Africa-Press – South-Africa. South Africans can expect significant interest rate cuts in 2026, with the Reserve Bank currently having space to slash rates by a cumulative 75 basis points throughout the year.

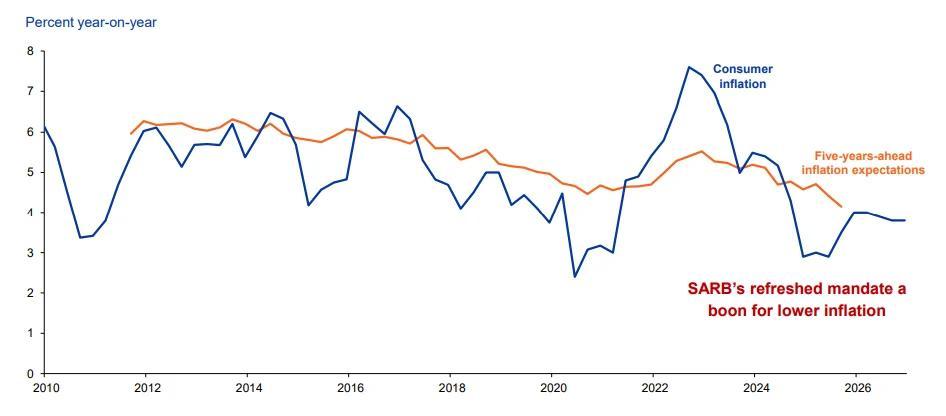

While this is unlikely to be a straight line downwards, with the Reserve Bank taking alternating pauses to assess conditions, the rate cuts will come as inflation remains around its new 3% target point.

The bank’s efforts to anchor inflation and expectations around 3% have resulted in it being relatively cautious to cut rates since the target was officially endorsed by the Finance Minister towards the end of 2025.

Standard Bank chief economist Goolam Ballim explained that this has resulted in the Reserve Bank’s current policy rate being fairly restrictive, giving it space to cut rates.

This has come about largely due to a stronger-than-expected rand, which has surged on the back of rising commodity prices and a weaker dollar.

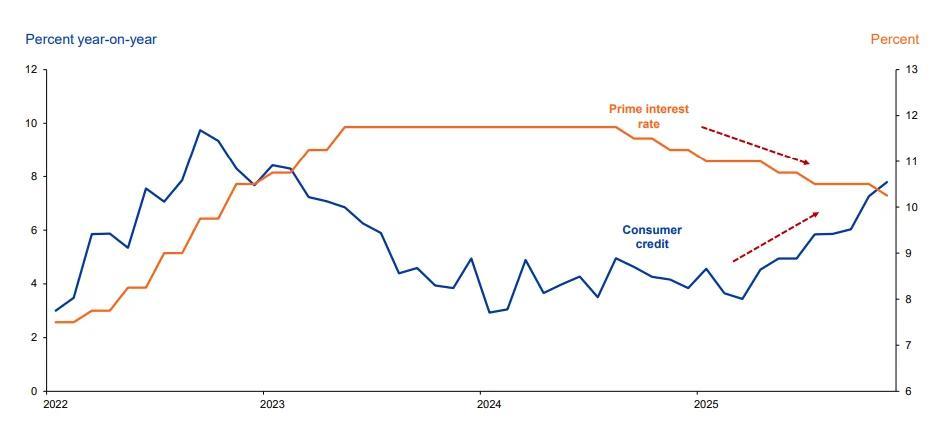

“The credit environment in South Africa is becoming a little bit more encouraging, with strong private sector growth,” Ballim said.

“Interest rates fell notably throughout 2025, and we expect further interest rate relief this year. We think it could be up to three-quarters of a percentage point cumulative cut.”

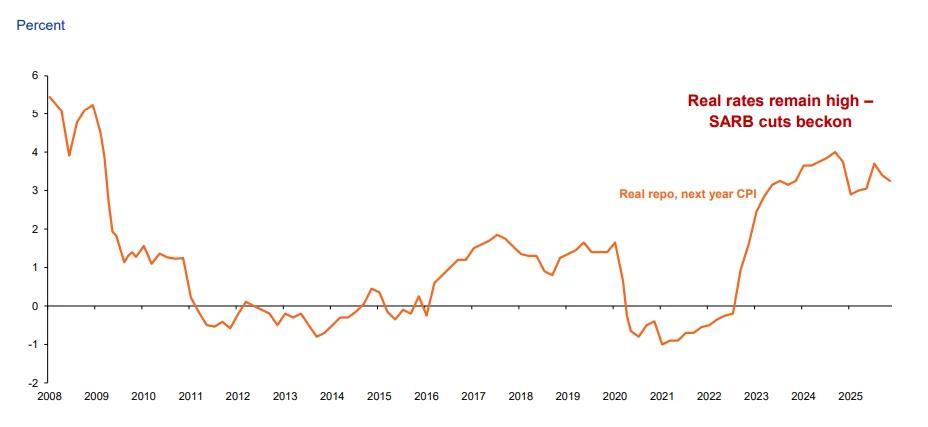

“The real repo rate, which is the repo rate minus inflation, is still fairly high and therefore encourages the Reserve Bank’s proclivity for lower interest rates.”

Ballim explained that this will further stimulate consumer credit and thus spending, as credit becomes more affordable for individuals with lower rates.

Standard Bank’s expectations of a total 75-basis-point reduction in 2026 are higher than most other forecasts out there, with two 25-basis-point cuts being the consensus view.

Ballim explained that the Reserve Bank’s frontrunning of the shift to a lower inflation target and its clarity in communicating its intention to ensure inflation remains close to 3% have helped bring expectations downwards.

This is crucial to ensure that wage negotiations and price increases from companies and the state are anchored around this level.

The Reserve Bank has been helped by a stronger-than-expected rand in keeping inflation tied to its new lower target.

Ballim explained that a stronger rand makes it cheaper to import goods into South Africa, reducing pricing pressures in the economy.

Source: Standard Bank, Goolam Ballim

Source: Standard Bank, Goolam Ballim

Consumer spending boom

A downstream impact of lower inflation and interest rates is that things are broadly getting better for households in South Africa.

Ballim explained that lower inflation means that incomes are growing much faster in real terms than they have historically, boosting disposable incomes.

Data shows that household income is growing at 2% to 3% year-on-year after inflation, ensuring that South African consumers can continue spending.

This is coupled with lower interest rates, which reduces the cost of servicing debt, freeing up further disposable income for spending.

Crucially, Ballim noted that the type of spending in South Africa has changed, with it moving away from short-term essentials and towards durable goods and services.

Ballim explained that this points to increasing consumer optimism in the local economy, indicating that South Africans are making big-ticket purchases after delaying them.

This is not only more substantive in terms of the contribution of spending to economic growth in South Africa, but also shows that consumers generally think things will be better in the future.

However, Ballim said there is one major threat to this positive flywheel, and it comes in the form of online gambling, which is steadily eroding households’ disposable income.

Ballim explained that a growing portion of increased disposable income is going towards online gambling and is, thus, “dead money”.

Spending on online gambling does not have the positive multiplier that spending on goods, services, or investing has on the South African economy.

Ballim said that online gambling is simply a redistribution of income, typically from lower-income households, to the house, which is predominantly made up of companies domiciled outside of South Africa.

This means that much of the revenue made by local gambling flows out of the country to shareholders elsewhere and does not even benefit local companies.

Ballim said the increase in online gambling can indicate that South African consumers are weakening, as they are hopeful of “big wins” to maintain their lifestyle rather than growing incomes.

For More News And Analysis About South-Africa Follow Africa-Press