Africa-Press – Liberia. An Ongoing investigation into the controversial decision by the Central Bank of Liberia to guarantee loan to SI Bank Liberia Limited has established that President Joseph Nyuma Boakai and his team were aware of the decision.

FrontPage Africa has seen back and forth letters from SIB Liberia and the Executive Mansion that show the president was briefed right after his victory on the loan negotiation process which started back in 2020.

In line with the discussion held with you, please find attached the formal request we submitted to your office on 28th December 2023 on the matter. In addition, we have also attached the full petition we submitted to the Executive Governor of the Central Bank, Honorable J. Aloysius Tarlue Jr., on the same matter dated December 20, 2021. I am confident that these two letters would be adequate to inform your action on the matter,

an excerpt from the letter written by SI Bank through its President and Board Chairman Dr. Papa Kwesi Nduom.

The negotiation for the takeover of FIB by Sapelle International Bank Liberia Limited (SIBLL) started in 2020. That purchase was approved by the Central Bank of Liberia (CBL) recently to operate under the license as SIBLL.

In a bid to mitigate the losses during their purchase transactions, the CBL went on to guarantee that it will cover some of the Non-Performing Loans and dole in millions to cover the losses on the FIB-GN Bank—SBLL loans.

As the CBL comes under staunch criticism for its role in providing guarantees under the guise of financial sector stability without proper procedures, there questions whether the Executive and Legislative branches of government were involved in the process.

However, as FPA gathered, President Boakai and his team at the Executive Mansion were in the know.

In the letter addressed to the President under the subject line “Gratitude and Request”, the SIBLL President expressed gratitude for granting them audience. He also expressed “deep appreciation for the time and the genuine attention he spent to listen to them.

The letter revealed that the bank had submitted a formal request (for the CBL’s guarantee) to the President on December 28t, 2023 when Boakai was not yet inaugurated. The meeting with the president was a follow-up of the request. The bank also attached the full petition to the CBL and expressed confidence that the two letters would be adequate to guide the president in his response.

Excerpt of the letter to the president.

“We wish to express our gratitude for the audience you granted to us today. We deeply appreciate the time and the genuine attention you spent to listen to our appeal.

In line with the discussion held with you, please find attached the formal request we submitted to your office on 28th December 2023 on the matter.

In addition, we have also attached the full petition we submitted to the Executive Governor of the Central Bank, Honorable J. Aloysius Tarlue Jr., on the same matter dated December 20d, 2021.

I am confident that these two letters would be adequate to inform your action on the matter.

Once again, be assured that Groupe Nduom believes in your vision and remains committed to continue its investment in Liberia. We also wish to assure you that SIB Liberia Limited remains committed to build a sound and resilient bank that retains the trust and confidence of the general public.

SIB Liberia’s history

On 3rd June 2016, the Central Bank of Liberia, in exercise of the power vested in it, issued a License to GN Bank Liberia Limited/ SIB Liberia Limited (SIBLL) to function as a bank financial institution and to do commercial banking business in Liberia. The CBL during the licensing process also tabled and negotiated the matter of the troubled Bank then (now defunct), First International Bank Liberia Limited with the owners of SIBLL. The CBL saw the need to prevent the total collapse of the legacy Bank (FIBLL) and to protect the soundness of the Liberian Banking System.

Accordingly, the CBL and SIBILL agreed and signed a Purchase and Assumption Agreement that sought to protect the parties involved and also reach that objective. In line with that objective, the Central Bank approved the liquidation of First International Bank Liberia and endorsed that SIB Liberia Limited should assume significant portions of the Assets and Liabilities of the now defunct First International Bank Liberia Limited.

“The transaction maintained the Nation’s confidence in the Financial Industry and prevented a complete collapse of the former Bank, which event, would have caused significant damage to the Financial Industry,” the bank said in a letter to then president-elect Joe Boakai dated December 28, 2023.

Since its entry into Liberia in June 2016, the bank says it has grown into a key Financial Institution providing financial services 16 strategic locations and offers full branch banking services to customers from our 11 main branches across Liberia.

What was the issue?

In the communication to the president, SIBLL said it had paid off US$14.7 million of the Legacy Depositors’ liabilities inherited from the defunct FIBLL, but the Bank still owed US$8.5 Million outstanding liabilities to pay-off to legacy depositors, with some depositors threatening legal actions on the Bank.

The payment of the US$14.7 Million, out of the working capital of GNBLL/SIBLL has significantly impacted the Cash flows of the Bank negatively. Accordingly, the bank appealed to the Central Bank to intervene in the repayment of the outstanding liabilities to the legacy depositors since that debt rightfully belongs to the Government of Liberia and the Central Bank.

The bank noted that the CBL Board of Governors saw the need and upheld the request of the Bank after a thorough review of the matter for over two years. The board has concluded and approved the payment of the outstanding legacy deposits liabilities of US$8 million to the Bank, but this was yet to be executed at the time of the letter.

The appeal

Owing to the CBL delay in executing the board’s mandate, the bank said it was compelled to seek the president’s intervention.

“As a Bank, we have done all we can do to maintain the Nation’s confidence in the Financial Industry, an effort without which this Country would – have experienced significant damage to its Financial Industry. The Bank has made significant strides to ensure sustained operations and we seek your intervention and collaboration to ensure that the gains made so far are not eroded.”

President Boakai’s response

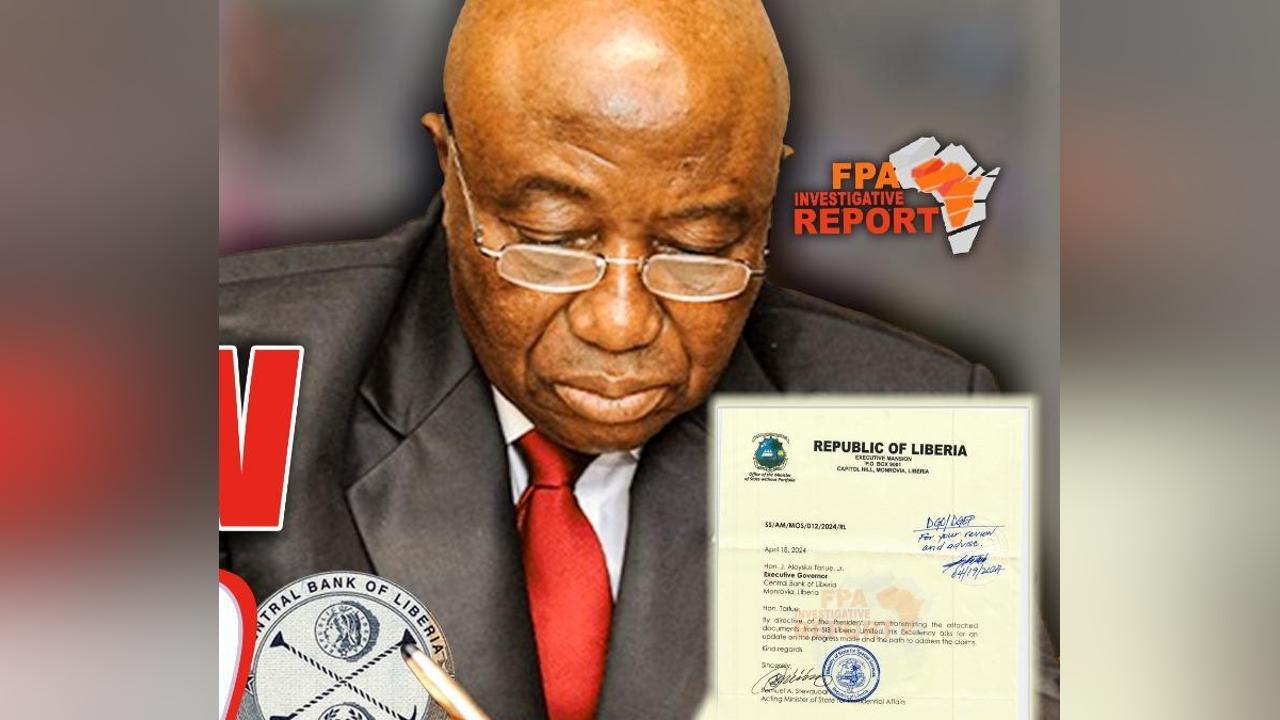

As FPA gathered, the president did not disappoint the bank. In a communication dated April 18, 2024, on behalf of the President, Acting Minister of State for Presidential Affairs Samuel A. Stevequah instructed Executive Governor Alloysius Tarlue (now suspended) to provide an update on the progress made and the path to address the claims by SIB Liberia.

Hon. Tarlue: By directive of the President, I am transmitting the attached documents from SIB Liberia Limited. His Excellency asks for an update on the progress made and the path to address the claims.

Samuel A. Stevequah

The implication

Just was in the case of the FIBLL- GNBLL/SIBLL, takeover, the central bank played an important role in the takeover of the Global Bank by Bloom Bank. Global was sold to Bloom Bank, but the Central Bank once again provided carte blanche guarantees to cover losses, including a lawsuit against Global Bank by one of its customers, businessman George Kailondo for damages due to failure to reconcile the customer account. Bloom Bank lost the case, and now the plaintiff is seeking payment.

The CBL is now required to pay an initial amount of $2.3 million (SC) and potentially more for other lawsuits.

Additionally, FPA has learned that the CBL has paid $705k representing 25% to George Kailondo. However, there is concern around weak supervision, with a recommendation for the Central Bank to review the liquidity and capital positions of commercial banks daily and not wait until they are in trouble before intervening.

Furthermore, some economists and financial analysts say there is a need for the CBL and the shareholders of the banks to recapitalize based on their liquidity position.

This is why criticisms are being voiced against the CBL’s role in providing guarantees in the name of financial sector stability without proper procedures, suggesting that Executive and Legislative branches should be involved in such decisions.

There is also a growing call for accountability for those breaking the laws and a mention of the reserve requirements policy. All of this has serious implications for the CBL reputation and could negatively affect GOL’s new program with the IMF.

Source: FrontPageAfrica

For More News And Analysis About Liberia Follow Africa-Press