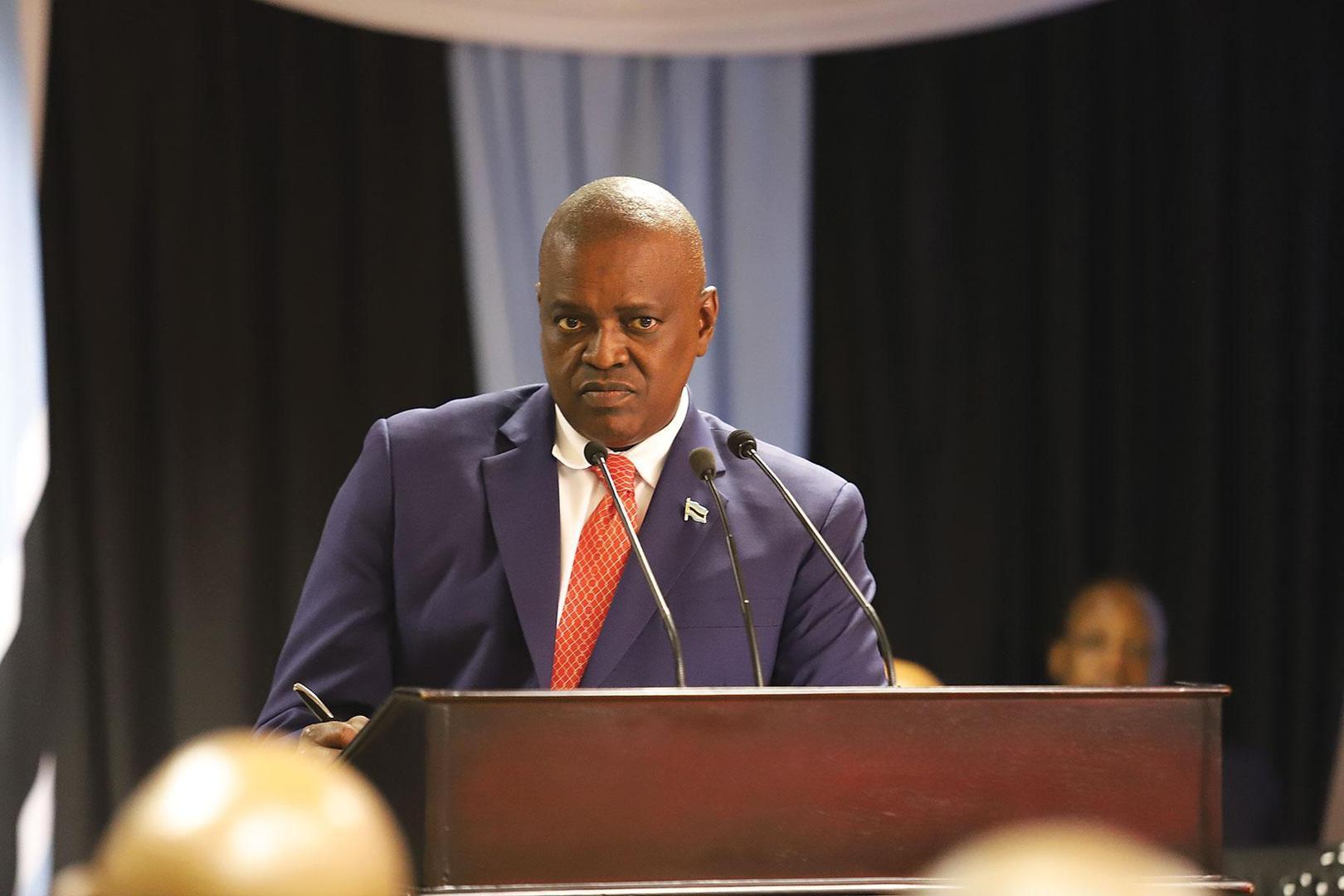

Africa-Press – Botswana. President Dr. Mokgweetsi Masisi has doubled down on his demands that Botswana should get a fair deal in the ongoing negotiations with De Beers.

Speaking on Thursday when addressing a kgotla meeting, Dr. Masisi said he is willing to risk losing the next 2024 elections in his pursuit for a deal that will unlock immense economic value for Botswana. The government and De Beers are currently in protracted negotiations over the diamond sales agreement as well as the mining rights agreement. The 2011 sales agreement that governs the relationship between the two parties expired in September 2020, and after three extensions, a deadline has been set for end of June 2023.

The president said the country deserves more in the next sales contract following some insights gained from the past, which he said shows that Botswana has been shortchanged through previous agreements with De Beers. Dr. Masisi said they will not be denied the chance to extract more value from the diamonds, while other people benefit.

“Some people got rich from the diamond trade, while we have been left in poverty like we are in now. We want a deal that will propel economic growth and end poverty in a blink of an eye,” he said.

Dr. Masisi said the current sales agreement has pinned them down, limiting the country to only rough diamond trading which is not as lucrative as the upper end of the diamond market. The president said the annual value of rough diamonds is $15 billion while the diamond cutting and polishing, as well as jewellery, have a combined annual market value of $100 billion.

“Botswana is the biggest producer of diamonds by value in the world. Yet to our shock, we get $7 billion to $8 billion. We want more value addition to the rough diamonds so that we can get as much revenue from the $100 billion market,” he said.

The president revealed that he has sent an order to the government negotiating team that he will refuse a lopsided agreement that maintains the status quo. Dr. Masisi also disclosed that according to the current contract, mediation and dispute resolutions are to be done in the United Kingdom using British law.

“Even if we go for dispute mediation, we will maintain our stance that we want to extract more value from our diamonds. If we lose, whatever happens after happens. But our diamonds will remain in our country. We have two options, either we give up and accept breadcrumbs, or we stick to our demands,” he said.

Botswana and De Beers have a long history. The diamond mining company started prospecting for diamonds between 1932 and 1938 in Eastern Botswana, resulting in the first diamond being spotted along Motloutse River, which ultimately led to the discovery of the Orapa kimberlite field in 1967, just a year after Botswana became independent.

De Beers ceded 15 percent of the company to the Botswana government in 1969, and entered in a 50/50 joint venture for the creation of Debswana, which remains as the world’s longest known public private partnership. Over the years, the discovery of diamonds propelled Botswana from one of the world’s poorest country to a middle income country.

De Beers gets diamonds from its owned mines in Canada, South Africa, and Namibia, which are then imported and consolidated with the Botswana diamonds, which account for nearly 70 percent of De Beers’ inventory. The rough stones are then sorted and valued by Diamond Trading Company Botswana (DTCB), a 50/50 joint venture between Botswana government and De Beers. About 75 percent of the rough diamonds are sold to De Beers Global Sightholder Sales (DBGSS), and 25 percent to Okavango Diamonds Company (ODC) – a wholly owned state entity.

De Beers’ rough diamond production in 2022 increased to 34.6 million carats, up from 2021’s 32.3 million carats, reflecting strong operational performance and higher planned levels of production to meet continued strong demand for rough diamonds, particularly in the first half of the year.

The diamond mining behemoth sold $5.67 billion of rough diamonds, which helped bring the group’s revenue to $6.6 billion, up from 2021’s $5.6 billion. In the end, De Beers reported a profit of $1.4 billion, an increase of 29 percent from 2021’s profit of $1.1 billion. The 2022 earnings are the highest since 2014, when De Beers’ revenue hit $7.1 billion and delivered almost $1.4 billion in profit.

From the profit, government gets 15 percent of its share, which was $210 million. Furthermore, Botswana’s earnings from the joint venture brought in $2.6 billion, and in addition to the 15 percent stake from De Beers, the country made $2.8 billion in 2022 from the partnership.

De Beers is also among the largest tax payers in the country. For 2022, the total taxes paid amounted to P15.2 billion, higher than the P13 billion paid in 2022. The breakdown of the total tax for 2022 includes: P8 billion paid as taxes and royalties, P4.8 billion as corporate tax, and P2.4 billion paid for royalties and mining taxes.

For More News And Analysis About Botswana Follow Africa-Press