Africa-Press – Angola. A cooperation agreement between the Pension Funds Management Society and the regulatory entity Ohuasi Investment was signed on Monday (16) in Luanda, with the aim of structuring long-term savings mechanisms, focused on the security and retirement of employees.

According to a note to which on Tuesday (17), the agreement could guarantee pensions for old age, disability or even in case of death, guaranteeing, in an initial phase, the collective membership of workers.

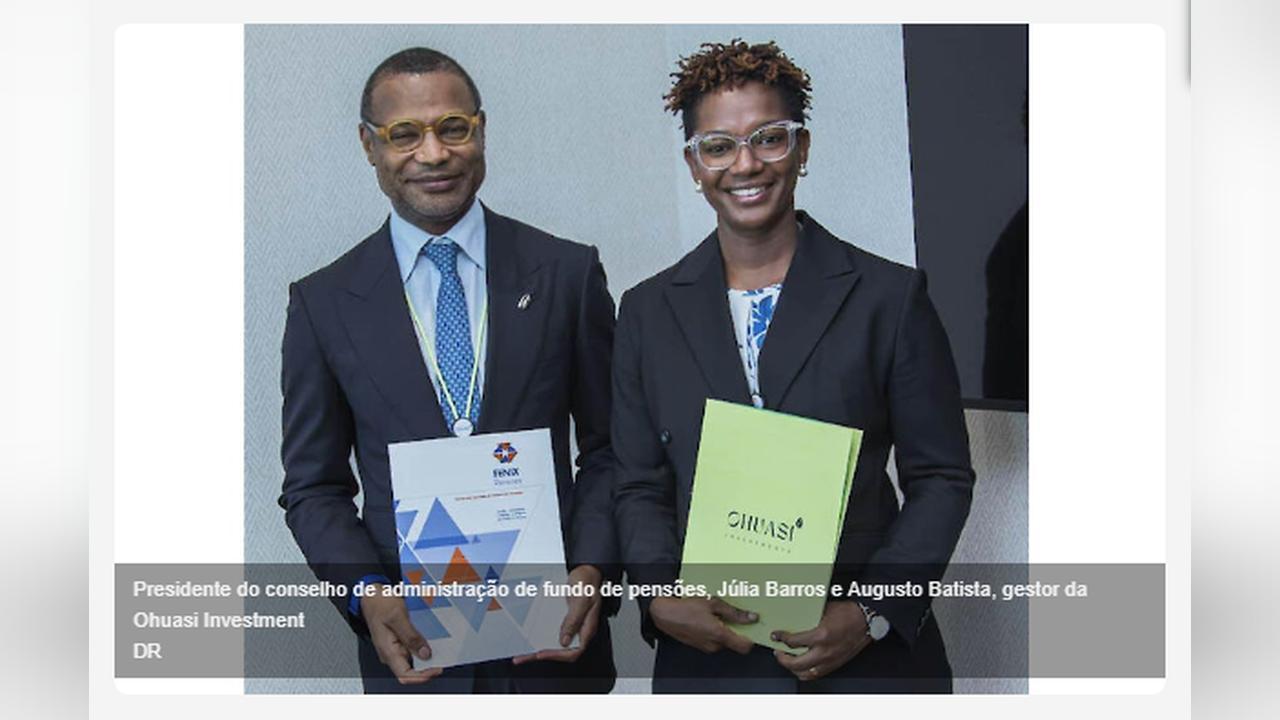

On the occasion, the Head of the board of directors of the Pension Fund Management, Júlia Barros, stated that pension funds play an essential role in the appreciation of human capital throughout working life and in the financial stability of each employer.

“It is a significant step in the institutions that also values the effort to boost this segment in the Angolan market, where the level of financial literacy still faces several challenges,” she said.

In turn, the representative of the regulatory entity Ohuasi Investment, Augusto Baptista, considered that the pension fund market in Angola has high growth potential, globally ranking among the largest institutional investors.

According to the official, the choice of the Funds Management Society to manage the assets reflects confidence in its experience and positioning in the sector.

Founded on Nov 14, 2003, the Pension Management Society is currently among the leading pension fund managers in the country.

Bringing diversified solutions in both open and closed funds, focusing on expanding participation and consolidating the culture of pension savings in the country.