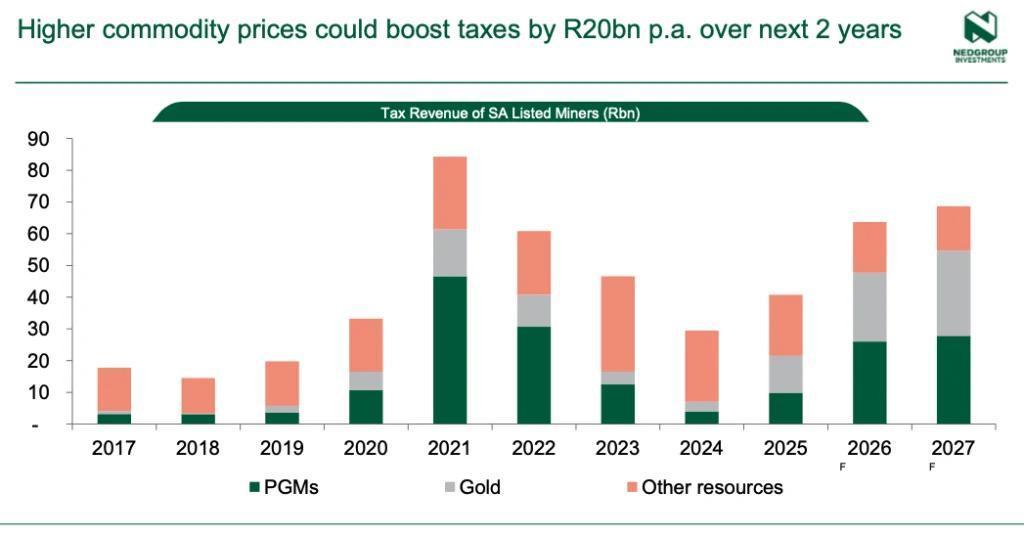

Africa-Press – South-Africa. An ongoing commodity rally could boost the government’s tax intake by R20 billion per annum over the next two years.

Higher prices for platinum group metals (PGMs) and gold over the past year have seen mining companies’ profits skyrocket, spelling good news for the government’s corporate income tax (CIT) revenue.

This comes as the state is in desperate need of a tax windfall, with its options to raise current income tax levels severely limited by the country’s narrow tax base.

Foord chief investment officer Nick Balkin recently explained that this windfall could come in the form of higher CIT, as JSE-listed mining companies have seen their profits surge on the back of a commodity rally.

Speaking at Nedgroup Investments’ recent Investment Perspectives 2026 event, Balkin explained that these higher commodity prices could boost tax revenue by R20 billion per year over the next two years.

He specifically highlighted PGM and gold prices as potential drivers of higher mining profits and, in turn, government tax revenue, over the next two years.

This tax windfall would be the latest in a string of benefits South Africa has seen from the commodity rally over the past year.

As an economy heavily reliant on commodities, South Africa’s currency, trade balance, and mining companies have benefited immensely from the commodity rally.

The commodity rally has been particularly focused on gold and PGMs, both of which South African mining companies produce.

For example, JSE-listed Valterra Platinum, the world’s top platinum producer by value, expects its annual profit to more than double on the back of soaring PGM prices.

Valterra, like many other JSE-listed mining companies, is one of the biggest corporate income taxpayers in South Africa.

Therefore, mining giants’ soaring profits on the back of the commodity rally will prove highly beneficial to the state’s coffers, which are in desperate need of such a windfall.

The graph below, courtesy of Balkin, shows the expected tax revenue from South Africa’s listed miners over the next two years.

Welcome relief

Over the next few weeks, the National Treasury and Finance Minister Enoch Godongwana will find themselves in a tough spot as they put together South Africa’s 2026/27 Budget.

Their fiscal consolidation efforts have paid off over the past few years, with state debt set to stabilise in the current fiscal year and the government on track to achieve a primary budget surplus.

However, given the state’s ambitious spending plans, including implementing policies such as National Health Insurance and investing heavily in infrastructure, revenue will be tight.

Therefore, the expected CIT windfall from mining companies will bring welcome relief to the government’s coffers.

This revenue boost is particularly advantageous for the government, as it did not necessitate tax increases – something the government can scarcely afford.

The government has essentially exhausted its options for raising major tax rates to boost revenue.

This is because South Africa’s tax base – both for personal and corporate income tax – has become too small and strained to risk hiking tax rates.

For example, South Africa has one of the most concentrated CIT bases in the world, with 0.1% companies paying over 66% of all CIT in the country.

According to economist Dawie Roodt, South Africa is over the Laffer Curve with regard to CIT, meaning any hikes in the tax rate would reduce the state’s income from this source, rather than increase it.

In addition, Roodt previously said South Africa’s already high CIT rate makes the country look unattractive to investors and corporates, warding off potential investment that would boost economic growth.

Therefore, the state is unlikely to risk hiking either personal income or corporate income tax rates in its upcoming Budget for the 2026/27 fiscal year.

As seen in South Africa’s 2025/26 Budget debacle, which saw the National Treasury having to draw up three different budgets, hiking the value-added tax rate is also an unpopular and unlikely avenue to increase state revenue.

Therefore, the state has very few options left to increase its income, aside from tighter compliance driven by the taxman or increasing rates on smaller revenue sources such as fuel and excise taxes.

For More News And Analysis About South-Africa Follow Africa-Press