Africa-Press – Rwanda. The role of critical minerals in powering AI, aerospace and clean energy was emphasised during the 8th edition of Rwanda Mining Week from December 2 to 5 in Kigali.

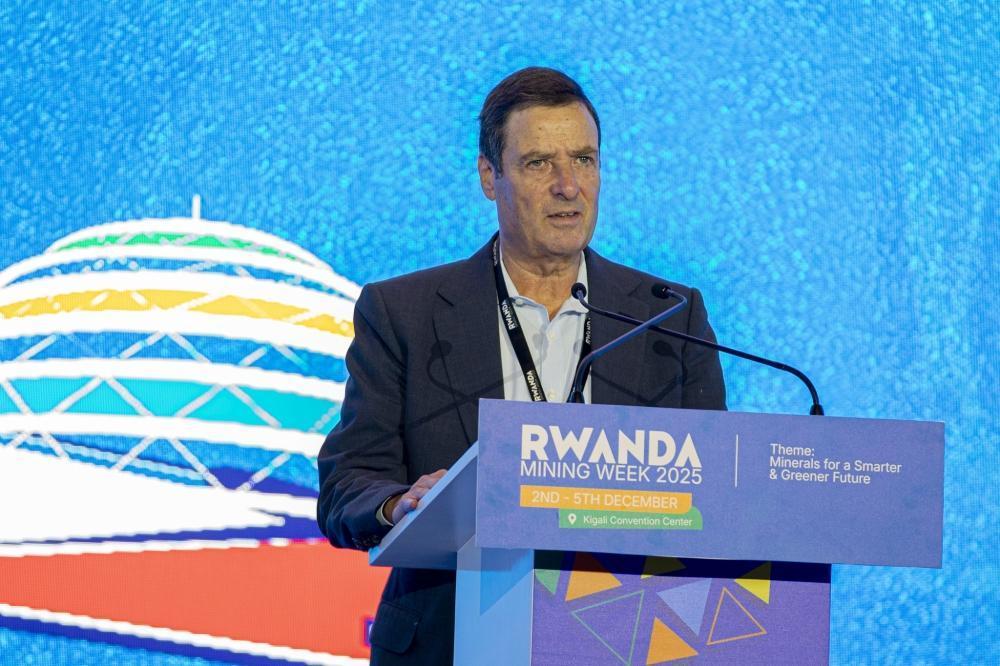

Itzhak Fisher, Chairman of the Rwanda Mines, Petroleum and Gas Board (RMB), said Rwanda is set to tap into opportunity as the world is experiencing an unprecedented surge in demand for critical minerals as nations transition towards clean energy technologies, electric mobility and advanced digital systems.

“Rwanda continues to be a responsible and reliable source of critical minerals, including tantalum, tin, tungsten, high-grade lithium, beryllium, rare earth minerals, as well as gold and a variety of gemstones. These resources position Rwanda as a strategic partner in an evolving global mineral economy,” he said.

Participants tour the exhibition during Rwanda Mining Week in Kigali on December 2. Photos by Kellia Keza

A panel of discussions on Tuesday, December 2, explored how critical minerals are powering the world’s most advanced technologies – driving artificial intelligence, enabling aerospace innovation and supercharging the global shift to clean energy.

The panel also examined how this positions Africa at the centre of global technological transformation.

The theme for 2025 is “Minerals for a smarter and greener future”, which comes at a pivotal time as the global demand for critical minerals is reaching unprecedented levels.

As the world accelerates into the digital era, Rwanda is a trusted source of responsibly sourced critical minerals.

Investors are targeting critical minerals used in EV batteries, electronics and advanced manufacturing.

These include tin (Sn), which is key for electronics manufacturing as it is essential for soldering in all electronic devices. Rwanda is one of Africa’s leading producers of tin.

Tantalum (Ta), which is vital for capacitors in smartphones, EVs and aerospace, is also present.

Participants tour the exhibition during Rwanda Mining Week in Kigali on December 2. Photos by Kellia Keza

Rwanda ranks among the top producers globally and accounts for more than 22% of global tantalum production.

It is used in high-performance capacitors, semiconductors and superalloys.

Tungsten (W) is key for aerospace, defence and cutting tools.

Rwanda is a top African producer of tungsten concentrate, owning Africa’s largest tungsten mine, Nyakabingo, operated by Trinity Metals.

These minerals are critical for high-temperature and high-strength applications.

Lithium and graphite potential is also emerging.

Rwanda holds immense lithium potential thanks to ongoing exploration campaigns, including Rio Tinto’s lithium exploration in the northern, southern and western parts of the country, Aterian PLC’s exploration in the southern part, and Trinity Metals’ lithium exploration in Ntunga/eastern part.

New exploration indicators point to opportunities for battery-grade minerals.

Rare-earth elements (REEs) and lithium are under-explored and increasingly critical for magnets, EV motors, wind turbines and defence technology.

“In terms of AI, minerals are used to produce the semiconductors and the GPUs that are now used to run the AI workloads,” noted Yves Mujyambere, Chief Innovation Officer, QT Rwanda.

He challenged Africa to stop exporting raw ore and start producing products.

“Why can’t we invest in manufacturing these capacitors?” he asked, noting that Rwanda’s tantalum and rare earth minerals could be transformed into magnets and components for global EV and semiconductor industries.

“We can provide the capacitors to these companies… We can leverage our mineral wealth by transforming it into products.”

Prof. Wilfred Ndifon, President of AIMS Research and Innovation Centre, spoke about quantum sensing technologies capable of detecting subtle magnetic or gravitational changes linked to mineral deposits.

“You can use it to detect things like changes in magnetic fields or changes in gravity. And if you combine this data with machine learning, you can then learn the patterns predictive of the presence of specific minerals,” he said.

Such advances could dramatically reduce exploration costs, he explained, helping African concession holders avoid selling rights “for pennies on the dollar”.

Samuel Wagstaff, Aluminium Process and Product Consultant, Oculatus Consulting, USA, said that Africa loses by exporting unprocessed ore.

A panel discusses how critical minerals are powering the world’s most advanced technologies, including artificial intelligence.

He envisioned Rwandan tin, Congolese cobalt, Zambian manganese and Tanzanian graphite “all being refined and manufactured here inside the African centre.”

“When we talk about the future, which is AI, aerospace, electric cars… actually everything depends on and cannot exist without critical minerals,” stated Dr Anatoly Agulyansky, Chief Scientist, PRIZ Guru Inc, USA.

Despite widespread belief that microchips are all silicon, he explained: “The key material is tantalum that separates copper lines from silicon oxide. And without tantalum, no chip will continue to work.”

He noted that every mobile phone contains “at least 20 to 30 tantalum capacitors. No replacement. Only tantalum can be used for this.”

Niobium, meanwhile, is essential for high-temperature superconductors and quantum computers. “Even MRI machines will never work without niobium,” he said.

Despite Rwanda supplying an estimated 22% of global tantalum, he warned that producers will never reduce prices “even if you give raw material concentrate free of charge.”

The solution, he insisted, was local refining and innovation.

Global demand and role of East Africa

A presentation on “East Africa’s Edge: Critical minerals for a tech-driven world” explored how resources such as tantalum, tin, tungsten, lithium and rare earth elements could make the region a key player in the global race for innovation, while highlighting opportunities for responsible, sustainable and tech-driven mining that benefits both local economies and global industries.

Prof. Stanislaw Wokowicz, Professor at the Polish Geological Institute, said: “According to USGS data, over 900 geological structures could contain rare earth deposits. Documented resources are between 90 and 100 million tonnes. There is no problem with resources — the challenge is technology for recovery and separation.”

“Tantalum is critical for the EU. There are deposits in Canada, Brazil, DRC, Rwanda, Burundi, Uganda and China,” he noted.

Talking about global production figures, he said that last year, the biggest producers included the DRC, Nigeria, Mozambique, Ethiopia, Rwanda and others.

On tin, he stated that about 40% of global tin production comes from artisanal and small-scale mining.

“Rwanda, Nigeria, the DRC and Bolivia play an important role.”

He emphasised the potential of Rwanda’s waste materials.

“Rwanda has a lot of tailings and post-mining waste. With advanced technology, these could become secondary deposits for the future,” he said.

On tungsten, he referred to USGS projections.

“It was expected that global tungsten production would reach 115,000 tonnes in 2026, but production remains around 91,000 tonnes. Prices are rising and the market is stable.”

“In my opinion, Rwanda’s most important commodities are tin — number one — followed by tantalum and tungsten. Lithium is still very small,” he added.

Call for mineral processing

Justin Uwiringiyimana, Rwandan Senior Geologist, discussed production potential and mechanisation.

“Despite artisanal and small-scale operations, we make a strong presence on the global list. Imagine if we mechanised and installed processing plants we could significantly increase production. For example, in Nyakabingo in 2019–2020, we were producing 15 to 20 tonnes a month with simple mechanisation. Now we produce above 100 tonnes per month — a simple mechanisation improvement,” he said.

He also explained Rwanda’s position in African mining.

“If you combine production from three sites, including Rutongo and Musha, they make the second largest tin producers in Africa. Despite this, the country still has untapped potential and needs investment in exploration and mechanisation.”

Uwiringiyimana highlighted Rwanda’s strategic advantages.

“We are strategically positioned because of abundant and underexplored mineral deposits. Large-scale geophysical data exists, though old maps need updating. We have young, trainable labour, and mining schools are emerging. Infrastructure is improving, including transport and green energy, which gives us an advantage.”

As there is a rising appetite for these minerals in the Western world, he said, East Africa has opportunities in modernising mining, introducing processing plants and refineries.

“The region is uniquely positioned to supply the minerals that power electric mobility, renewable energy and advanced electronics. We are an agent for the clean tech transition. But challenges remain: inaccessible areas, limited electricity, few processing plants, financing constraints, skill shortages and regulatory gaps. ESG compliance and traceability need strengthening,” he added.

Rwanda’s Prime Minister Justin Nsengiyumva reiterated the need for deepening partnerships with investors, researchers and development partners to unlock opportunities across the entire value chain.

Itzhak Fisher, Chairman of the Rwanda Mines, Petroleum and Gas Board (RMB), speaks during Rwanda Mining Week in Kigali on December 2. Photos by Kellia Keza.

For More News And Analysis About Rwanda Follow Africa-Press