AfricaPress-Tanzania: CHANCES are high that the government will roll out Electronic Tax Stamps (ETS) management system for cement and sugar during the next fiscal year, according to the Parliamentary Standing Committee on Industry and Trade.

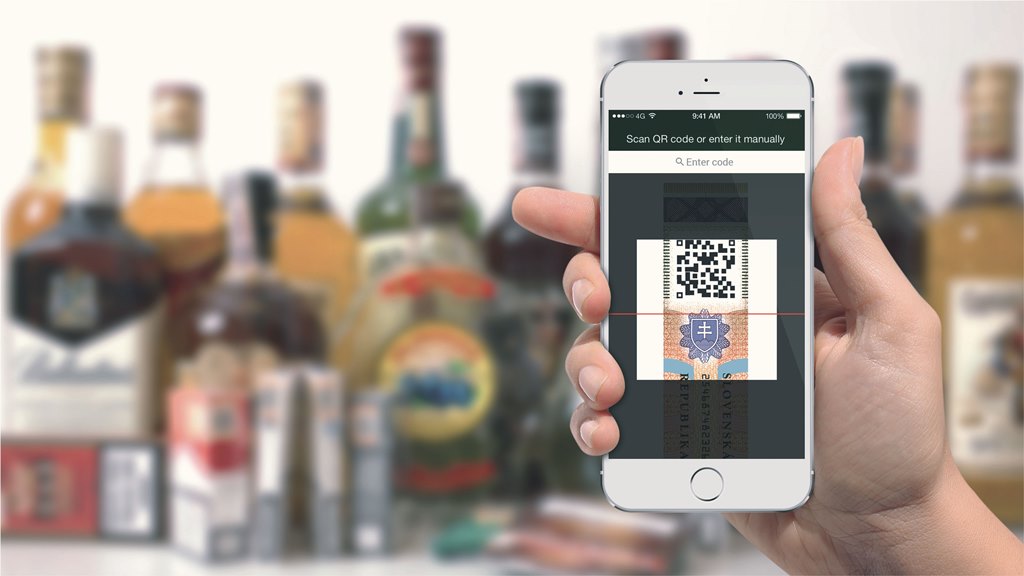

The envisaged introduction of the digital stamps is after successful roll out of the system for excisable goods such as cigarettes, beers, wines, spirits and bottled water which came into effect in January 15, last year.

Speaking in an exclusive interview, the Chairperson of the parliamentary committee, Mr Suleiman Sadiq (Mvomero-CCM), was upbeat that the digital stamps will record increased revenues from sugar and cement factories.

“The first stage of ETS goods subjected to excise duties has already shown significant progress and we hope the next stage will have more impact given huge production volumes and revenues generated from sugar and cement producing plants,” Mr Sadiq said in a telephone interview.

The MP was of a view that the Ministry of Trade and Industry will shed more light on commencement of the digital stamps for cement and sugar when it presents its budget estimates for financial year 2020/2021 in the National Assembly.

“Since the ministry is yet to table its budget we hope to know the way forward in the near future since the intention of the government was to roll out the technology to various industries in the country starting with those producing excisable goods,” he explained.

Just recently, the Chairperson of the Parliamentary Budget Committee, Mr Mashimba Ndaki (Maswa West-CCM), proposed that the digital stamps should be applied on other products such as cement and sugar.

“Arrangements are underway for a meeting between the committee and the government through TRA to propose modalities for applying digital stamps for the above mentioned products and others to boost revenue collections,” Mr Ndaki said in an interview.

“Available data indicates that the electronic stamps have been instrumental in increasing taxes to the government and thus should be rolled out to other products to curb loopholes of tax evasion and under declaration of produced goods.”

The MP went further and proposed that it was high time that the government through the Tanzania Revenue Authority (TRA) extended the application of the electronic tax to both widen the tax base and boost revenue collections to the Treasury Coffers.

He was equally impressed that some challenges such as costs associated with installation of the technology and manning of the system had been addressed so far.

“For instance, manufactures were initially required to bear the cost for installation of system at their lines of production but after negotiation with TRA it was decided that the charges will be deducted from income taxes paid by the producers,” he elaborated.

The other challenge was on who will monitor the system at the industrial plants but it was later decided that there would be representative from the respective plant, an official from TRA and an expert from SICPA, a Swiss firm which was contracted by TRA to provide software and hardware for the sophisticated tax monitoring system.

The government of Tanzania through TRA rolled out the first phase of ETS system on beers, wines, spirits and cigarettes in January, last year.

A Swiss firm, Société Industrielle et Commerciale de Produits Alimentaires (SICPA) won the tender and subsequently signed a contract with TRA for supply, installation and provision of supporting software and hardware for ETS management system.

ETS is meant to replace the hitherto paper-based tax stamps initially attached to cigarettes, wines and spirits. The old system was prone to cheating of taxes through under declaration, among other malpractices.

Available data indicates that since ETS was implemented during the first phase on tobacco and alcoholic drinks starting January, 2019, collection for excise duty on locally produced spirits increased by 22.7 per cent.

TRA indicates in the data that excise duty from the spirits increased from 18.5bn/- between January and March 2018 compared to 22.7bn/- which was recorded between January and March, 2019.