Africa-Press – Rwanda. Equity Bank Rwanda, on Monday, October 6, launched the Customer Service Week 2025 at its Kicukiro Branch, pledging to deepen customer engagement, improve service quality, and position its clients as “champions” in a fast-evolving digital banking environment.

The week, which marks the beginning of what the bank calls a “Customer Experience Month”, celebrated under the theme, Making Every Customer Mission Possible, will see the bank engage its clients through a series of interactive activities across the country. This includes understanding their needs, improving service delivery, and strengthening relationships that create shared value.

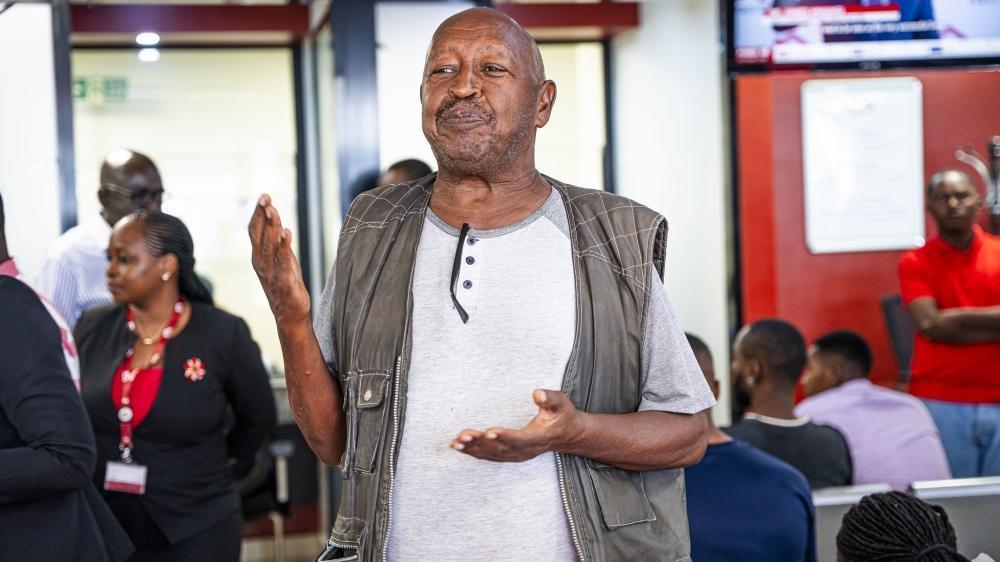

Equity Bank customers being served at the launch of at the launch of Customer Service Week.

Throughout the month, customers are encouraged to share their ideas, feedback, and experiences through open forums, surveys, and direct conversations which will help shape future banking services tailored to their evolving needs.

WATCH: Hannington Namara, Managing Director of @RwEquityBank, speaking at the launch of the Customer Service Week 2025 at the bank’s Kicukiro Branch, told customers that the month will be a homecoming for every Equity customer. He pledged to further enhance service quality and… pic.twitter.com/n6FtvJsFrw

— The New Times (Rwanda) (@NewTimesRwanda) October 6, 2025

Speaking at the launch, Hannington Namara, Managing Director of Equity Bank Rwanda, described the month-long initiative as a “homecoming for every Equity customer”, noting that the bank’s commitment is customer-centred and inclusive.

“Today is a special day,” Namara said. “We have dedicated this entire month of October to recognise our customers, to cherish them, and to show them our programmes. It is for customers that we exist.”

Namara highlighted that the annual initiative aims to bridge the gap between the bank and its clients by facilitating an open space for service improvement and innovation.

Hannington Namara, Managing Director of Equity Bank Rwanda, described the month-long initiative as a “homecoming for every Equity customer”.

“We feel we should take time to understand their needs, to bridge the gap between them and us, so that when we come together like this, they tell us what we have not done right, talk to them, correct it, and have an opportunity to tell them what we are planning for them,” he added.

Championing digital banking, inclusive growth

As part of its ongoing digital transformation, Namara encouraged customers to utilise online and self-service banking options, noting that convenience and efficiency are at the heart of modern financial services.

“As the world goes digital, we would like our customers to be the champions, not to lie back and continue to use brick and mortar, but to be digital, and they can serve themselves and they can get value for their time,” he said.

He also noted that the bank’s role goes beyond financial services, adding that Equity aims to empower clients through capacity-building and financial literacy programmes that help them grow their businesses and investments.

“We want to ensure that they understand what we have in store for them in terms of capacity. We know they are in businesses, in different things they are doing, how can they multiply whatever they are doing? We’d like to be part of that journey so that we create value together, and we can’t do that without building these relationships,” Namara noted.

“We will use this month to catalyse all that, and I’m sure that our customers in the end will be the beneficiaries. This month, therefore, is a stepping stone,” he said.

“What we learn during this Customer Experience Month from customer input to service trends will directly inform how we improve, innovate, and serve better in the months and years ahead,” he added.

Celebrating trust, milestones

Equity Bank, which was established in Rwanda 13 years ago, has expanded to 36 branches across the country with two more expected to be open by the end of this year. Namara expressed gratitude to customers for their continued trust, which has seen Equity Bank grow into the country’s second-largest financial institution.

“We now have the trust of about 1.4 million Rwandans. That’s not small at all,” he noted. “To be trusted by so many in just 13 years is a milestone we recognise. It’s a milestone we know we wouldn’t have done by ourselves without their support.”

He pointed out several milestones that prove Equity’s progress, including the 2023 acquisition and merger with Cogebanque, which expanded its balance sheet, network, and systems for the benefit of clients.

Namara also cited the bank’s success in rolling out agency and digital banking, which have increased accessibility across Rwanda.

“Wherever they are in their villages, they can go to the next coast and get the services of the bank, without having to travel kilometres. Our digital banking services, to date, have over 80 per cent of our transactions being done digitally. People not coming to the branch, that is a huge milestone,” he explained.

Bank officials listen to their customers’ testimonies during the launch of the Customer Service Week.

Commitment to service excellence

Namara said that while no single issue stands out related to customer concerns, the bank is focused on improving service excellence across all customer touchpoints.

“It is service excellence that is standing out for now. Whether it is the branch, on the phone, or online, to ensure that we become relevant, continue to be more relevant to them in the fast-changing world, be reliable, and customer-centric. We’re going to integrate them within our processes, procedures, ways of work, and ensure that we live up to their expectations,” Namara said.

Customers weigh in

Florence Kayiraba, a businesswoman in real estate, particularly in apartment development, has been an active Equity Bank customer since 2012. She commended the bank’s efficiency, especially in loan services, noting that the process is quick.

“If you present your project, the bank understands it quickly. If it’s a loan that can be approved, you get it in a short time. If it’s not possible, they notify you promptly. We celebrate their excellent service that truly stands out,” she said.

The week which marks the beginning of what the bank calls a “Customer Experience Month”, celebrated under the theme, Making Every Customer Mission Possible,

Jean Marie Vianney Rudasumbwa, a customer for the past three years, also praised the bank’s service delivery, saying that some services reach customers wherever they are, while others are efficiently provided at the branches, both with high levels of hospitality.

“However, if they could add a few more counters, it would improve service delivery even further. The branch is located in the centre of Kigali, so it gets quite busy,” he noted.

Equity Bank offilcials launch the Customer Service Week 2025 at Kicukiro Branch Rwanda, on Monday, October 6. Photos by Kellya Keza

“Customer Experience Month”, celebrated under the theme, Making Every Customer Mission Possible.’

Bank officials and customers pose for a group photo at the launch of Customer Service Week.

For More News And Analysis About Rwanda Follow Africa-Press