Africa-Press – Uganda. Airtel Africa has reported robust operating and financial results for the nine-month period ended 31 December 2025, driven by strong network investment, digitisation, and innovative partnerships.

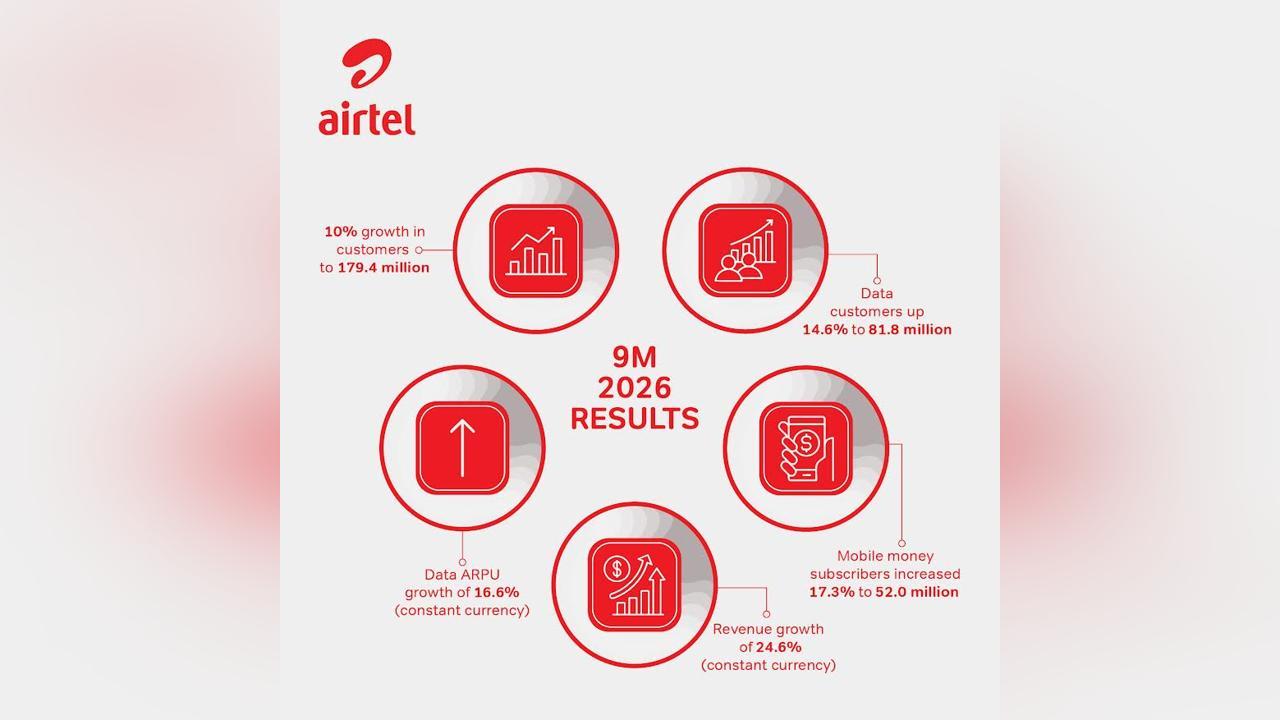

The company’s total customer base grew 10% year-on-year to 179.4 million, with data users increasing 14.6% to 81.8 million. Smartphone penetration rose to 48.1%, up 3.9%, while data usage per customer increased to 8.6GB per month from 6.9GB, supported by expanded network capacity. Data revenues grew 36.5%, making them the largest contributor to group revenues.

Airtel Money, the company’s mobile financial service, surpassed two key milestones during the period. The customer base grew 17.3% to 52 million, while the annualised total processed value (TPV) exceeded $210 billion, up 36% from the previous year. These gains were supported by a broader merchant ecosystem and increased digital adoption.Financially, Airtel Africa posted revenues of $4.667 billion, up 28.3% in reported currency and 24.6% in constant currency. Mobile services revenue increased 23.3% in constant currency, with voice revenue up 13.5% and mobile money revenue rising 29.4%.

EBITDA reached $2.283 billion, a 35.9% increase in reported currency, with margins expanding to 48.9% from 46.2%. Quarterly margins further improved to 49.6%, underpinned by revenue growth and cost-efficiency measures. Profit after tax rose to $586 million from $248 million, while basic earnings per share climbed to 13.1 cents from 4.4 cents in the prior period.

Airtel Africa also continued its capital investment strategy, with $603 million spent on rolling out approximately 2,500 new sites and expanding the fibre network by 4,000km to over 81,500km. Population coverage now stands at 81.7%, up 0.6% from the prior year. Leverage improved from 2.4x to 1.9x, reflecting stronger earnings and financial discipline.

Chief Executive Officer Sunil Taldar said the results highlight Airtel Africa’s strong strategic execution. “We accelerated investment to enhance coverage and data capacity while expanding our fibre network. Digitisation, technology innovation, and embedding AI in our processes are enhancing the customer experience and driving financial inclusion,” he said.Taldar added that Airtel Money’s expansion to over 52 million customers and the TPV exceeding $210 billion demonstrates the platform’s critical role in providing financial services across Africa. He also confirmed that the company remains on track for the listing of Airtel Money in the first half of 2026.

“Disciplined execution on cost efficiency, alongside accelerating revenue growth, has enabled another sequential improvement in EBITDA margins, underpinning constant currency EBITDA growth of 31%. Our strategic priorities remain clear: invest in best-in-class connectivity, accelerate financial inclusion, and deliver a great customer experience,” Taldar said.

For More News And Analysis About Uganda Follow Africa-Press