Africa-Press – Liberia. Liberia, a small country on the west coast of Africa, still experiences people of different nationalities entering and creating companies in the country without declaring the actual value of those companies to the government through the Liberia Revenue Authority.

What is Tax evasion?

Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer’s affairs to the tax authorities to reduce the taxpayer’s tax liability. Techniques include dishonest tax reporting, such as declaring less income, profits or gains than the amounts actually earned, or overstating deductions. African countries like Liberia lose billions of dollars every year to tax evasion; this is money that could be spent on uplighting people and delivering services especially to the needy.

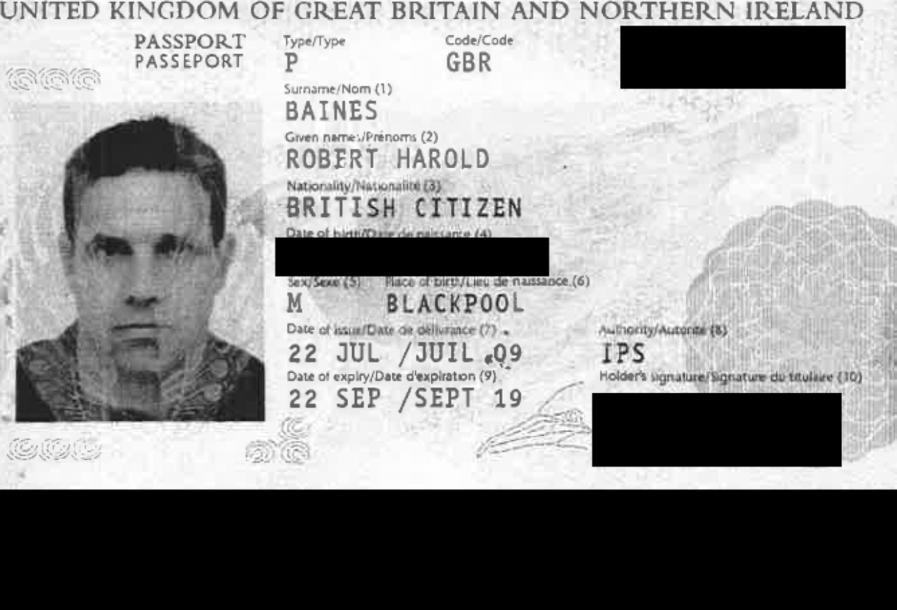

How Robert Baines Evaded Taxes in Liberia

Robert Baines, a British man, in 2013 and 2014 listed his address on confidential documents in the possession of the International Consortium of Journalists (ICIJ) as Switzerland. In 2013 Baines, however, ordered a shell company in the Seychelles, a tax haven off the east coast of Africa, The shell company was intended to “be active in commodity trading, mining, construction, raw and land cleaning.” By 2014 Baines had signed a document that confirmed he used a nominee shareholder for his new Seychelles company, which was called Prometheus International Ltd. Nominees can be used to make it harder for authorities and the public to identify the owner of a shell company. Baines also signed a document to open a bank account in the name of Prometheus International Ltd and the account was based at Euro Pacific Bank in St Vincent and the Grenadines, a tax haven in the Caribbean.

Moreover, in the document to open the bank account, Baines wrote that his source of funds was from “assignments done through RB Group in Liberia” and other work in Europe.

He wrote that the RB Group had a bank account with Ecobank in Monrovia as well. The leaked documents revealed that Companies linked to Prometheus International all had connections with Liberia, Sierra Leone and other European countries. Baines wrote that he expected his new offshore company to receive half a million dollars in the first year.

In 2015, it was reported that the Liberia Revenue Authority (LRA), through a tip-off, along with some officers of the Liberia National Police (LNP) and a sheriff of the Paynesville Magisterial court, stormed the compound of a foreign business man named Robert Baines and owner of the RB Group. They were armed with a search and seizure warrant for the evasion of taxes. Also, the following year, the Government of Liberia published a report (Public Expenditure and Financial Accountability Assessment (PEFA) 2016 on Liberia’s Public Financial Management Systems) that named RB Group as one of several companies that were part of “landmark tax compliance cases.” RB Group was one of 56 companies in 2016 that “had their containers seized for non-payment of tax that had been levied at the APM Terminal.

When contacted about the status of the case (RB Group vs. LRA), Liberia’s Tax Authority told us that in 2015, RB Group appealed against an assessed tax bill of US$639,165.91 adding that the company failed to prove its assertion by evidence that LRA improperly computed deductible depreciation allowance, income as well as advance taxes withheld. The LRA however stated that Baines claimed that because its documents were seized by LRA, he was unable to prove that the tax bill sent by LRA was improperly computed.

According to the LRA, the case is still before the Board of Tax Appeal (BOTA) and a Legal Memorandum has already been filed. Based on the LRA’s request, BOTA issued an assignment for November 16, 2017 but said the hearing could not be held due to the fact that documents seized from Robert Baines had not yet been presented to BOTA.

We are told by the LRA that there hasn’t been any movement of the case before BOTA since 2017 and they[LRA] hasn’t given any reason why it is the case.

Baines whereabouts is unknown at the moment but however we have made efforts to reach out to him using every resource we have including his Linkedin and Gmail accounts to get in touch concerning his involvement with tax evasion in Liberia and everything else concerning the leaked documents but we did not get a reply from him.