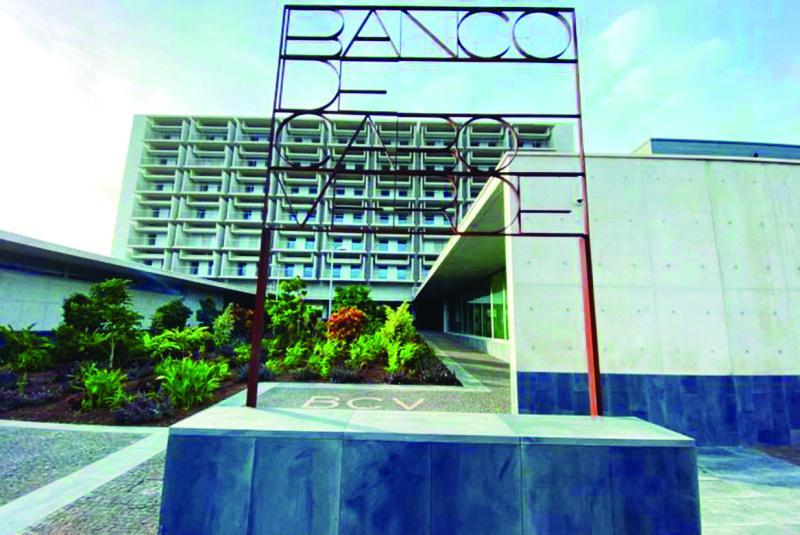

Africa-Press – Cape verde. The INPS auction provoked three frantic days, with announcements after announcements – and a press conference by the secretary general of the UNTC-CS in between, which did not help to calm the situation. Banks didn’t like it, BCV didn’t either, INPS guarantees that it just wants to improve the profitability of its portfolio. Now, the Central Bank wants to change the rules to avoid financial instability in Cape Verdean banks.

The story was no longer new when the Bank of Cape Verde reacted, in a statement, to say that the INPS auction could jeopardize the financial stability of the national banks – the continuity of the auctions, the document stated, in the manner carried out, could have an impact “ negatively affect some bank ratios”, namely liquidity ratios.

At the beginning of the month, the newspaper A Nação reported that in order to make a profit on the approximately 20 million contos deposited in national banks, the Social Security administration decided to resort to auctions of term deposits.

In the statement, the Central Bank explained that it only became aware of the auction on December 12, 2023, when it received a complaint signed by the majority of participating banks, in which they alleged a lack of transparency in the process, namely the “lack of communication to competitors of the Competition regulations, the rationale for choosing the chosen ratios and their weighting”, as well as concerns about risks to the financial system, due to the nature of INPS as a systemic depositor. The BCV stressed that “it could not ignore the complaint presented, especially when subscribed by the majority of banks participating in the auction (four of the six participating banks)”.

“In this context”, said the BCV, “once the complaint was received, internal tests demonstrated, in fact, that the continuity of the auctions, in the manner carried out, could negatively impact some banks’ ratios, namely liquidity ratios”.

“Faced with this scenario and the tests carried out”, continued the BCV, “the Bank had to act, recommending that banks refrain from participating in auctions until measures to mitigate concentration risk factors for large exposures and additional monitoring metrics of liquidity are resolved by the central bank”.

UNTC-CS vs Banks

On the same day, the secretary general of the UNTC-CS, Joaquina Almeida, cited by inforpress, defended the legitimacy of the INPS in promoting the auction and accused the banks of living at the expense of taxpayers, pointing to the BCN, which she accused of making a “ declared kidnapping” of public funds.

The administration of Banco Caboverdiano de Negócio later repudiated, also in a statement, the statements made by the Secretary-General of the UNTC-CS, “which could only have resulted in profound ignorance about the facts that actually occurred, revealing that they did not have the capacity to give an opinion on this matter of relevance national, or even worse, in clear bad faith”, he stated.

“The BCN received, on December 5, 2023 at 7:10 pm, an invitation from INPS to participate in an auction aimed at placing half a million contos, with proposals being submitted by December 8, 2023 at 10:30 am at the Facilities of the INPS, that is, in less than 59 hours”, said the banking institution.

“Despite the fact that the BCN considered that a deadline of 59 hours for participation in a tender procedure for the placement of half a million contos as abnormal, it contacted the INPS confirming its availability to participate in the aforementioned auction, having requested the regulation of the same in order to be able to prepare its proposal, however, INPS, surprisingly, refused to provide the regulation in question”, he continued.

Following the opening of proposals for this first auction, “participating Banks emphasized to INPS the need to extend the deadline for participation in the tender procedure and to make auction regulations available to competing Banks, which, once again, INPS was not available to do so.” And, according to the BCN, “inexplicably, in this auction the INPS did not choose the best proposal, allocating the entire half million contos to the Bank that presented the third best rate”.

“Even more surprisingly, on December 13, 2023 at 5:54 pm, INPS invited the BCN to participate in a second auction for the placement of 1 million contos, with the delivery and opening of the proposals being made simultaneously on December 15th at 10:30 am , that is, in addition to continuing to not make the regulation available with the rules of the tender procedure, the deadline for participating in an auction worth 1 million contos had been reduced to just over 38 hours”, highlights the statement.

This refusal by INPS to provide the auction regulations and the unusual deadlines led to a group of 4 Banks making a presentation to the BCV to assess the regularity of the procedure that was being adopted.

INPS vs Banks

All that was missing was the INPS version, which also arrived via statement to deny the lack of transparency in the deposit auction and ensuring that banks were provided with all the necessary elements to understand the rules of the process.

“In addition to the evaluation criteria being presented in the invitation letter, during the opening session of the proposals relating to the first auction, all doubts of the bank representatives were clarified and recorded in minutes that everyone signed”, he said.

The National Social Security Institute highlighted that the calculation formula to determine the winner of the auction contains cumulative criteria, with the interest rate entering the equation, with a weight of 55% and prudential and risk ratios with a weight of 45%. . The same source states that the process was set up, ensuring that the mobilization of funds for the constitution of the deposit was distributed proportionally according to the INPS demand deposits, available among the participating banks, so that no institution would respond, individually, for the entirety of the auction value.

For More News And Analysis About Cape verde Follow Africa-Press