Africa-Press – South-Africa. While there is a significant amount of money in South Africa ready to be spent on addressing the country’s problems, the private sector, which holds most of this funding, lacks the right incentives to invest.

Deputy Finance Minister and Public Investment Corporation (PIC) chair David Masondo recently outlined the reasons why the PIC and the private sector may be hesitant to invest in infrastructure in South Africa.

This was said in response to a question Masondo received during a presentation to the Standing Committee on Public Accounts (Scopa).

The deputy minister was asked whether the government has approached the PIC to tap into its R3.2 billion in assets under management for infrastructure funding in South Africa.

The African Development Bank (AfDB) recently estimated that South Africa needs to invest R5.8 trillion in the years leading up to 2030 to arrest the deterioration of its infrastructure and improve the country’s poor service delivery.

This equates to around R725 billion a year, of which most will have to come from the private sector due to the government’s poor financial health.

South Africa’s slow economic growth over the past decade has severely impacted tax revenue and exacerbated the deterioration of the government’s balance sheet.

This lower revenue has been combined with elevated government spending, which has seen the government run deficits year after year.

In addition, government debt has ballooned, and the state now spends around R1.2 billion a day on debt-service costs.

To make matters worse, many of South Africa’s state-owned enterprises (SOEs) are also burdened by substantial debt, with many requiring government bailouts, placing additional pressure on the strained fiscus.

All of these factors mean the government cannot invest as much in infrastructure as needed to arrest the country’s infrastructure crisis and drive economic growth.

In addition, the government’s poor fiscal health is a key concern for international institutions and global investors, making it unlikely that they will invest heavily in the country.

Therefore, the government needs local private sector investment, of which there is an abundance in South Africa.

South Africa’s private sector is sitting on an estimated R1.4 trillion in cash waiting to be deployed into the economy.

However, Masondo explained that the private sector currently does not have enough incentive to fund the government’s ambitious infrastructure plans.

A confidence crisis

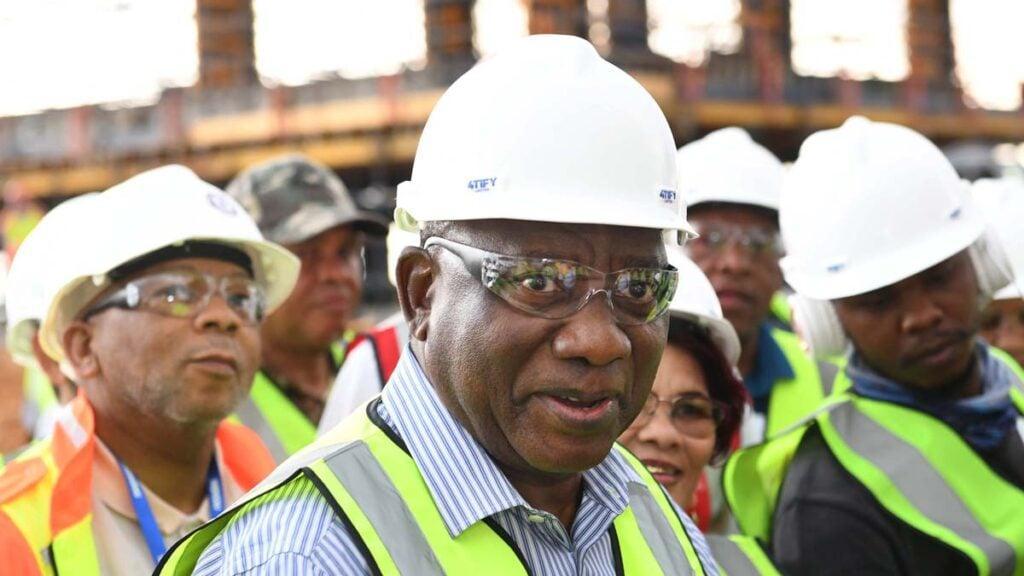

Deputy Finance Minister David Masondo

Masondo explained that, although there is a significant amount of money in South Africa, the right incentives are not yet in place for the private sector to deploy its capital in government-run projects.

“The key question for us as government is, what are the incentive structures we are putting in place for investors to direct that money towards that particular infrastructure?” he said.

He explained that this would involve placing the right incentives and personnel in charge of specific projects, and managing those projects’ risks to ensure investors receive a return on their investments.

“Because if you’ve got capital, you are investing in something, you must see cash flows,” he said.

“Where will cash come from for me to get my money back? In fact, even more than what I’ve initially invested because if you don’t do that, you’re going to have this bottom investment performance.”

Masondo acknowledged the work the National Treasury has done in trying to set up better incentives to attract private capital.

In the 2025 Budget Overview, the Treasury noted transformative changes it is making that will make it easier for the state and private sector to invest in the critical infrastructure needed to build South Africa’s economy.

“If reforms are executed with speed and determination, they can provide a powerful boost to the economy and create much-needed jobs,” it said.

“Yet success hinges largely on a willingness to act on all roadblocks that stifle investment.”

One of the roadblocks the AfBD has also highlighted is a lack of business confidence in South Africa.

The organisation has explained that a key step to creating a dynamic economy that grows is increased competition, which is built upon making it easier to do business in the country.

This entails easing regulations regarding business in South Africa and becoming more efficient and effective in enforcing some existing regulations.

The AfDB added that an overlooked part of this reform is increased labour market flexibility, which will enable companies to hire more easily and find the skills they need to operate.

“It’s up to the government, in my view, to really set up the proper incentive structures. Capital will flow. The key issue is incentive structures that will attract capital,” Masondo said.

For More News And Analysis About South-Africa Follow Africa-Press