THE Tanzania Insurance Regulatory Authority (TIRA) is charting strategies that will see the insurance sub-sector’s contribution to the country’s Gross Domestic Product (GDP) rising from 0.7 percent to five percent by 2024.

The authority also targets 60 percent of Tanzanians to register with insurance services by 2024.

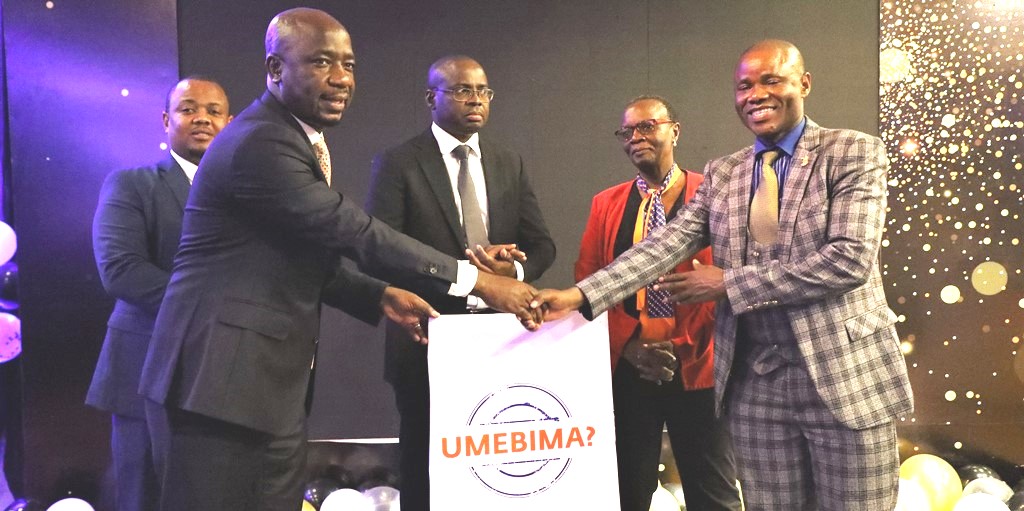

This was pointed out by TIRA Commissioner, Dr Mussa Juma during the launch of NMB’s Bancassurance product on Thursday, disclosing that the sub-sector was looking forward to increase its contribution to the country’s GDP strategically.

He said it will start by moving from 0.7 percent to three percent in 2023 and later to five percent by 2024.

“Our plan is to see this sector playing a big role in boosting this country’s economy, we are looking forward to close to five percent contribution to GDP by 2025,” he noted.

NMB launched the new product that enables Tanzanians to access insurance services from all NMB Bank’s branches across the country. The bank enables its clients to access insurance services from six companies.

“Similarly, at least 60 per cent of the entire population should be aware of what insurance entails by the year 2024,” he said.

According to TIRA boss, for the goal to be achieved, insurance companies, brokers, agents and Bancassurance service providers will be required to apply modern technology to reach the lower end of the market segment.

“With concerted awareness campaigns, we are confident insurance services will be able to reach out to small scale traders and food vendors among others and that is how we will meet the intended growth for the sub-sector,” he said.

The bank has signed agreements with Sanlam Life, UAP, National Insurance Corporation (NIC), Jubilee, Zanzibar Insurance Corporation and Reliance that allow NMB Bank to act as insurance agents for the insurance firms.

NMB Senior Manager for Insurance, Mr Martin Massawe said the bank’s presence in each and every district of Tanzania will spur the growth of the insurance sector and raise its contribution to the GDP.

“We received a Bancassurance license as soon as the regulations were ready. With our presence in each and every district of Tanzania, our Bancassurance business will help spur the growth of the insurance sub-sector,” he said.

NMB Bank Plc has trained over 200 of its members of staff who have been duly certified to handle insurance services across its 224 branches countrywide, according to the bank’s Chief of Retail Banking, Mr Filbert Mponzi.

“Our coming into Bancassurance business is a game changer. It will move the insurance sector to the next level,” he said.

He said the bank will make use of its NMB business clubs to create awareness on the importance of insurance among its clients.

NMB Bank Plc, he said, works with a number of businesses and individuals, including farmers who will be able to learn the type of insurance products that meet their various needs in their different locations.

Contrary to assumptions that Bancassurance would drive insurance brokers and agents out of business, TIRA believes the service will help to widen the scope and coverage of the sub-sector beyond the reach of the available insurance firms.