Africa-Press – Namibia.

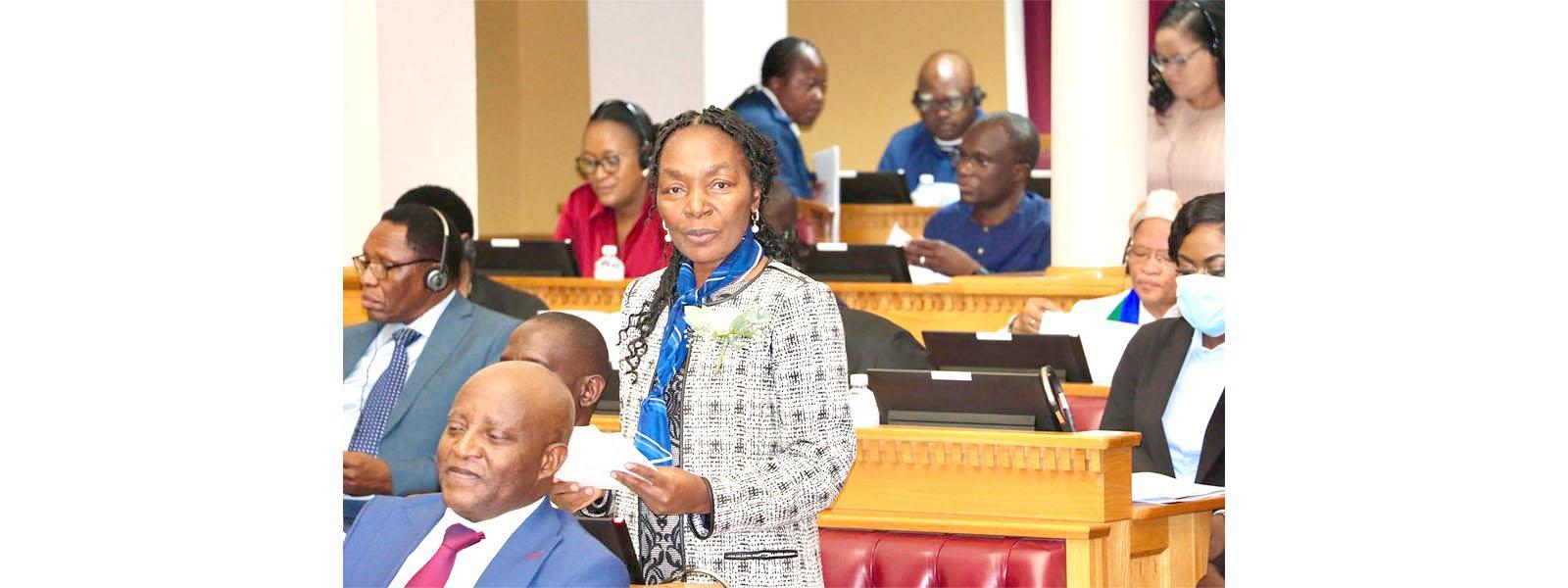

The mid-year budget review, tabled in Parliament yesterday by finance and public enterprises minister Ericah Shafudah, indicates that domestic growth persists, albeit at a slower pace than anticipated.

Delivering the mid-year fiscal review to account for unforeseen and unavoidable expenditure. The minister cautioned that an increased burden of debt servicing and the slow uptake of development spending signal tightening in fiscal space.

These challenges have resulted in the finance minister focussing on tighter prioritisation of resources, stronger revenue focus and cost discipline.

“The government’s revenue streams have shown resilience despite economic slowdowns. Personal income tax projections were initially optimistic due to robust economic development, but global commerce has changed. Personal income tax growth is modest compared to FY2024/2025. VAT refunds have increased, resulting in decreased net collections.

However, other areas, like taxes on non-mining companies, have seen improvements. To increase total tax collections, sustainable economic growth and more advancements in tax administration and compliance remain crucial,” said Shafudah.

Overall, the total Appropriation Amendment Bill for 2025/26 remains unchanged at N$89.4 billion.

However, the finance ministry increased the operational budget for the current financial year by N$826 million to a total of N$80.6 billion.

The minister added that, as of September 2025, total domestic expenditure and commitments, excluding statutory, had reached N$41 billion, which accounts for 39% of the budgeted spending for the fiscal year.

This execution rate reflects a decrease of 4 percentage points compared to the 43% rate recorded during the same period in FY2024/25.

On a positive side, Shafudah said the alignment of public expenditure with NDP6’s pillars, particularly human development and infrastructure, offers hope for inclusive progress, provided execution is effective.

Meanwhile, development expenditure is being reined for the current financial year.

It is reduced to N$8.8 billion, down 9.4% from N$9.6 billion.

In contrast, operational expenditure is increased to N$80.6 billion, while debt servicing is revised upwards to N$14.3 billion, representing just over 16% of total revenue.

Meanwhile, the minister’s reform agenda has been described as ambitious, from tax transformation to State-owned enterprise (SOE) diversification and improved expenditure management.

Analysts have commented that success of these reforms will hinge on government’s ability to translate policy design into implementation, to ramp up private‐sector dynamism, and to shield the economy from external and climate shocks.

Shafudah delivered the budget review under the theme of ‘Beyond 35: For a Prosperous Future’.

This theme speaks to the newly launched NDP6 and positions Namibia’s finances behind the broader ambition of Vision 2030.

In conjunction with other reforms, the finance ministry is developing a comprehensive Medium-Term Revenue Strategy (MTRS), aimed at guiding the tax reform process.

“This strategy will address policy, administrative and legal considerations, while also focusing on mobilising resources for development. Further tax proposals are expected to be revealed in the main budget announcement scheduled for February 2026,” said Shafudah.

She continued that the ministry continues to review the ease of tax compliance.

In this regard, the validity period of good standing certificates, which are a necessary tool in tax compliance, will be revised to one year for individuals and small and medium enterprises, and to six months for other taxpayers.

Yesterday, Shafudah stressed that domestic economic performance must be read in the context of a subdued global and regional outlook.

She cited projections from the International Monetary Fund (IMF) and other sources showing world growth declining from 3.3 % in 2024 to 3.2 % in 2025 before edging down to 3.1 % in 2026.

Advanced economies are forecast to grow even slower at around 1.5 %.

Sub-Saharan Africa is projected to grow at 4.1 % in 2025, rising to 4.4 % in 2026.

Shafudah identified global risks, including rising protectionism, labour-supply disruptions, fiscal vulnerabilities and potential corrections in financial markets.

In this respect, Namibia’s economic fortunes are linked not just to domestic policy, but to the shifting currents of global trade, commodity markets and climate-shock exposure.

On the domestic front, the review notes that the economy expanded in the first half of 2025, but at a slower pace than 2024, held back by declines in output of diamonds, zinc concentrate, cement and blister copper.

On the upside, uranium and gold production increased, while agriculture enjoyed better rainfall and investment in irrigation.

Moreover, the latest figures reflect a state of relative resilience in terms of revenue growth and the narrowing trade deficit.

However, mounting pressure in the form of slower growth, rising interest costs and tight execution rates that point to the need for disciplined reform.

The minister underscored that, without action “key fiscal anchors, such as the debt-to-gross domestic product ratio” will deteriorate.

Commentary

Commenting on the budget review, economist Josef Sheehama noted that government’s proactive approach to managing its international debt, which includes partially refinancing a US$750 million Eurobond backed by a sinking fund, helps to maintain fiscal stability.

“By doing this, investor trust is enhanced and sensitivity to fluctuations in currency rates is contained. Additionally, I am thrilled with the target areas, which include youth empowerment, healthcare infrastructure and agriculture, but more work needs to be done. Notwithstanding prudent debt management, Namibia’s debt levels will remain high and unsustainable, with threat to fiscal stability,” he stated.

He added that a source of concern is a commitment to unproductive spending in the face of persistent fiscal challenges.

Also weighing in, managing director of Twilight Capital, Mally Likukela, pointed out that the budget review once again reaffirmed government’s commitment to social development.

“Generally, the funding allocation that weighs heavily toward the social sector reallocation remains largely in line with the main budget projection tabled earlier this year. However, the growing concern that lingers is with regards to deteriorating efficiency that manifests itself through low execution rate,” Likukela stated.

He added that, while the review did not introduce sweeping new reforms or programmes, it nonetheless offered something far more important than new reforms, namely credibility.

“During the time where the economy remains under a lot of pressure, which could weaken the trust and confidence into the fiscal policy, there is a great need to ensure credibility and preserve the trust and confidence,” Likukela added.

Klaus Schade, another economist who weighed in, concerningly noted that the execution rate of projects and programmes has declined.

“The execution rate in the previous FY was already disappointing. A low execution rate implies that the economy has not benefited from government expenditure as expected, which contributes to the lower economic growth rate and also lower returns to government in form of VAT and Corporate Income Tax. A thorough analysis is needed concerning the low execution rate,” he stated.

He continued that the capital budget was cut to re-allocate funds to the operational budget, which will result in necessary investment in infrastructure not taking place.

Schade pointed out that this will reduce returns on investment in the short and longer periods.

“The lower revenue projections could imply that envisaged programmes such as free tertiary education, increase in the social old age pension might not be feasible next year… The proposed increase in guarantees as opposed to the issuance of bonds for Public Enterprises needs careful consideration to avoid increased financial obligations of the State,” Schade stated.

However, he emphasised that government must be applauded for not increasing total expenditure but resorting to re-allocating funds to priority areas from under-performing entities and programmes.

“Overall, the fiscal outlook has certainly deteriorated, which requires a clear policy prioritisation,” Schade advised.

For More News And Analysis About Namibia Follow Africa-Press