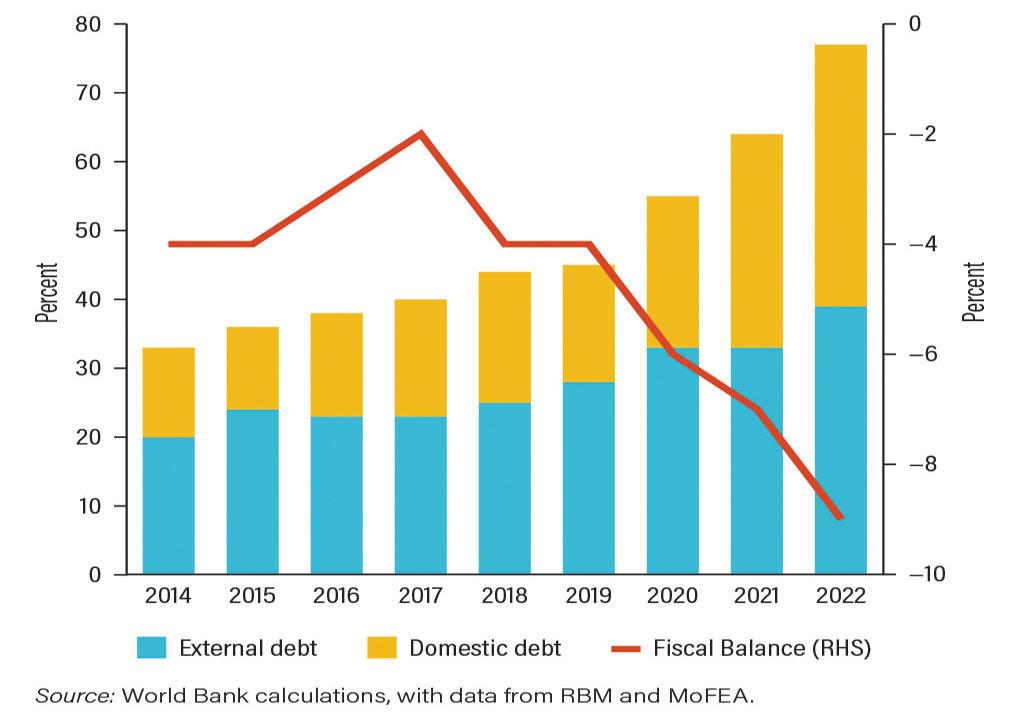

Africa-Press – Malawi. Malawi risks having its debt-to-gross domestic product (GDP)- ratio soaring to 76.6 percent by the end of 2022, the World Bank estimates. The debt-to-GDP ratio compares a country’s sovereign debt to its total economic output for the year. It increased to 64.0 percent of GDP in 2021, up from 54.8 percent of GDP in 2020.

Financing of fiscal deficits through domestic resources has led to the accumulation of domestic debt, which increased from 21.9 percent of GDP in 2020 to 31.2 percent of GDP in 2021, according to the World Bank.

It says a shift in the composition of external debt toward commercial creditors at non-concessional terms has increased debt-servicing costs significantly.

“However, the government is implementing a debt-restructuring strategy with its debt advisers to bring debt onto a sustainable path over the medium-term by reducing debt-servicing commitments to commercial creditors,” the report reads. Available data show that external debt slightly decreased from 32.9 percent of GDP in 2020 to 32.8 percent of GDP in 2021.

The World Bank says while the government has taken measures toward fiscal consolidation, fiscal deficits remain high and will contribute to continued accumulation of public debt in the short term. Public debt is estimated to reach 76.6 percent of GDP by the end of 2022.

As at September 2022, Malawi’s total public debt stood at K7.3 trillion, up by 14 percent from K6.38 trillion in March 2022. External debt accumulated during the period under review accounted for 45 percent (about K3.3 trillion) while domestic debt, valued at K4.0 trillion, accounted for 55 percent.

Speaking when presenting the mid-year budget statement in Parliament late last month, Finance Minister Sosten Gwengwe conceded that rising public debt was on account of persistent budget deficit, suspension of budgetary support and clearing arrears incurred in the previous financial year, among others.

Experts say the composition of external debt has shifted toward commercial creditors at non-concessional terms, increasing debt-servicing costs, with domestic government debt uptake by the banking sector remaining high, crowding out resources for private sector investment.

But Gwengwe said the government is working towards addressing the situation by, among other things, narrowing the budget deficits and the debt-to-GDP-ratio by about 1.1 percent each year.

Among other things, the Treasury has set a debt treatment structure where it is asking creditors to restructure the debt. The government is also on a grant mobilisation drive where a multi-donor fund has been set up to solicit bail out packages.

For More News And Analysis About Malawi Follow Africa-Press