Written by

Faridah N Kulumba

Africa-Press – Kenya. After toppling Japan and Germany from the list of top bilateral lenders to Kenya, China has more than tripled its share of debt to Kenya in less than a decade.

A new analysis of the composition of Kenya’s bilateral lenders by the Central Bank Kenya (CBK) shows that China controlled less than one per cent of Kenya’s external debt portfolio in 2006.

Surprisingly in June 2011, China was in third position, behind France and Japan, on the list of top lenders, according to Daily Nation.

How the positions shifted

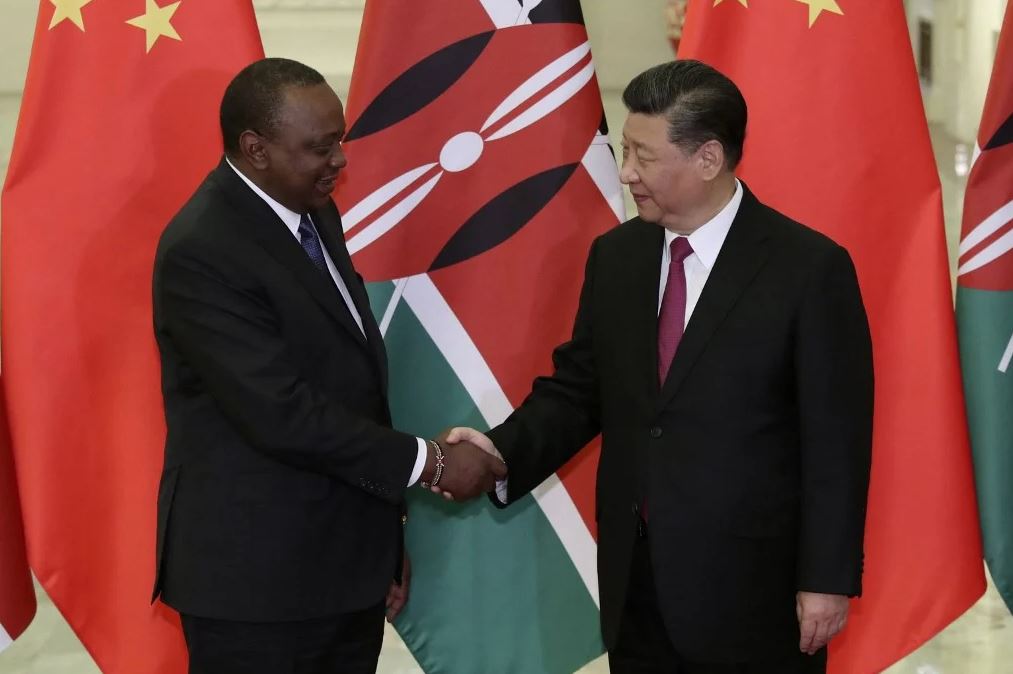

China’s position drastically shifted after the Jubilee government took over in 2013 in favour of China, which now accounts for 67 per cent of Kenya’s external debt, up from just 13 per cent in June 2011.

Japan’s share has dropped from 44 per cent in 2011 to just 14 per cent in June 2020, and France has also whittled down from 16 per cent at the moment.

According to CBK governor Dr Patric Njoroge, the leading bilateral lender shifted from Japan to China between 2011 and 2020, blaming Kenya’s increased indebtedness to a rise in fiscal deficit largely due to development expenditure such as infrastructure, but also recurrent expenditure in key sectors such as education and health as well as increased guaranteed debt.

China debt financing relations

Kenya has taken large loans of at least $3.8 billion from China between 2006 and 2017. Chinese debt accounts for 72% of overall foregn debt. China lent Kenya extensive loans of more than $5 billion to build Standard Gauge Railway (SGR) between Mombasa and Nairobi and highways in Kenya.

The Kenyan media has debated whether Chinese loans are worth the risk of falling into “debt traps” drawing analogies with Sri Lanka’s Magampura Mahinda Rajapaksa Portdeal, and some commentators have argued that these loans could jeopardize Kenyan sovereignty.

The CBK also attributed Kenya’s debt trouble to worsening terms on new loans, such as lower concessionality and increased commercial loans.

The country’s high indebtedness is also blamed on exogenous economic shocks such as drought and Covid-19 pandemic.

Debt service

CBK noted that the total debt service to revenues increased to 57 per cent in 2019 from 17 per cent in 2012 due to a jump in debt stock and changing terms on new loans, including one-off repayment of syndicated loans and Eurobonds in 2019.

But this trend is expected to reverse in the medium term due to improving terms on new loans, and the restructuring of external commercial loans that have heavy naturities and high interest cost.