Africa-Press – Eritrea. Commodity prices saw an upward trend last month, as the Fed continued rate cuts and the trade tensions between the US and China eased, while geopolitical risks continue to be a determinant in price trajectory.

Gold climbed 3.7% last month, hitting a record of $4,381.55 per ounce, while silver rose 4.3% to an all-time high of $54.7 per ounce. Platinum saw its highest level since February 2013 at $1,734 per ounce.

The US Dollar Index’s recovery and the investor shift towards profit-taking led gold to decline from record highs, while the search for safe-haven assets, strong industrial demand, and the ongoing supply shortage pushed up silver, and declining production supported platinum.

Aluminum rose 7.8% due to increased use in the global green transition and rapidly rising demand for its use in renewable energy and electric transportation, while zinc climbed 3.4% due to declining stocks on the London Metal Exchange. Copper rose 5.3% and lead 1.8% per pound, while nickel fell 0.3%.

Natural gas surged 24.9% amid supply shortage concerns in northern regions as temperatures dropped since winter started, while Brent crude oil fell 2.2%.

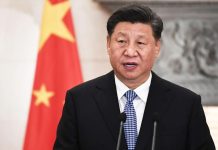

Meanwhile, soybeans increased 11.3% per bushel following the meeting between US President Donald Trump and Chinese President Xi Jinping. Wheat rose 5.1% per bushel due to increased Chinese demand, corn climbed 3.9%, led by the rise in soybeans, and rice fell 8.1%.

Coffee hit a historic high of $4.3795 per pound, rising 4.6% throughout the month due to supply concerns, expected tariffs on Colombia, and declining coffee stocks. Sugar had its lowest since October 2020 at $0.1407 per pound, falling 14% on strong production estimates in Brazil, Thailand, and India.

Ole Hansen, head of commodity strategy at Saxo Capital, told Anadolu that gold’s “extraordinary rally” had entered a cooling.

“While near-term momentum has stalled, the fundamental reasons for holding gold remain intact—only the timing of the next advance, in our opinion, is uncertain,” he said.

Hansen stated that despite Fed Chair Jerome Powell’s current cautious stance, macro data show the next move of the bank will be towards easing.

“A softening US labor market and slowing nominal growth will likely bring additional cuts into 2026, setting the stage for renewed gold strength,” he said.

“Central banks, led by emerging-market institutions seeking reserve diversification, are maintaining a strong appetite for bullion,” he added.

For More News And Analysis About Eritrea Follow Africa-Press