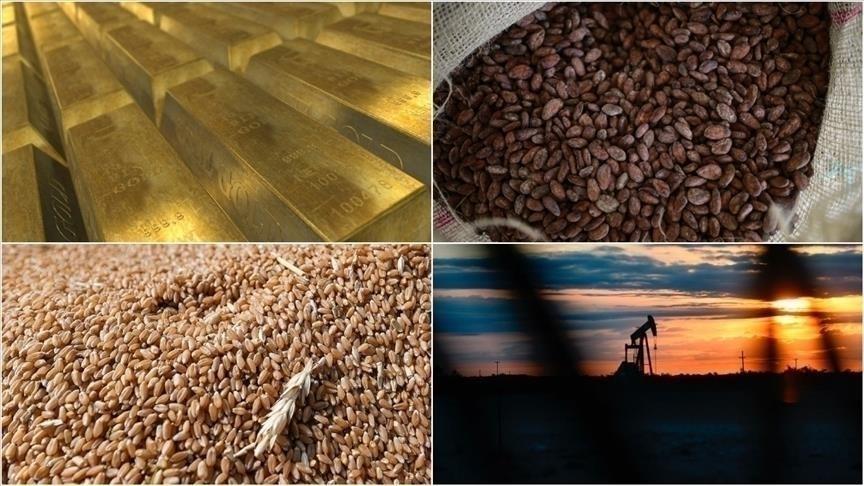

Africa-Press – Eritrea. The commodity market had a difficult month for pricing in November due to the Fed’s monetary policy, global economic activity, the Chinese economy, as well as concerns about production and weather events.

Gold prices continued to rise amid growing expectations that the Fed will cut interest rates in the first half of next year, concerns over the expansion of the Israel-Palestine war, the wedding season in India, Christmas in the West, and the Chinese New Year.

In November, the price of gold rose by 2.7% and silver by 10.5%, while platinum fell by 0.5% and palladium by 9.5%.

Palladium is among the commodities most affected by recession concerns, such as a global oversupply causing its price to fall.

An increase in demand in the commodity market was also anticipated due to indications of a softening of bilateral ties following the meeting between US President Joe Biden and Chinese President Xi Jinping.

Brent crude oil lost 6.2% in November

The OPEC+ group agreed to a supply cut of approximately 900,000 barrels per day, but this did not prevent the decline in Brent crude oil.

The decline in the US oil demand pushed down Brent crude oil prices, which lost 6.2% in November, and natural gas traded on the New York Mercantile Exchange, which fell 19.8%.

Copper rose by over 4.5%

There were concerns last month over signs of a slowdown in economies leading to recession-affected base metal prices.

Despite the volatile course in base metals and rising expectations for the Fed’s peaked interest rates, the price of copper rose by 4.6% and zinc by 2.4% in November.

Prices of lead fell by 0.7%, aluminum by 3.4% and nickel by 8.7%.

The miner strikes in Peru and the news that Canada-based First Quantum Minerals may shut down its Panama operations also highlighted supply concerns in copper and were among the factors that caused its prices to rise.

Zinc prices gained on rising supply concerns after the Dutch mining firm Nyrstar announced that it would close two of its mines.

Concerns over global demand suppressed nickel prices.

The agriculture group saw increases except for cotton and sugar

In November, the price of wheat climbed by 7.5%, corn by 0.8%, soybeans by 2.5%, and rice by 8.4% on the Chicago Mercantile Exchange.

Cotton traded on the Intercontinental Exchange lost 1.4% and sugar 0.9% value, while coffee gained 10.4% and cocoa 12.1%.

Lower wheat production forecasts, unfavorable weather conditions in Brazil, concerns over rice production in the Far East, and an imbalance in the supply-demand relationship for cotton all contributed to the changes in agricultural commodities.

The General Department of Vietnam Customs reported that the country’s coffee exports fell by 9.5% in the first nine months of this year, with harvest expected to fall by more than 7%.

The decline in Brazil’s coffee harvest also resulted in a surge in coffee prices.

Sugar production in Brazil is estimated to go up by 27.4% to 46.88 million tons.

The cocoa market has been supported by the expectation of a global deficit in the 2023/24 season due to lower production in the Ivory Coast and Ghana.

After the European Parliament approved legislation to ban the import of products into European Union countries produced by damaging forests, concerns were raised that this could increase costs for the chocolate industry in the region.

For More News And Analysis About Eritrea Follow Africa-Press