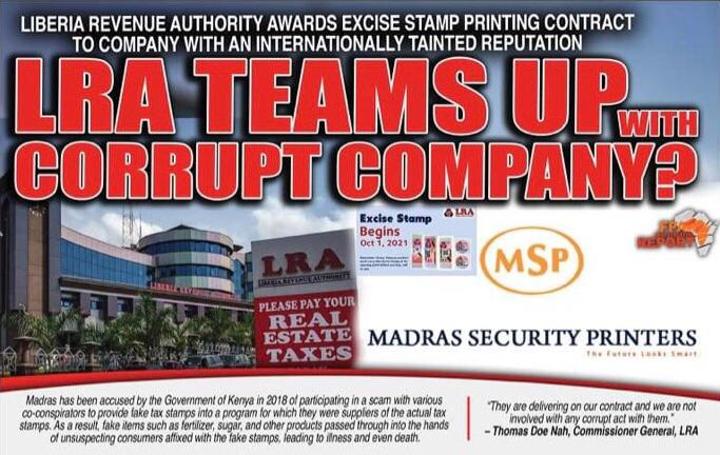

Africa-Press – Liberia. A FrontPageAfrica investigation has discovered that the Liberia Revenue Authority (LRA) has awarded the contract to print excise tax stamps to an Indian company, Madras Security Printers Inc., whose reputation is marred with corruption and other scandals in several countries including Kenya, Sudan, India and Bangladesh, among others.

The LRA intends to introduce the excise tax stamps all alcohol products and tobacco beginning January 2022. The essence of the stamps, according to the LRA, is to help curtail the smuggling of these products into the country. This means, every tobacco product or bottle of alcohol products imported or manufactured in the country would have to bear the excise.

The Excise Tax Stamp is a specially designed stamp with digital and other security features which is affixed on excisable goods to show that taxes and duties have been paid or would be paid. … The Excise tax stamp is not a new tax. It is a means of identifying goods on which excise has been paid or will be paid.

The Commissioner General of the LRA, Thomas Doe Nah, described the launch of the excise tax stamp as a major milestone geared toward expanding the tax net and increasing revenue collection, critics are unsure amid concerns that the stamp is mired in secrecy and lacking conspiracy.

Corrupt Company Gets the Contract

Madras Security Printers competed with the likes of De La Rue (the company printing the stamps for the Ghana Revenue Authority), but according to the LRA, Madras offered the best prices during the bid.

However, A FrontPageAfrica background check of the Madras Security Printers revealed that the company has a bad track record in various countries it has operated providing similar service.

In 2018, Madras was accused by the Kenyan government of conniving in a scam with several co-conspirators to provide fake tax stamps though they were the legitimate suppliers of the actual stamps.

As a result, fake items such as fertilizer, sugar, and other products passed through into the hands of unsuspecting consumers affixed with the fake stamps, leading to illness and even death.

Subsequently, Madras directors in Kenya charged with conspiracy to defraud, breach of trust, abuse of office and cheating. All directors have absconded and refused to appear to face the charges. The Kenyan government put out a press release that international warrants of arrest by way of Interpol Red Notices had to be issued.

In South Sudan, Madras Security Printers was accused of corrupt and collusive behavior in 2020 with regard to their tax stamp program. The company is alleged to have pocketed millions of dollars in a scam that has bankrupted the program that was supported by a loan from the African Development Bank of East Africa.

The company was suspended and blacklisted in India – the country of origin – because of violations in relation to a national ID card program in which they were the legitimate supplier. There are numerous public accounts of illegal conduct by the company in this program, including selling of personal data.

Mauritius withdrew its accreditation of Madras as a supplier of secure technologies for its banks while at the same time there are a number of allegations in other countries including Bangladesh and Sri Lanka, where Madras has failed to live up to its contractual obligations or failed to provide the supplies of tax stamps, licenses, or other products that were agreed to.

LRA’s Defense

When FrontPageAfrica brought the attention of the Commissioner General of the LRA to the numerous negative media reports on Madras on their corrupt track record, Mr. Thomas Doe Nah responded:

“They are delivering on our contract and we are not involved with any corrupt act with them.”

However, an anti-corruption campaigner who spoke to FrontPageAfrica on the basis of anonymity said it is administratively incorrect to do business with a company with a proven track record of corruption and do business with such a company.

80/20 Vs. Extra Charge

Sources familiar with the contract informed FrontPageAfrica that Madras will be selling a thousand pieces of stickers for US$25 which they claim is extremely high. FrontPageAfrica was also informed that Madras would benefit 80 of the revenue generated while the Government of Liberia takes 20 per cent.

Commissioner General Doe Nah told FrontPageAfrica when contacted for comments said the 80% – 20% revenue sharing in the case of Liberia is ideal. According to him, in other jurisdictions, the company producing the stickers benefit 100 percent of the sales of the stickers.

Explaining further, the Commissioner Robert Kamei also told FrontPageAfrica that the Government of Liberia is not sharing the sales revenue with the company 80-20 as it is being put. He said, while the company is selling the stickers to the LRA at US$23.53 for a thousand stickers in the case of alcoholic products, the LRA will then sell the stickers at US$25 for a thousand pieces of stickers.

According to Commissioner Kamei, the extra US$1.47 placed on the stickers is intended to take care of the LRA operational cost. “We as LRA, we reached out to the Public Procurement that though this is the price, when we introduce it, we need to get resources, we need to put people on the field and all of that, we beg you PPCC can we put one or two dollars over this money so as to help us with our operation to ensure that we maximize government’s revenue collection,” he said.

Ghana’s Introduction Came with No Cost

FrontPageAfrica

further gathered that when Ghana introduced the excise tax stamps in 2018, the Ghana Revenue Authority was stamping products with no cost to the importers.

In June this year, The Project Manager of Excise Tax Stamp at the GRA, Mr Kwabena Apau Awuah Anto, told a team of Ghanaian journalists: “What we do here at the Tema facilities and 13 other stations across the country where we have affixing facilities is at no cost to importers.”

Operating the facilities, he said, came with headline costs such as the procurement of the stamps, utility, labour, operational cost and materials such as shrink wraps.

He indicated that when the project took off in 2018, the government decided to give a six-month window to supply the stamps for free, but that had continued till date, hence the Commissioner General’s directive for the stakeholders to be engaged and sensitised to the need for them to pay.

The engagements, Mr Anto said, would determine whether the GRA would charge the full cost or there would be cost sharing between it and the stakeholders.

“In countries such as Kenya, importers pay for the stamps or they get the products stamped at the point of export. Ghana’s policy on the tax stamp policy places the responsibility on the affected excise product on the importer or the manufacturer. In many countries where similar policies are implemented, manufacturers have affixing facilities at their production units,” Mr Anto said. In the case of Liberia, the LRA will sell the stamps to the manufacturers or importers.

For More News And Analysis About Liberia Follow Africa-Press