Africa-Press – South-Africa. The South African Reserve Bank (SARB) Monetary Policy Committee has voted to cut South Africa’s interest rates by 25 basis points.

This takes the repo rate to 6.75% and the prime lending rate to 10.25%. The decision was unanimous.

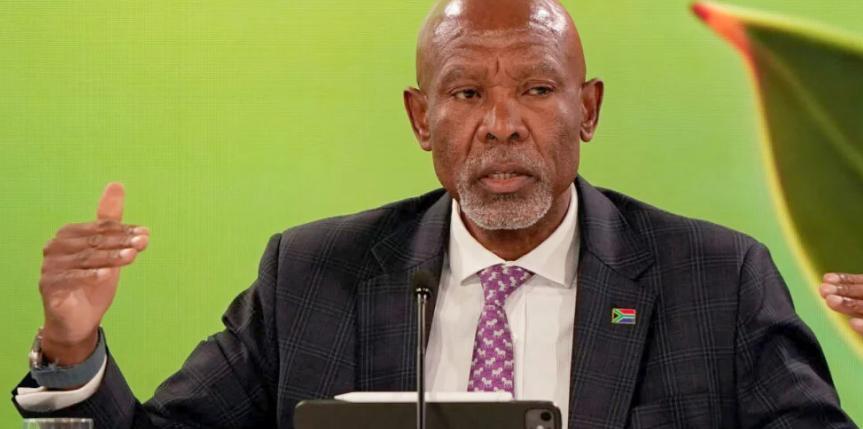

Reserve Bank governor Lesetja Kganyago said that while inflation has ticked higher, it is due to non-core items and temporary shocks, like in the red meat market.

“We continue to see this pressure as temporary, with inflation heading lower again from the beginning of next year. Indeed, recent outcomes have undershot our forecasts slightly,” he said.

Stats SA published inflation data for October this week, recording CPI at 3.6%. This was higher than the 3.4% recorded in September, but lower than market expectations of 3.7%.

Inflation has come in lower than market expectations for the past three months, with August even surprising by cooling rather than heating up as expected.

“Because of these downside surprises, together with a stronger rand, and a lower oil price assumption, we have small downward revisions to our inflation outlook, for both 2025 and 2026,” Kganyago said.

“We remain on track to deliver 3% inflation over the medium term.”

For inflation expectations, the governor said that market rates and surveys of analysts both show further progress towards the formally-adopted 3% objective.

Core goods prices are benefiting from exchange rate strength, and food price inflation seems to have peaked, Kganyago said.

“Services inflation is unchanged from the last meeting. Announced medical aid increases are lower than last year’s; at the same time, housing inflation has accelerated, which warrants ongoing scrutiny,” he said.

Against this backdrop, the MPC decided to reduce the policy rate by 25 basis points, to 6.75%, with effect from 20 November.

“Members agreed there was scope now to make the policy stance less restrictive, in the context of an improved inflation outlook,” Kganyago said.

Looking ahead, the central bank noted that its Quarterly Projection Model continues to forecast gradual rate cuts as inflation subsides.

However, as is always the case, this rate path remains a broad policy guide.

“Our decisions will continue to be taken on a meeting-by-meeting basis, with careful attention to the outlook, data outcomes, and the balance of risks to the forecast,” Kganyago said.

The decision to cut rates was generally in line with market expectations, where economists and analysts were split between calling a cut or a hold.

A cut was seen by stakeholders who viewed the balance of economic indicators as being more favourable, with little inflation pressure and restrictive rates putting a damper on economic growth.

Those who anticipated a hold viewed the SARB MPC as being more hawkish and cautious to undermine the newly-adopted 3% inflation target.

Ultimately, the doves won the debate.

The November meeting marks the final rates decision for the year, with the MPC expected to meet again in January 2026.

For More News And Analysis About South-Africa Follow Africa-Press