Africa-Press – Nigeria. By Cathy Maulidi:

The Cashgate scandal of 2013 exposed a systemic massive looting of the public treasury, through fraudulent transactions enabled by weaknesses in the Integrated Financial Management Information System (IFMIS).

In the aftermath, numerous officials and businesspeople were prosecuted, but for years now, many of the criminally restrained assets remained idle, awaiting clear legal pathways for forfeiture and use.

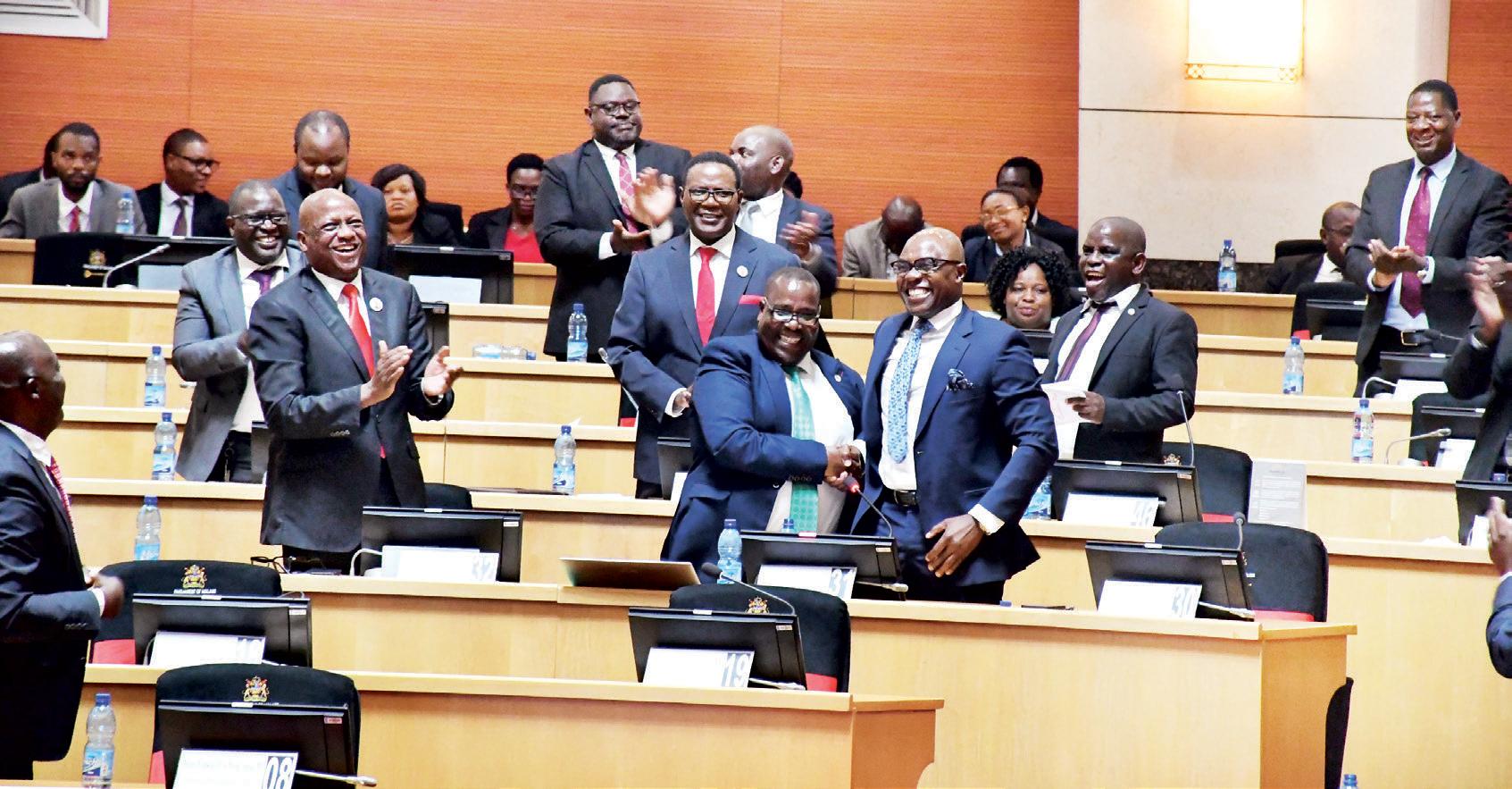

In its last meeting, Parliament amended the Financial Crimes Act of 2017 to improve the use of the Confiscation Fund.

The amendment expanded its application to include compensating direct victims of financial crimes, financing initiatives that enhance the investigation and prosecution of financial crimes and asset recovery.

However, this remains a dream.

This is because as President Lazarus Chakwera assented to some bills which Parliament passed during its sitting in April, the amended Act was on the list of the bills he assented to.

Asked as to when the President plans to assent to this crucial bill, his spokesperson Anthony Kasunda said he needed to make follow-ups.

Presenting the bill in Parliament, Minister of Finance, Simplex Chithyola Banda, said improving operations of the Confiscation Fund would also improve the fight against corruption by transforming frozen or forfeited assets into tangible support for victims, providing deterrence mechanisms and institutional strengthening.

“The bill aims to improve the use of the Confiscation Fund by expanding its application to include compensating direct victims of financial crimes, financing initiatives that enhance the investigation and prosecution of financial crimes and asset accumulated, remained idle and not guided on allowable uses.

Until mid-2024, although the fund existed on paper, the absence of operational regulations meant that assets, like a prominent Cashgate-linked house, could just sit largely unused.

Velli NyirongoAn economic expert Vellie Nyirongo said the Fund and the relevant regulations, once fully operationalised, can strengthen Asset recovery efforts.

“The continued delay in operationalising Malawi’s Confiscation Fund has significant negative implications for the country’s anti-corruption and financial crime efforts. With billions of kwacha seized from corruption and money laundering cases lying idle, the government is unable to deploy these resources towards critical areas such as compensating victims, bolstering investigations, or supporting asset recovery,” Nyirongo said.

He added that the apparent inertia to get the Confiscation Fund full operational effectively undermines public trust in the justice system and signals a lack of resolve in combating financial crimes.

“Moreover, the absence of clear regulations and legal frameworks exposes the recovered assets to risks of mismanagement, depreciation, or even re-looting, which further erodes the potential deterrent effect of asset confiscation,” Nyirongo said.

He said that at a time when Malawi is experiencing heightened incidences of financial crimes, making the Confiscation Fund operation is a matter of urgency.

“The Fund is not merely a repository for seized assets; it is a strategic tool for restoring integrity to public finances, deterring would-be offenders, and providing restitution to those directly harmed by economic crimes.

“Its timely activation would also enable the government to finance enhanced investigative and prosecutorial capacity, closing the impunity gap that emboldens corrupt actors,” Nyirongo said.

According to Nyirongo, the lack of progress on this front risks Malawi falling short of international anti-money laundering standards, which could have broader consequences for the country’s financial reputation and relationships with global partners.

“I would say, the operationalisation of the Confiscation Fund is both a practical and symbolic necessity. It demonstrates commitment to the rule of law, ensures that crime does not pay, and channels illicitly acquired resources back into the fight against corruption and financial crime. Delays only serve to perpetuate impunity and squander opportunities for justice and economic recovery,” he said.

By early 2024, the Ministry of finance, in collaboration with the Financial Intelligence Authority (FIA), completed a draft of regulations designed to “operationalise” the fund, establishing eligibility criteria, application processes, and oversight mechanisms for disbursements.

Under these rules, once property is forfeited, its net proceeds (after auction or sale) flow into the Fund; agencies such as the Anti- Corruption Bureau (ACB), the FIA, or certified civil society organisations may then apply for earmarked grants, whether to compensate direct victims, finance specialized investigations, or support preventive programs (e.g., community financial-literacy workshops).

For More News And Analysis About Nigeria Follow Africa-Press