AfricaPress-Kenya: East African Portland Cement Company (EAPCC) narrowed its loss by 35 per cent for the six months ended December 2020 on reduced administrative and selling costs.

This saw the listed firm, which has been rocked by boardroom squabbles, trim its losses to Sh1.04 billion from Sh1.6 billion at a similar period in 2019.

The company saved Sh533 million from expenses, which dropped from Sh1.07 billion to Sh584 million as part of wider turnaround efforts, its unaudited results for the period under review show.

“This accrued from the ongoing business reorganisation geared towards aligning manpower costs to current productivity levels,” said the cement maker in results published yesterday.

Sales fell 6.5 per cent in a tough period due to the coronavirus pandemic, attributed to selling prices and fixed cost of sale structure, with revenue down to Sh1.39 billion compared to Sh1.48 billion in 2019.

“Sales volumes in the period remained stable despite a challenging business environment resulting in a 6.5 per cent decline of gross margin occasioned by a general decline in selling prices and fixed costs of sales structure,” said the financials.

In the period under review EAPC spent Sh35 million in loan restructuring.

The cement maker said it was at the “tail end” of terminating its corporate loan facility to stem high finance expenses through balance sheet restructuring.

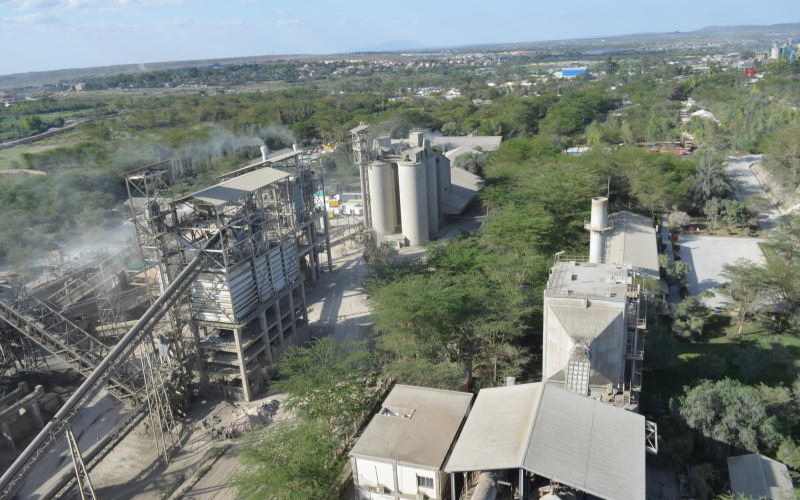

This would help boost cashflows and also fund plant refurbishment, it said.

Finance costs in the six months fell 31.25 per cent to Sh1.1 billion from Sh1.6 billion in 2019.

“The company is at the tail end of terminating its corporate loan facility to eliminate the high finance costs through a balance sheet restructuring programme, which will yield sufficient cash flows for optimal working capital and also fund plant refurbishment to attain a competitive cost of production,” said the results statement signed by Company Secretary Jane Joram.

Cash used in investing activities fell from Sh1 billion to Sh235 million, and the directors did not recommend the payment of an interim dividend.

EAPCC has over the last few years struggled to turn around its fortunes as competition from new market entrants, mismanagement and piling debts continue to erode its earnings.

But the firm put a brave face that it would return to profits.

“The board remains optimistic that with the conclusion of the business reorganisation initiatives, the company will return to profitability,” it said.

Recently, the company’s board kicked out acting Managing Director Stephen Nthei and named insider Daniel Kiprono as acting MD, ending Nthei’s 19-month stint at the helm.