Africa-Press – Kenya. A new projection puts Kenya’s Gross Domestic Product (GDP) 2021 at 5.8 percent on account of a rebound of socio-economic activities.

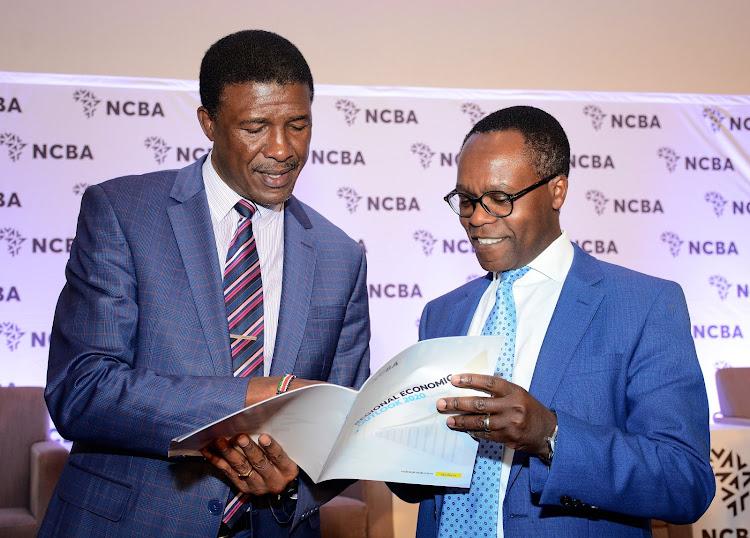

The NCBA 2021 Economic Outlook released yesterday is an upward revision to the bank’s initial baseline estimate of 5.3 per cent in June.

It anticipates growth to remain above trend at 5.2 per cent in 2022 driven by the continued release of earlier pent-up demand.

According to the report, trade, real estate, health care and financial services are all expected to revert to historical growth trends.

“Manufacturing could also emerge stronger as companies rebuild inventory in response to growing demand,” the report reads in part.

The sectors hardest hit by the pandemic such as accommodation, education, trade, and transport are projected to maintain above-trend growth as the economy “normalizes”.

These sectors now contribute more to GDP after the rebasing of national accounts.

Disruptions to agriculture from the pandemic, NCBA notes, have been moderate although harsh weather could keep growth below the historical average.

The sector, according to the report now contributes about 23 per cent to Gross Domestic Product (GDP), a marked decline from 33 per cent, prior to rebasing.

It shows that sectors hardest hit by the pandemic notably services are leading the rebound driven by low base effects and upside from easing of containment measures.

Commenting on the forecast, NCBA Group managing director John Gachora said the economic recovery will tightly track the path of the pandemic into 2022.

“The transition to normalcy that began in late 2020 will continue as public and business anxiety over the virus wanes and stringent containment measures begin to diminish,” Gachora said.

The lender is, however, warning that growth could quickly slide back to the pre-crisis trend beleaguered by high input costs, rising energy prices and the steep tax landscape.

A weak exchange rate, NCBA notes, could cause significant price pressures with negative implications for the purchasing power of consumers, and therefore demand.

NCBA in its analysis does not expect the upcoming 2022 elections to adversely affect the economy unlike in previous years.

The bank is optimistic that investments could increase immediately post-the election, offsetting any pre-election lull.

“However, confidence in institutional maturity and the Judiciary’s ability to resolve election disputes has risen in recent years, providing the much-needed respite. This is anchoring confidence ahead of the transition,” Gachora said.

The bank expects credit markets to continue to suffer from lagged effects of interest rate capping and increased credit risk resulting from the pandemic.

Additionally, the proliferation of unregulated mobile lenders is expected to challenge the conduct of monetary policy, as the market moves from the formal intermediation channels.

NCBA expects the economic recovery to allow for a steady reduction in the fiscal deficit, consistent with the fiscal consolidation program by the government.

Meanwhile, as the private sector finds its footing, the government is expected to scale back spending to reduce the deficit and stabilize the debt.

Ongoing reforms at state-owned enterprises could also present further strain on the sovereign which may have to accommodate some more debt and or inject some funding to stabilize them.

Whereas the progress has been encouraging, NCBA warns risks could still stem from the treatment of public guaranteed debts as well as the overall discipline in the administration of public finances.

The lender’s growth forecast is, however, lower compared to that of CBK, National Treasury, World Bank and IMF which have projected the economy to rebound at an average of 6 per cent.

Last month, CBK projected the country’s economy to grow by 6.1 per cent this financial year after a 0.3 per cent contraction in 2020.

For More News And Analysis About Kenya Follow Africa-Press