Africa-Press – Gambia. Salton Massally is a key figure in Sierra Leone’s fintech industry. He created the country’s first job board, Careers.sl, and founded Mikashboks, a digital social finance platform that simplifies and secures group saving and lending. His efforts earned him the Queen’s Young Leader Award and a congratulatory note from U.S. President Joe Biden. He shared his tech journey with Nneji Godwin Amako.

Can you share your background?

I grew up in Freetown, Sierra Leone, excelling academically and driven by curiosity. I built a helicopter prototype at age nine and later pursued aerospace engineering at Buffalo University, United States. When my father fell ill, I returned home. I taught myself programming and created Sierra Leone’s first job board, Careers.sl. This led to developing payroll systems, including one for Ebola workers, and eventually founding Mikashboks that cut across Africa.

How did you develop the payroll idea?

During the Ebola outbreak, I saw problems with the cash-based payroll system for frontline workers, leading to strikes. The government asked my company, iDT Labs, to find a solution. Using my experience with large-scale financial systems, I proposed a digital payment system with mobile wallets. We built it in 14 days, using open-source software like Odoo, Kannel, and Dedupe, and used OpenCV for facial recognition. Our solution reduced payment time from over a month to a week, preventing strikes and saving about US$10.7 million over 13 months.

What inspired you to create Mikashboks, an SMS-based savings scheme?

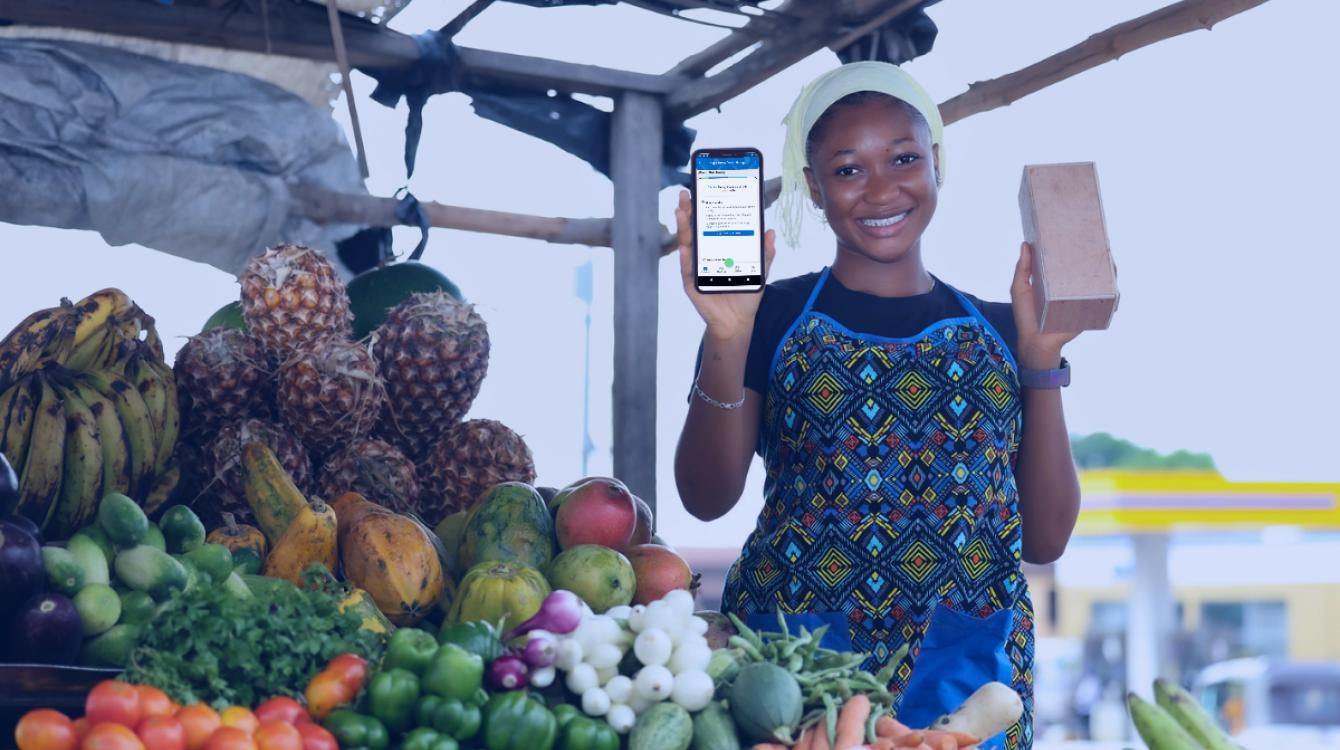

Mikashboks was inspired by my experience developing the national Ebola Response Workers Payment System, showing how technology could transform financial processes. Personally, my mother’s struggles with communal Osusu savings circles highlighted a gap where responsible participants lacked access to formal financial tools. Mikashboks bridges this gap by digitizing communal financing circles like Osusus, making savings more convenient and secure. The app builds verifiable financial identities and connects users to mainstream banking tools, enabling financial inclusion.

Tell us about some of your awards and how they have motivated you?

I was honoured to receive the Queen’s Young Leader Award in 2017 and to be among the finalists for the 2022 Harvard Presidential Awards, for which I received a congratulatory note from President Joe Biden. These accolades affirm that our efforts are on the right track and prove the potential for enhancing financial inclusion through technology.

What key lessons guided your journey from college dropout to successful entrepreneur?

Several key lessons powered my journey. Dropping out of college revealed opportunities to uplift communities, showing that perceived failures can open new doors. Transitioning from engineering to coding taught me to evolve continuously. My innovations prioritize real impact over recognition, inspired by my mother’s struggles with financial access. Mentors, partners, and teams have been crucial in transforming visions into sustainable ventures.

How do you see the future of fintech in Africa?

The future of African fintech is bright, with rapid technological advancements addressing persistent financial access barriers. Innovations must be hyper-localized, considering infrastructure limitations and user nuances. Supportive policies and regulatory frameworks are crucial for attracting investment and protecting consumers. Developing world-class talent in user experience, data science, engineering, and product development is essential. Collaboration among regulators, traditional finance, and startups is necessary to address foundational gaps like digital IDs, credit rating systems, and interoperability.

How can technology continue to address humanitarian crises in Africa, like it did during the Ebola outbreak?

While technology is modernizing humanitarian aid, gaps remain in adaptive systems that learn from communities. Digital interventions are often one-off efforts, discarded when headlines fade. During COVID-19, governments scrambled to provide social assistance from scratch. I revamped my Ebola payroll system into openG2P, an open-source economic resilience backbone for crises and routine use. Its modular infrastructure continues to protect marginalized communities during climate disasters and conflicts.

What challenges did you face while developing and implementing Mikashboks, and how did you overcome them?

A standout success story for Mikashboks is from a rural community in Portloko, Sierra Leone. We met a Village Savings and Lending group that used Mikashboks to digitize their savings operations. Previously, their savings were recorded manually by the only literate member. With Mikashboks, they found it easier to trust the simple text message confirmations, which made the process transparent and trustworthy. This success mirrors our impact in Africa, where 20,000 users manage savings groups.

What are your future goals for Mikashboks and your role in Sierra Leone’s fintech landscape?

Our goal is broader financial inclusion for the 400 million relying on informal financing. We aim to evolve Mikashboks into a full-stack social finance platform, integrating digital tools with communal structures to reshape access. We envision a marketplace for lending, asset financing, pensions, and insurance tailored to cash flow patterns.

What message do you have for aspiring entrepreneurs and innovators across Africa?

Have a strong belief in your ability to transform systems. Understand that challenges are growth opportunities, not failures. Use local insights to address genuine needs. Prioritize people over profit. Surround yourself with supportive allies, and together we can drive social justice and innovation across the continent. We are on the cusp of an African innovation revolution.

For More News And Analysis About Gambia Follow Africa-Press