Africa-Press – Malawi. A study by Malawi Economic Justice Network (Mejn) and Tax Justice Network Africa has revealed that Malawi’s fiscal performance has resulted in large and increasing budget deficits over the past 10 years with the shortfall expanding from K30.7 billion in 2012 to K857.8 billion by 2022.

The report says while the government of Malawi has made significant fiscal reforms in recent years, the development points to troubling fiscal times ahead.

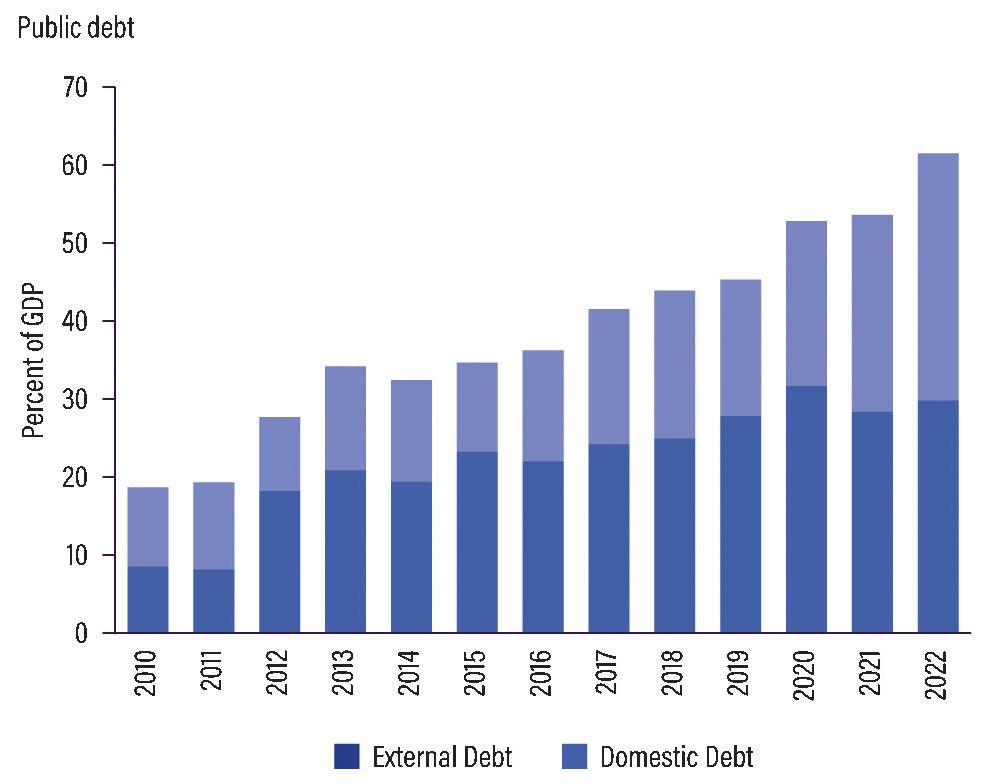

The sharp rise in annual budget deficits has resulted in an astronomic jump in public debt levels which have increased from 28.6 percent of gross domestic product (GDP) in 2012 to 66.9 percent of GDP in 2022.

In its most recent Article IV assessment, the International Monetary Fund (IMF) indicated that the external position of the country had deteriorated, largely due to reduced levels of exports of tobacco products amidst the global economic downturn as a result of the Covid induced economic downturn.

Exports also suffered due to a United States (US) ban on the import of tobacco products from Malawi. Production of tobacco products and other agricultural products also face severe threats due to risk of climate change.

During 2012 to 2013 and 2015 to 2018, the country faced severe droughts, placing pressure on the sector to meet export requirements. The report says should climate risks increase in the future, the country’s ability to service its debt may worsen.

“The prior factors will place pressure on the country to earn foreign currency revenues to service any external obligations such as import, debt servicing, etc. This estimate is validated by the IMF in its most recent Debt Sustainability Analysis (DSA) where both its external debt distress risk and the overall risk of debt distress have been rated at high.

“This risk is further highlighted by the IMF DSA framework which indicates a debt-service to revenue of 45.9 percent in 2021 and steadily increasing to 121.1 percent by 2026,” the report says.

Mejn Executive Director Bertha Phiri has since tipped government to invest heavily in tax systems, inorder to curb illicit financial flows. “People need to understand how domestic revenue is mobilised and the government need to come up with interventions which will increase revenue collection,” Phiri said.

Tax Justice Network Africa policy officer, Francis Kairu says Africans will not achieve SDGs if the countries will not mobilise enough resources domestically.

“If we do not focus on building our economies, If we do not industrialise, if we do not ensure that we have enough citizens and industries paying tax within our countries, we will not achieve our national economic agendas,” Kairu said.

Amidst the impact of the Covid pandemic on global economic conditions and the resultant fiscal pressures placed on governments, countries have faced increased pressures on their tax policy regimes to restore their fiscal health.

In 2021 the Ministry of finance launched a five year domestic revenue mobilisation strategy which will see the country realising five of the countries growth domestic products.

For More News And Analysis About Malawi Follow Africa-Press