Africa-Press – Kenya. Kenya Power cut its negative working capital further by Sh6.7 billion to Sh12.54 billion in the first six months to December 31, 2025 in an aggressive balance sheet clean-up, promising investors more returns in the near future.

Negative working capital is when a company’s current liabilities exceed its current assets.

The company’s working capital has remained in the red since December 2016, with the largest deficit recorded in 2020 at Sh74.8 billion.

This means that Kenya Power has managed to pay creditors and suppliers at least Sh63 billion in the past five years. Finance costs fell by Sh492 million following scheduled loan repayments and reduced debt levels.

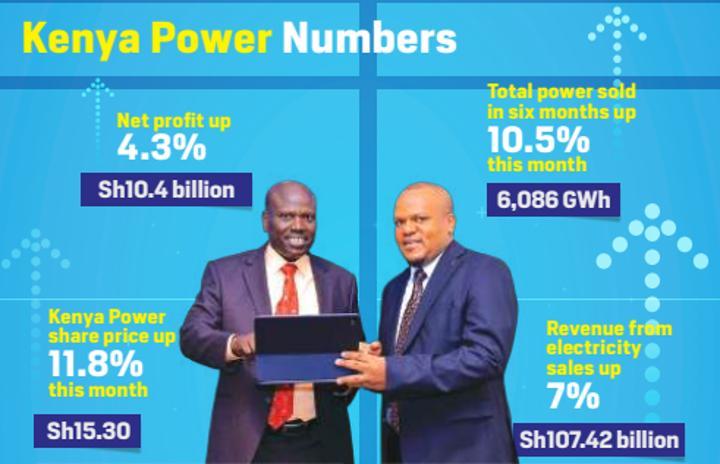

On Tuesday, the power distributor’s share price at the Nairobi Securities Exchange (NSE) rose by 100 basis points to hit Sh15.30 from Sh15.20 the previous trading day.

The power man began the year with a share price of Sh13.60 and has since gained 11.8 per cent on that price valuation, ranking it 10th on the NSE in terms of year-to-date performance.

Market analysts say that shareholders can be optimistic about KPLC, knowing the stock has accrued 11 per cent over the past four-week period—ninth best on NSE, earning them Sh2 per share.

According to the firm’s financial results unveiled at an investor briefing held in Nairobi yesterday, total borrowings declined by six to Sh84.23 billion, supported by stability in the Kenya Shilling.

Furthermore, revenue from electricity sales during the period increased by 6.9 per cent, from Sh107.42 billion to Sh114.87 billion, supported by higher electricity demand and improved distribution efficiency over the two comparative periods.

During the period, electricity sales grew 10.5 per cent to 6,086 GWh, as distribution efficiency improved to 78 per cent from 76.4 per cent, reflecting network upgrades and loss-reduction initiatives.

The improved performance, primarily attributed to higher electricity sales and reduced finance costs, saw the firm report a net profit of Sh10.4 billion, a 4.3 per cent rise compared to a similar period in 2024.

The firm’s gross earnings for the period increased 5.5 per cent to Sh14.83 billion.

Following the results, the board has declared an interim dividend of Sh0.30 per share, payable toward the end of next month, to shareholders on the register as of February 23, 2026.

Speaking at the investor briefing session in Nairobi, Kenya Power boss Joseph Siror said that the half-year results reflect continued momentum in strengthening performance and building resilience through a stronger balance sheet.

“The continued growth in electricity sales, supported by rising demand, improving distribution efficiency, combined with lower finance costs, lays out a solid foundation for improved profitability,” Siror said.

Even so, power purchase costs increased by Sh5.33 billion, largely driven by higher electricity demand, as total energy purchases increased by 8.3 per cent to 7,807 GWh during the period, mostly from Uganda.

Kenya Power data shows imports from Uganda rose to 83.74 million kWh between July and September 2025 from 54.5 million kWh a year earlier, and total imports for January–November 2025 reached 254.7 million kWh, up 28.04 per cent year on year, as peak demand hit 2,439.06MW in early December 2025.

This data is corroborated by another one by the latest quarterly economic data by the Kenya National Bureau of Statistics (KNBS), which shows Kenya imported electricity worth Sh978.3 million in Q3 2025, up 46.8 per cent from Sh666.3 million a year earlier.

This ranks second only to sugar among imports from Uganda; over the same period, the value of milk and cream imports fell to Sh764.3 million from Sh1.36 billion.

The power distributor has warned that relying too much on regional hydropower puts Kenya at risk of not having enough power during droughts or major plant failures.

There has also been a ban on new power purchase agreements, which has limited the addition of domestic capacity since 2018.

In November 2025, Parliament voted to lift the ban, which raised hopes for new projects. William Ruto has promised to add 5,000MW by 2030, and the draft 2026 Budget Policy Statement warns that the current built capacity of 3,300MW is not enough for an economy that is modernizing quickly.