Africa-Press – Namibia. Namibia has repaid a US$750-million eurobond issued in 2015, the largest single-day debt maturity in the country’s history.

The redemption was financed through two channels: US$444 million from the sovereign sinking fund (cash that had been built up over years specifically for this purpose) and US$306 million raised from commercial banks shortly before maturity.

Since the US$306 million was financed by new borrowing, roughly 40% of the obligation was effectively rolled over, while 60% was settled outright from the sinking fund. The overall public debt stock has, therefore, declined only partially, though the composition of debt has shifted meaningfully.

This transition reduces foreign-exchange exposure and rollover risk, but increases the state’s presence on local bank balance sheets, potentially tightening credit conditions for the private sector if fiscal borrowing remains elevated.

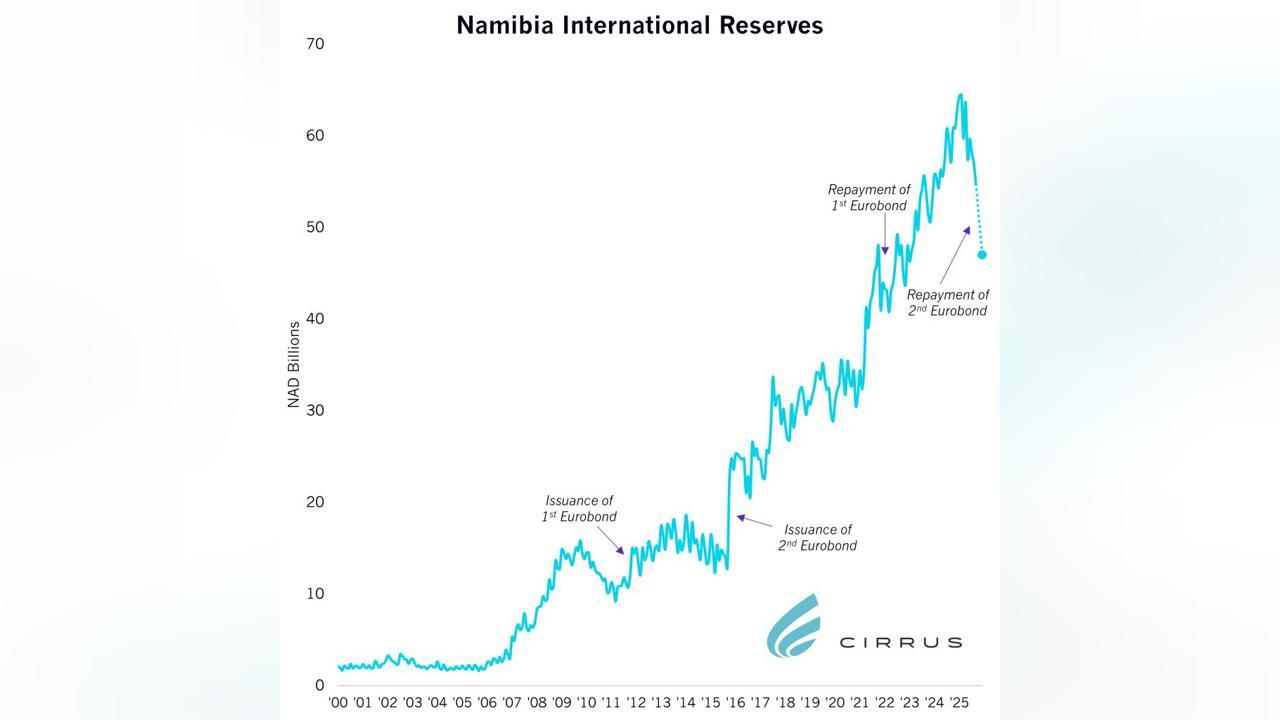

The repayment exerts material downward pressure on Namibia’s international reserves. At end September, reserves stood at N$54.7 billion. By end-2025, they are projected to fall to around N$47 billion – 25% lower than at end-2024 (N$63 billion).

This contraction weakens Namibia’s external buffer required to service imports, maintain the currency peg with the rand and meet external obligations, leaving the economy more exposed to adverse terms-of-trade or Southern African Customs Union revenue shocks.

Despite the pressure on reserves, the Bank of Namibia on 15 October elected to cut the repo rate by 25 basis points to 6.50%, widening the interest rate spread with South Africa to 50 basis points. While the rate cut eases domestic funding conditions, it marginally increases pressure on foreign reserves, given that lower domestic yields could slow capital inflows or encourage outflows.

The Ministry of Finance emphasises that honouring the full repayment reinforces Namibia’s fiscal credibility and positions the country favourably with international investors.

Source: The Namibian

For More News And Analysis About Namibia Follow Africa-Press