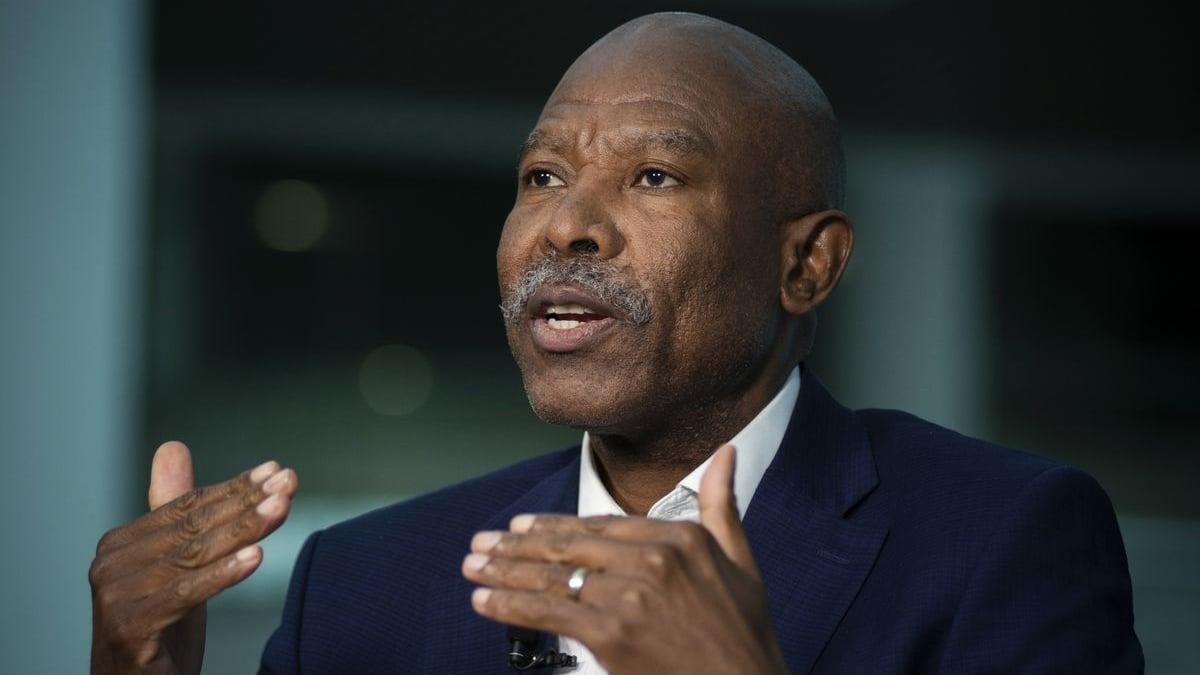

Africa-Press – South-Africa. South Africa’s Reserve Bank Governor Lesetja Kganyago said that officially locking in a lower inflation goal could underpin another drop in bond yields, which have already fallen sharply since he announced the bank was aiming at the bottom of its 3% to 6% target range.

“Once you have a formal announcement of what the new target would be, we potentially could see a further decline in the bond yields,” Kganyago told Jennifer Zabasajja in an interview on Bloomberg Television on Thursday.

“This would be consistent with the work that the staff of the bank has done.”

Yields on South Africa’s 10-year bond have fallen to around 9.1% from more than 11% in April, as price pressures eased.

The decline accelerated after Kganyago’s unexpected July 31 announcement on the inflation target. It previously aimed for the midpoint of the range.

While Finance Minister Enoch Godongwana has not formally ratified the new anchor, Kganyago said the two men have “found each other” and are aligned on a lower goal, pointing to a joint statement between the National Treasury and the Reserve Bank last month that was “the real driver” of investor optimism of South African assets.

According to the joint statement, the finance minister will make an announcement as soon as it is practical to anchor expectations. Kganyago would not be drawn on when that might be.

Godongwana may offer clarity when he delivers his medium-term budget update on 12 November.

Inflation expectations two-year’s ahead, the MPC’s preferred gauge, fell to 4.2% in the third quarter — their lowest level since 2005.

The rand has also benefited, rising over 4% since the end of July. That places it among the top 10 best-performing currencies in the world tracked by Bloomberg, though rising commodity and lower oil prices have also provided support.

The current inflation framework has been unchanged since it was introduced in 2000 and the central bank and Treasury have been working on a review for nearly two years.

Getting explicit political backing from the minister for the lower goal would provide investors with additional assurance that inflation in the future won’t be allowed to drift back toward the upper part of the current target band, he said.

“The fact that there is so much headroom means that there is still uncertainty about what your tolerance would be,” he said.

If the minister adopts the lower goal, it will also push the government to set policies that are consistent with 3% inflation — specifically in setting administered prices like water and electricity tariffs, which have been stubbornly high and make it harder to moderate inflation.

South Africa’s monetary policy committee used the new goal to guide its interest-rate decision at its meeting last month, when the six-member panel kept borrowing costs unchanged at 7% even as inflation remained benign.

Annual inflation has hovered near the floor of the central bank’s target band since March and unexpectedly eased to 3.3% in August.

The central bank at its September MPC meeting projected to quicken to 4% in the fourth quarter before moderating to 3.2% by the end of next year.

The MPC meets again next month and will announce its decision on Nov. 20. Forward rate agreements — used to speculate on borrowing costs — are almost fully pricing in a quarter percentage point rate cut by the MPC’s January meeting.

For More News And Analysis About South-Africa Follow Africa-Press