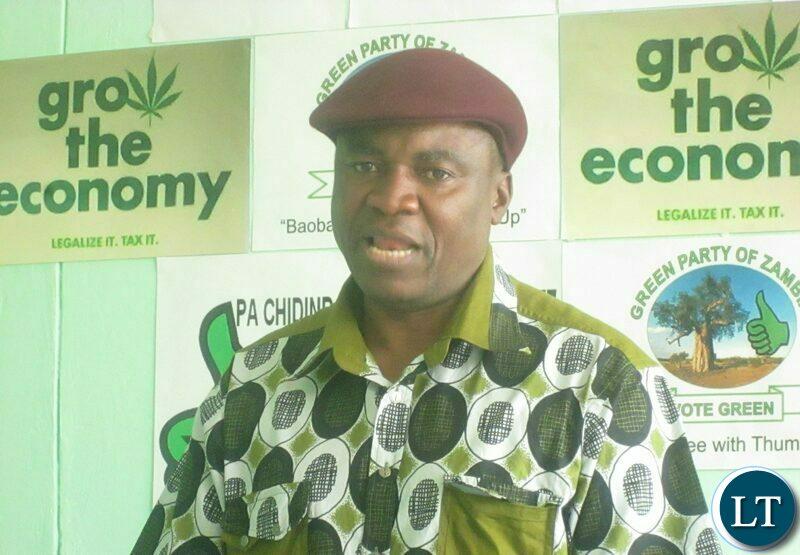

Africa-Press – Zambia. Green Party leader, Peter Sinkamba says the accumulation of enough dollars in the reserves has pushed down the demand for the US dollar, hence the appreciation of the Kwacha.

Mr Sinkamba has attributed the Kwacha’s recent speed appreciation to the boom in copper price which is now trading at US $9,700.85 per ton on the international market as well as the rise in the mineral loyalty tax.

Mr Sinkamba said in an interview that contrary to Economist, Chibamba Kanyama’s remarks that the major reason the Kwacha is appreciating, apart from the copper revenue, is that Zambia is not servicing any external dollar dominated debts at the moment and this has seen the reserves being heaped with dollars.

Mr Kanyama is quoted in some sections of the media stating that, currently it is hard to state or know whether the current appreciation of the Kwacha will last or not because it is not based on fundamentals but on defaulting on debt repayments.

But Mr Sinkamba in reiteration has argued that there has been no single country, institution or individual creditor that has raised any concern on Zambia defaulting on its debt, adding that the appreciation of the Kwacha is based on real fundamentals.

“We have seen the accumulation of more dollars in the reserves because Copper prices have continued rising on the international market. This coupled with the increase in the production of the red metal and the increase in the mineral loyalty tax has seen our reserves injecting more dollars, hence the appreciation of the Kwacha,” Mr Sinkamba said.

The Green Party president said the rising of the ‘sliding scale’ of the mineral loyalty tax to almost 10 percent, twice more than what mining firms were paying to government has also allowed the accumulation of more dollars in the reserves.

He said this has deteriorated the demand for the US dollar, thus allowing the Kwacha to gain over five percentage points in the last 14 days against other major convertible currencies. The Kwacha was by close of business trading in the range of K18 in some bureau de change and K19 at commercial banks across the country.