municipality collected at least N$556 million from these properties in 2019. Windhoek municipality spokesperson Harold Akwenye says the current interim valuation roll would not have any implications for the rates and taxes currently levied on properties.

Akwenye says the municipality will add the recent values determined to the main valuation roll to form “the basis for the levying of rates and taxes”.

“The values that are as a result of an amendment to the properties are already added to the values on the municipal rates and taxes. These values were done in the same manner as the ones for the main valuation roll on which rates and taxes are being levied,” he says.

Windhoek’s acting chief executive officer, George Mayumbelo, in a notice published earlier this month said the municipality has also compiled a provisional interim valuation roll which is now open for inspection by property owners. He said property owners within the borders of Windhoek can go and inspect the interim valuation roll at the municipality’s head office.

Aggrieved property owners whose valuation is contained in the provisional interim valuation roll are free to lodge objections against any of the valuations attached to their properties within 21 days from the date of publication of the notice, Mayumbelo said.

He said a valuation court hearing will be held at the council chambers on 7 October to consider the provisional valuation roll and written objections lodged if any.

Objectors or duly authorised legal representatives should be present at the valuation court hearing. Property values should not be confused with property rates and taxes levied by the municipality.

Property taxes are levies paid by all property owners, including commercial, industrial, residential and government owners. Rates are based on the municipal value of individual property.

The charges differ from area to area due to the value of the property. It should be understood that revaluation does not always result in a significant increase in rates.

Taxes are revised annually depending on the needs informed by the municipality’s budget, which means they can increase regardless of revaluation. The interim valuation process is therefore carried out to update information on the municipality’s main general valuation roll, which is only conducted every five years.

It details upgrades or additions made to properties, new houses, office malls and other properties constructed after the main valuation roll has already been conducted, among others. It is therefore the basis on which the municipality determines rates and taxes charged on immovable property.

WHY VALUATION? The systematic, in-depth process of revaluing all immovable property in the municipal area determines new property values for rating purposes.

The Local Authorities Act requires a general revaluation to be completed every five years. The primary purpose of general revaluation is to level property owners and property classes.

The value of a property is mainly determined by elements such as storage, age, size, wear and tear, and room layout. It is also based on the market value of similar properties in the area. The real estate market constantly fluctuates based on prices achieved as a result of the interaction between buyers and sellers.

Differences vary from one class of property to another, and from one township to another, because some properties appreciate in value more rapidly than others. This creates inequitable valuations among owners and types of property, which is corrected periodically through general revaluation every five years.