Reported by

Faridah N Kulumba

Africa-Press – Kenya. The government of Kenya is considering using reserves from the International Monetary Fund (IMF) to compensate for Chinese loans it repaid after the Treasury dropped an earlier request to defer debt payments.

Special Drawing Rights

These are the IMF’s unit of exchange based on sterling, dollars, euros, yen and yuan, and can be used to settle obligations like repayment of foreign public debt.

According to the Director general for public debt management office at the Treasury Haron Sirima, Kenya has a raft of options including use of additional SDR allocation by the IMF to fill the cash hole left after Nairobi started to service loans from China in July.

Chinese debt to Kenya

After toppling Japan and Germany from the list of top bilateral lenders to Kenya, China has more than tripled its share of debt to Kenya in less than a decade.

A new analysis of the composition of Kenya’s bilateral lenders by the Central Bank Kenya (CBK) shows that China controlled less than one per cent of Kenya’s external debt portfolio in 2006.

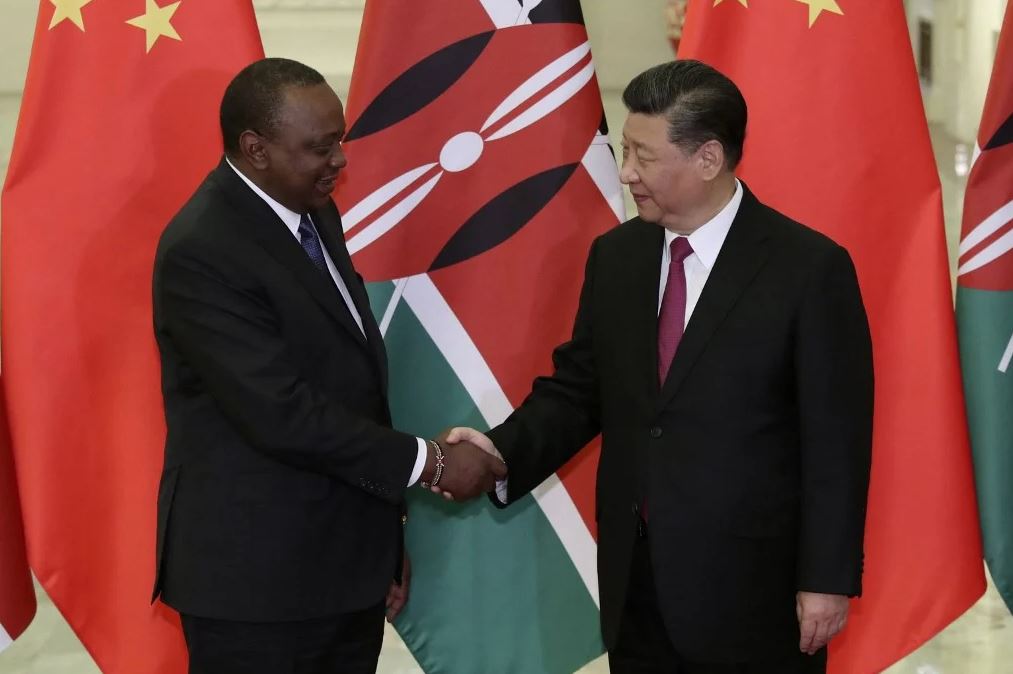

But China’s position drastically shifted after the Jubilee government took over in 2013 in favour of China, which now accounts for 67 per cent of Kenya’s external debt.

Kenya has taken large loans of at least $3.8 billion from China between 2006 and 2017. Chinese debt accounts for 72% of overall foregn debt. China lent Kenya extensive loans of more than $5 billion to build Standard Gauge Railway (SGR) between Mombasa and Nairobi and highways in Kenya.

Treasury’s Options

Kenyan Treasury could use its additional allocation of IMF reserve in Special Drawing Rights (SDR) assets, which can be converted to government backed money, as one of the options to plug the budget hole, YallAfrica reported.

Kenyan government had expected to extend a debt repayment moratorium from bilateral lenders, including China, which started in January 2021, by another six months to December 2021, saving it from making payments of nearly Sh50 billion to Beijing.

Chinese lenders, especially Exim Bank, were uncomfortable with Kenya’s push for extension of the debt service suspension with rich nations, prompting delays in disbursements to projects funded by Chinese financiers.

This forced Kenya to drop its push for the debt repayment holiday extension by China for fear of straining relations Kenya’s biggest bilateral cresitor.

Other options

Treasury’s other options, including seeking grants from development partners, changing the funding for “specific” capital projects to public-private partnership (PPP) and tapping the IMF reverse.

They also have the option to rationalise further expenditures to the extent of forgon DSSI funding.

Roots of debts

The high indebtedness is blamed on a deteriorating cash-flow situation by falling revenues. worsening debt service obligations, and on exogenous economic shocks such as drought and Covid-19 pandemic.

The IMF is expected to play a role in shaping policy that would require Kenya to implement tough conditions across many sectors.