AfricaPress-Tanzania: THE Government of Holland has distanced itself from information circulating in some social media that its Rabobank, a Dutch multinational banking and financial services company headquartered in Utrecht, Netherlands has withdrawn its shares from NMB bank.

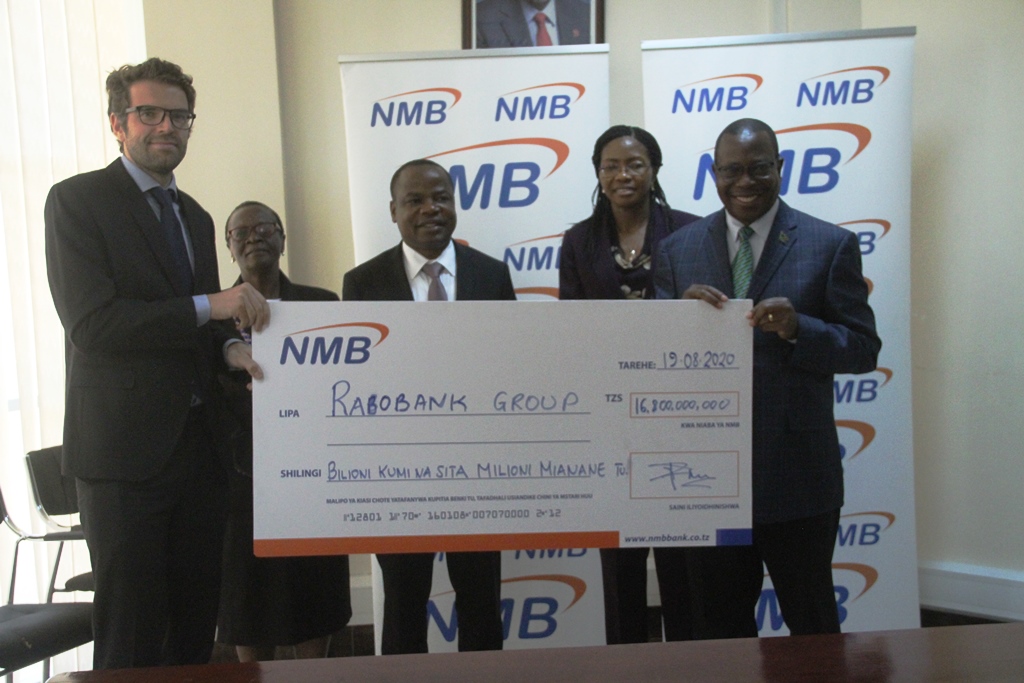

According to Holland Embassy in Tanzania’s First Secretary Economic Affairs, Mathij van Eeuwen, while receiving 16.8bn/- as dividends from NMB in Dodoma, recently, the diplomat said Tanzanians should rest assured that the news is fake.

Attending the occasion were the Minister of Finance, Dr Philip Mpango, Registrar of the Treasury, Athuman Mbutuka, NMB Board Chairperson, Dr Edwin Mhede and NMB Chief Executive Officer, Ruth Zaipuna and other ministry officials.

The diplomat said what transpired was putting the shares in a system called Arise that is owned by his bank back in the Netherlands, but not withdrawing as alleged by the people.

Van Eeuwen, who is an Economist, further assured the minister that NMB bank is still their favorite, and they do not contemplate withdrawing shares remitted from the Rabobank.

He clarified that what took place was a normal bank process of updating internal system that should not be interpreted otherwise, adding: “Allegations that we withdrew shares are not true, and we cant withdraw…because, we also notified the Tanzania government that we were updating and incorporating our Arise system, and its only that.”

Commenting on the issue, NMB bank CEO Zaipuna said they have no worries with the Rabobank, adding that during her tenure as acting Chief Executive Officer, the financial institution became satisfied with their performance, hence has no doubt with them.

On his part, Dr Mpango thanked the foreign bank for trusting Tanzania in the financial realm that is making them inject big shares and supporting their arrangement to have the first CEO, who is a national.

He said Tanzania government would continue to create a good environment for investors, especially in the financial sector so that the country no longer depends on donors, citing that 60 years since independence is a long history.

Dr Mpango noted that the country wants partnership with investors, because such deal ensures the government gets money to fund different community projects, citing an example that 15.2bn/- set aside from dividends and estimated as 31.8 per cent from the bank’s share was from them.

On the shares transfer to Arise, the minister noted that they are in the process harmonizing the stipulations according to the Dutch bank.

She said besides 15.2bn/- the government got from them as dividends, some 16.8bn/- also came from the Rabobank that also has a big share in the financial institution.

Ms Zaipuna said her bank also managed to sail well in the wake of coronavirus, and they would continue to work according to strategies laid down by the bank, including their staff being disciplined.